Get the free VRT Primary Legislation - Part 1 Part 1 - VRT Primary Legislation - Finance Act 1992...

Show details

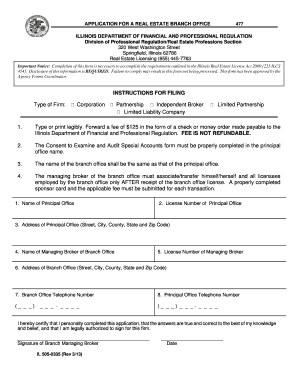

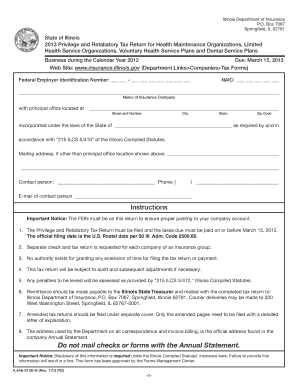

VEHICLE REGISTRATION TAX STATUTORY CONSOLIDATION of PRIMARY LEGISLATION Revised: January 2016 Introduction Finance Act 1992 Legislation INTRODUCTION AND GUIDE TO USE The purpose of this nonstatutory

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vrt primary legislation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vrt primary legislation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vrt primary legislation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit vrt primary legislation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

How to fill out vrt primary legislation

How to fill out vrt primary legislation:

01

Review the legislative requirements: Start by familiarizing yourself with the specific vrt primary legislation relevant to your jurisdiction. This may include statutes, regulations, or guidelines that outline the process and requirements for filling out the forms.

02

Gather necessary information: Collect all the information required to fill out the forms accurately. This may include details about the parties involved, specific transactions, applicable tax rates, and any supporting documentation needed.

03

Complete the appropriate forms: Based on the legislative requirements, fill out the necessary forms accurately and legibly. Pay close attention to any specific instructions or guidelines provided, and ensure that all relevant sections are completed.

04

Provide supporting documentation: Attach any supporting documentation required by the legislation. This may include invoices, receipts, transaction records, or any other evidence necessary to substantiate the information provided on the forms.

05

Double-check for accuracy: Review the completed forms and supporting documentation to ensure accuracy and compliance with the vrt primary legislation. Check for any errors, missing information, or discrepancies that may impact the validity or legitimacy of the submission.

06

Submit the forms: Once you are satisfied with the accuracy and completeness of the forms, submit them according to the specified procedure outlined in the vrt primary legislation. This may involve mailing or delivering the forms to the appropriate government agency or tax authority.

Who needs vrt primary legislation?

01

Individuals conducting taxable transactions: Any individual who engages in taxable transactions, such as purchasing, leasing, or importing specified goods or services, may need to abide by the vrt primary legislation. This legislation ensures that the appropriate taxes, fees, and duties are applied correctly.

02

Businesses and organizations: Companies, organizations, or other entities involved in taxable transactions are also subject to the vrt primary legislation. This may include businesses operating in specific industries, importers and exporters, or entities engaged in intercompany transactions.

03

Government agencies and tax authorities: Government agencies and tax authorities are responsible for enforcing and administering the vrt primary legislation. They play a crucial role in ensuring compliance, collecting taxes, and conducting audits or investigations to monitor adherence to the legislation.

Overall, anyone involved in taxable transactions or responsible for overseeing and enforcing tax compliance should be familiar with and adhere to the vrt primary legislation. It serves as a framework to ensure fair and consistent taxation practices, protecting the integrity of the tax system.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my vrt primary legislation in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your vrt primary legislation directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit vrt primary legislation on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing vrt primary legislation.

Can I edit vrt primary legislation on an iOS device?

You certainly can. You can quickly edit, distribute, and sign vrt primary legislation on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your vrt primary legislation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.