Get the free l efile Form GRAPHIC p rint DO NOT PROCESS 990EZ Department of the Treasury Internal...

Show details

Le file Form GRAPHIC print DO NOT PROCESS 990EZ Department of the Treasury Internal Revenue Service As Filed Data DAN: 93409038001068 Short Form Return of Organization Exempt From Income Tax For the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your l efile form graphic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your l efile form graphic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit l efile form graphic online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit l efile form graphic. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

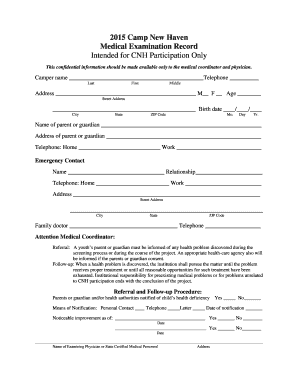

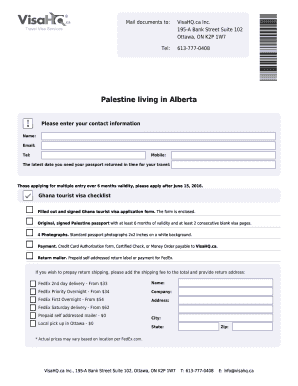

How to fill out l efile form graphic

How to fill out l efile form graphic:

01

Begin by gathering all necessary information and documents, such as your personal identification details and relevant financial information.

02

Access the l efile form graphic online or obtain a physical copy from the appropriate authority or institution.

03

Carefully read and understand the instructions provided with the form to ensure accurate completion.

04

Start by entering your personal information, such as your name, address, and social security number, in the designated fields.

05

Follow the form's instructions to input your financial information, including income, deductions, and credits.

06

Double-check all entered information for accuracy and completeness before proceeding.

07

If required, attach supporting documents, such as W-2 forms or receipts, according to the form's instructions.

08

Review the completed form once again to make sure everything is correctly filled out.

09

Sign and date the form in the designated area.

10

Submit the completed l efile form graphic to the appropriate authority or institution either electronically or via mail, following their specified submission instructions.

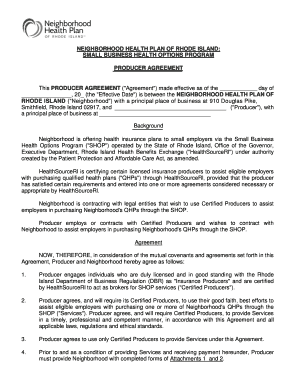

Who needs l efile form graphic:

01

Individuals or businesses who are required to file taxes often need l efile form graphic. This includes individuals who have an income that exceeds a certain threshold and are mandated by law to file an income tax return.

02

Individuals or businesses who have complex financial situations may also need l efile form graphic to accurately report their income, deductions, and credits.

03

Those who want to take advantage of electronic filing options and receive their tax refund faster may choose to use l efile form graphic, as it allows for faster processing and reduces the risk of errors often associated with manual paper forms.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify l efile form graphic without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like l efile form graphic, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit l efile form graphic in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing l efile form graphic and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit l efile form graphic on an Android device?

You can edit, sign, and distribute l efile form graphic on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your l efile form graphic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.