Get the free actionaid sacco form

Show details

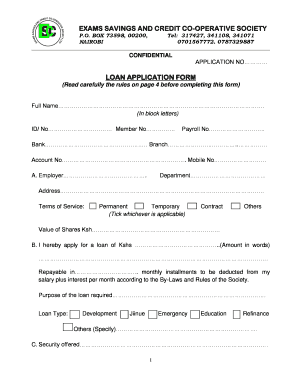

CONFIDENTIAL action aid Savings and Credit Cooperative Society Ltd P.O. Box 42814, 00100 Nairobi. Tel: 4440440/4/9 Fax: 4445843 Email: Sacco actionaidkenya.org LOAN APPLICATION & LOAN AGREEMENT FORM

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your actionaid sacco form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your actionaid sacco form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing actionaid sacco online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sacco application form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

How to fill out actionaid sacco form

01

To fill out the ActionAid Sacco application form, start by obtaining a copy of the form from the official website or the nearest ActionAid Sacco branch.

02

Fill in your personal details accurately, including your full name, address, phone number, email address, and occupation.

03

Provide information about your current employer or source of income, such as the company name, address, and contact details.

04

Indicate the type of account you wish to open, whether it's a savings account, loan account, or both.

05

Specify the initial deposit amount you are willing to make into your ActionAid Sacco account.

06

Provide any additional required information, such as your identification documents (ID, passport, etc.), proof of address, and proof of income.

07

Double-check all the information you have provided and make sure it is accurate and up-to-date.

08

Once you have completed filling out the form, sign and date it.

09

Submit the filled-out form along with any required supporting documents to the nearest ActionAid Sacco branch or through the specified online submission process, if applicable.

Who needs ActionAid Sacco?

01

Individuals who are looking for a safe and reliable way to save money can benefit from ActionAid Sacco. It offers various savings accounts that cater to different financial goals and needs.

02

Employees or self-employed individuals who need access to affordable loans can take advantage of the loan services provided by ActionAid Sacco. The Sacco offers competitive interest rates and flexible repayment terms.

03

ActionAid Sacco is also a great option for those who want to invest in their future. It provides investment opportunities, such as shares and other financial products, which can help individuals grow their wealth over time.

In conclusion, filling out the ActionAid Sacco form requires accurate personal information, details about your income source, and potential account preferences. ActionAid Sacco is suitable for individuals seeking savings options, affordable loans, and investment opportunities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is actionaid sacco?

ActionAid SACCO (Savings and Credit Cooperative Organization) is a financial institution established by ActionAid, an international non-governmental organization focused on ending poverty and promoting social justice. The SACCO aims to provide financial services and support to its members, who are primarily individuals from low-income backgrounds. It offers various products and services such as savings accounts, loans, and other financial assistance to help members improve their economic situation and enhance their livelihoods. The SACCO operates based on the cooperative principles of self-help, mutual assistance, and democratic control.

Who is required to file actionaid sacco?

Only members of ActionAid SACCO are required to file.

How to fill out actionaid sacco?

To fill out an ActionAid SACCO (Savings and Credit Cooperative) application, follow these steps:

1. Obtain the application form: Visit the ActionAid SACCO website or office to request an application form. Ensure you have all the necessary documents and information.

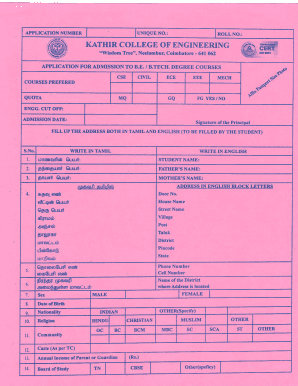

2. Personal Information: Start by providing your personal details, including your full name, date of birth, gender, nationality, and physical address.

3. Contact Information: Fill in your contact details, such as phone number(s), email address, and any alternative contact person or next of kin.

4. Employment and Income Information: Provide details about your current employment status, including your employer's name, address, and contact information. You may also need to provide your monthly income or salary.

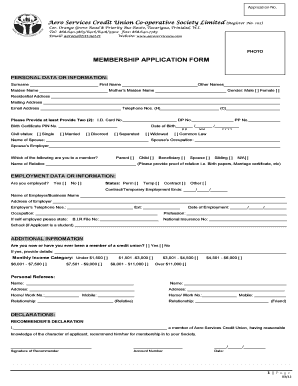

5. Membership Information: Specify the type of membership you are applying for, such as individual or corporate, and any other relevant membership details requested.

6. Savings and Deposits: Indicate the initial deposit or amount you are willing to save with the SACCO. Additionally, specify the kind of savings account you want to open, such as regular savings, fixed deposit, or special savings.

7. Loan Information: If you are interested in applying for loans, provide details on the loan amount you intend to borrow, purpose of the loan, and any collateral or guarantors you can provide.

8. Education and Skills: Mention your educational background and any special skills or qualifications that may be relevant.

9. Declaration and Signature: Read through the declaration section carefully and sign the form to certify that the information provided is true and accurate.

10. Attach Supporting Documents: Gather any required documents, such as a copy of your identification card or passport, proof of address (e.g., utility bill), letter of employment, and copies of your educational certificates. Attach these documents to the application form.

11. Submission: Once you have filled out the form and attached the necessary documents, submit them to the ActionAid SACCO office, following their specific instructions. Take note of any fees or charges you may need to pay when submitting the application.

It's important to note that the specific requirements and processes may vary depending on the SACCO and country of operation. Therefore, it is advisable to consult the official ActionAid SACCO website or contact their office directly for accurate and up-to-date instructions.

What is the purpose of actionaid sacco?

ActionAid Sacco is a financial institution that primarily serves the members of ActionAid, a global federation of organizations working to alleviate poverty and promote social justice. The purpose of ActionAid Sacco is to provide financial services and products to its members, such as savings accounts, loans, and other financial assistance, in order to support their economic well-being and empower them to improve their livelihoods. The Sacco aims to promote financial inclusion, foster savings culture, and provide affordable credit facilities to its members, enabling them to access financial resources for income-generating activities, education, healthcare, and other essential needs. Ultimately, the purpose of ActionAid Sacco is to contribute to poverty reduction and social development by providing financial support and services to ActionAid members.

What is the penalty for the late filing of actionaid sacco?

It is unclear what specific penalty would be imposed for the late filing of ActionAid SACCO. The penalties can vary depending on the jurisdiction and the specific rules and regulations governing SACCOs in that jurisdiction.

In general, late filing of required documentation or reports may result in financial penalties or additional fees charged by the regulatory authority. It may also lead to loss of certain privileges, such as the ability to conduct certain transactions or access certain services.

To find the specific penalty for late filing of ActionAid SACCO, it is advisable to consult the bylaws, regulations, and guidelines of the SACCO or contact the SACCO directly for clarification on the consequences of late filing.

How can I send actionaid sacco for eSignature?

When you're ready to share your sacco application form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get action aid sacco?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific actionaid sacco and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit sacco application form on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share action aid sacco on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your actionaid sacco form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Action Aid Sacco is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.