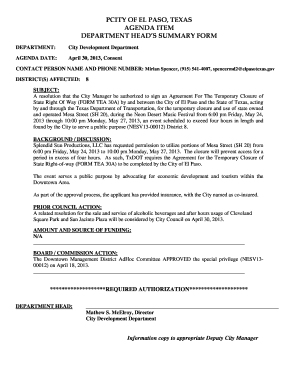

Get the free Understanding Your Form 1099-KInternal Revenue Service

Show details

Understanding Merchant Card, Third Party Network Payments and Basis Reporting 1099K Reporting and Securities Reporting Changes7/16/2012Provisions fall under two Internal Revenue Code sections Payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your understanding your form 1099-kinternal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding your form 1099-kinternal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit understanding your form 1099-kinternal online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit understanding your form 1099-kinternal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out understanding your form 1099-kinternal

How to fill out understanding your form 1099-kinternal:

01

Gather necessary information: Before filling out the form, gather all the required information such as your business name, address, taxpayer identification number, and payment details for each transaction.

02

Familiarize yourself with the instructions: Read the instructions provided with the form 1099-kinternal to understand the specific requirements and guidelines for filling out the form accurately.

03

Complete the payer information: Start by entering the payer's name, address, and taxpayer identification number in the designated fields. Ensure that the information provided is correct and matches the latest records.

04

Provide recipient information: Enter the recipient's name, address, and taxpayer identification number. It is crucial to accurately fill out this section to avoid any confusion or errors.

05

Report transaction details: For each transaction, record the date, gross amount received, and any adjustments or fees associated with it. Make sure to include all necessary transaction details, as failing to report any income could lead to penalties.

06

Determine transaction type: Indicate the type of transaction being reported, such as credit card payments, third-party network transactions, or other payment platforms.

07

Verify withheld federal income tax: If any federal income tax was withheld from the payments received, enter the amount in the corresponding field.

08

Review and submit: Carefully review the completed form for any mistakes or missing information. Ensure that all entries are accurate and legible before submitting the form to the appropriate tax authorities.

Who needs understanding your form 1099-kinternal:

01

Business owners: Understanding form 1099-kinternal is essential for business owners who receive payments through credit cards or other payment platforms. It helps in reporting income accurately and meeting tax obligations.

02

Independent contractors: Individuals working as independent contractors or freelancers may also receive form 1099-kinternal from their clients. Knowing how to interpret and fill out the form correctly is crucial for proper tax reporting.

03

Tax professionals: Tax professionals who assist businesses or individuals with their tax filings need to have a comprehensive understanding of form 1099-kinternal. It allows them to guide their clients accurately and ensure compliance with tax regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify understanding your form 1099-kinternal without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including understanding your form 1099-kinternal, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete understanding your form 1099-kinternal online?

Completing and signing understanding your form 1099-kinternal online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out understanding your form 1099-kinternal using my mobile device?

Use the pdfFiller mobile app to fill out and sign understanding your form 1099-kinternal on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your understanding your form 1099-kinternal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.