Get the free GENERAL INSTRUCTIONS FOR INCOME, NET WORTH, AND ... - vba va

Show details

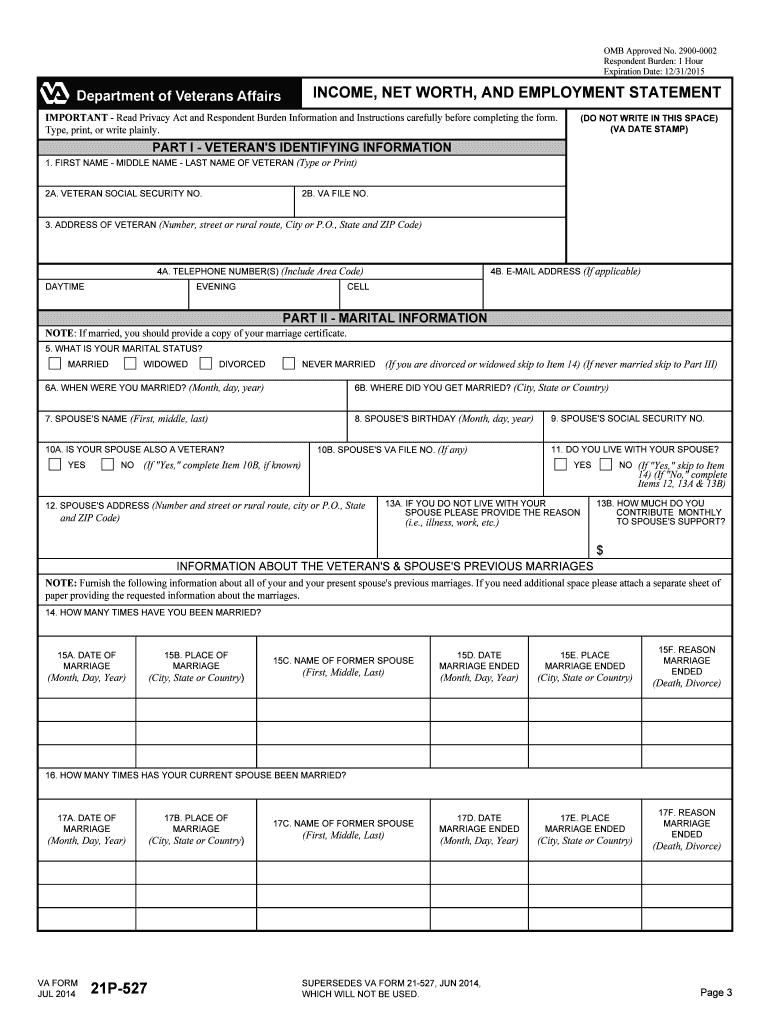

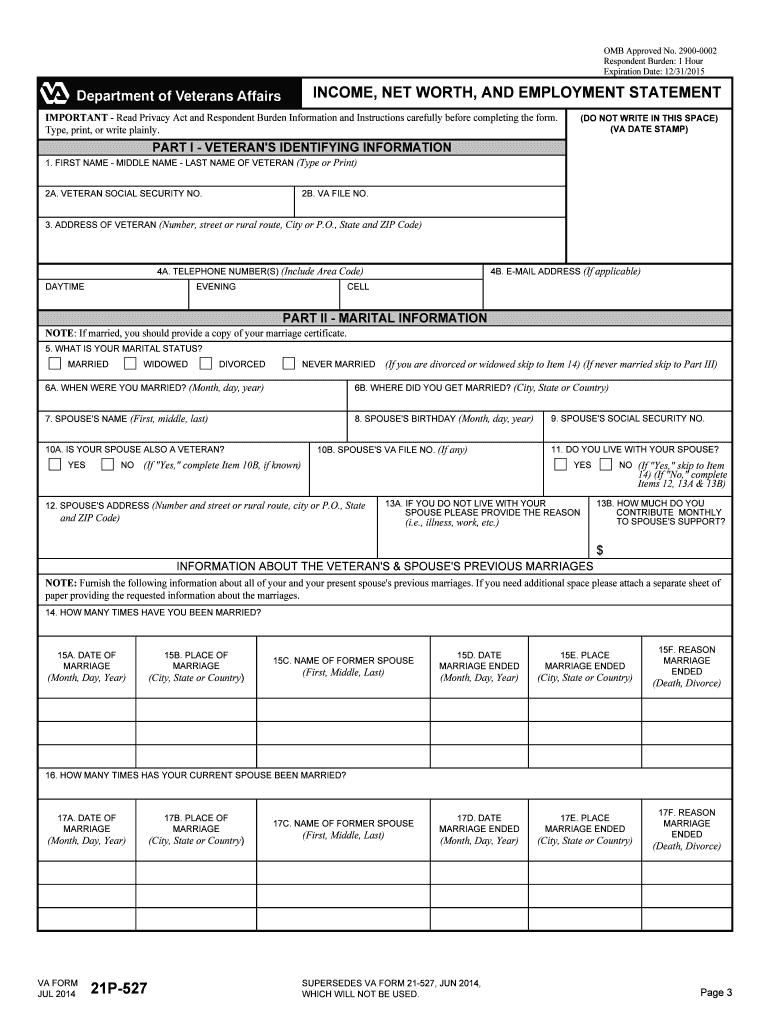

You may also contact VA by the Internet at: https://iris.va.gov. Use VA Form 21P- 527 to apply for disability pension if you ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your general instructions for income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general instructions for income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit general instructions for income online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit general instructions for income. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out general instructions for income

01

General instructions for income can be filled out by anyone who receives income, whether it's from employment, business activities, investments, or other sources. It is important to understand how to accurately report your income to ensure compliance with tax laws and regulations.

02

Begin by gathering all relevant documents that provide information about your income. This may include W-2 forms from employers, 1099 forms from clients or financial institutions, business statements, rental income documentation, and any other sources of income you receive.

03

Review the instructions provided by the tax authorities, such as the Internal Revenue Service (IRS) in the United States, to understand the specific requirements for reporting your income. These instructions may vary depending on your country's tax laws, so it is important to access the official instructions to ensure accuracy.

04

Start by filling out the identification section of the general instructions for income form. This typically includes fields for your name, social security number or taxpayer identification number, and contact information. Make sure all information is accurate and up to date.

05

Proceed to the income section of the form, where you will report the details of each income source separately. Carefully follow the provided instructions to accurately report the amounts and include any necessary supporting documentation, such as W-2 forms or 1099 forms.

06

If you have multiple sources of income, consider organizing them by category or type to facilitate the reporting process. This will help ensure that you don't miss any income sources and can easily cross-reference with your supporting documents.

07

Pay attention to any specific requirements or additional forms that may be necessary for certain types of income, such as self-employment income or rental income. These may require additional calculations or disclosure of specific details, so it is important to thoroughly read the instructions and provide the requested information accordingly.

08

Take your time when filling out the general instructions for income form to avoid mistakes or omissions. Double-check all entered information before submitting to ensure accuracy and completeness. If you are unsure about any aspect of reporting your income, consider seeking professional advice from a tax preparer or accountant.

In summary, anyone who receives income should understand how to fill out general instructions for income. By carefully following the provided instructions, gathering all necessary documents, and accurately reporting each income source, you can ensure compliance with tax laws and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find general instructions for income?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the general instructions for income. Open it immediately and start altering it with sophisticated capabilities.

Can I create an eSignature for the general instructions for income in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your general instructions for income and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out general instructions for income using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign general instructions for income. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your general instructions for income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.