Get the free liberia revenue authority forms

Show details

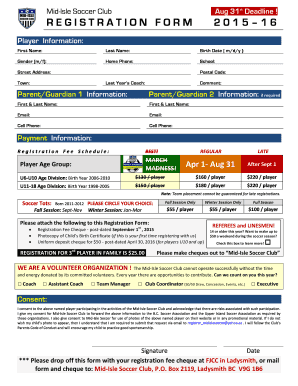

LIBERIA REVENUE AUTHORITY (ERA) REGISTRATION FORM INDIVIDUALS Form: IN01 (Rev. June 2014) (FOR USE BY INDIVIDUALS AND SOLEPROPRIETORSHIPS) Republic of Liberia Revenue Authority Domestic Tax Department

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your liberia revenue authority forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your liberia revenue authority forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing liberia revenue authority forms online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit liberia revenue authority website form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out liberia revenue authority forms

How to fill out Liberia Revenue Authority forms:

01

Start by gathering all necessary information and documents required to complete the forms. This might include personal identification documents, tax documents, and any relevant supporting documentation.

02

Carefully read and understand the instructions provided with the forms. Ensure that you have a clear understanding of each section and the information required.

03

Begin filling out the forms by entering your personal information, such as your full name, address, and contact details. Be sure to provide accurate and up-to-date information.

04

Proceed to the sections that require specific tax-related details, such as income, expenses, deductions, and credits. Take your time to accurately enter all the relevant information. It might be helpful to gather all the required financial documents beforehand to ensure accuracy.

05

If applicable, provide any additional supporting documentation as requested by the forms. This might include copies of receipts, bank statements, or other relevant documents that support your tax-related claims.

06

Review the completed forms to ensure all information is accurate and complete. Double-check for any errors or omissions.

07

Sign and date the forms as required. Ensure that your signature is legible.

08

Make copies of all completed forms for your records. It's essential to keep a copy of the filled-out forms as proof of submission.

Who needs Liberia Revenue Authority forms:

01

Individuals who are liable to pay taxes in Liberia, whether they are citizens, residents, or non-residents, may need to fill out Liberia Revenue Authority forms.

02

Business entities, such as companies and partnerships, that operate in Liberia are also obligated to complete these forms to fulfill their tax obligations.

03

Any individual or entity that is required to withhold taxes on behalf of the government, such as employers deducting income tax from their employees' salaries, will need to fill out these forms.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file liberia revenue authority forms?

All businesses and individuals operating in Liberia, as well as any international entities doing business in the country, are required to file Liberia Revenue Authority forms.

What is the purpose of liberia revenue authority forms?

The Liberia Revenue Authority (LRA) administers a variety of forms to collect taxes and other payments from individuals and businesses in Liberia. These forms are used to report income, claim deductions, and calculate taxes due. They also provide information to the LRA which helps them to track economic activity in the country.

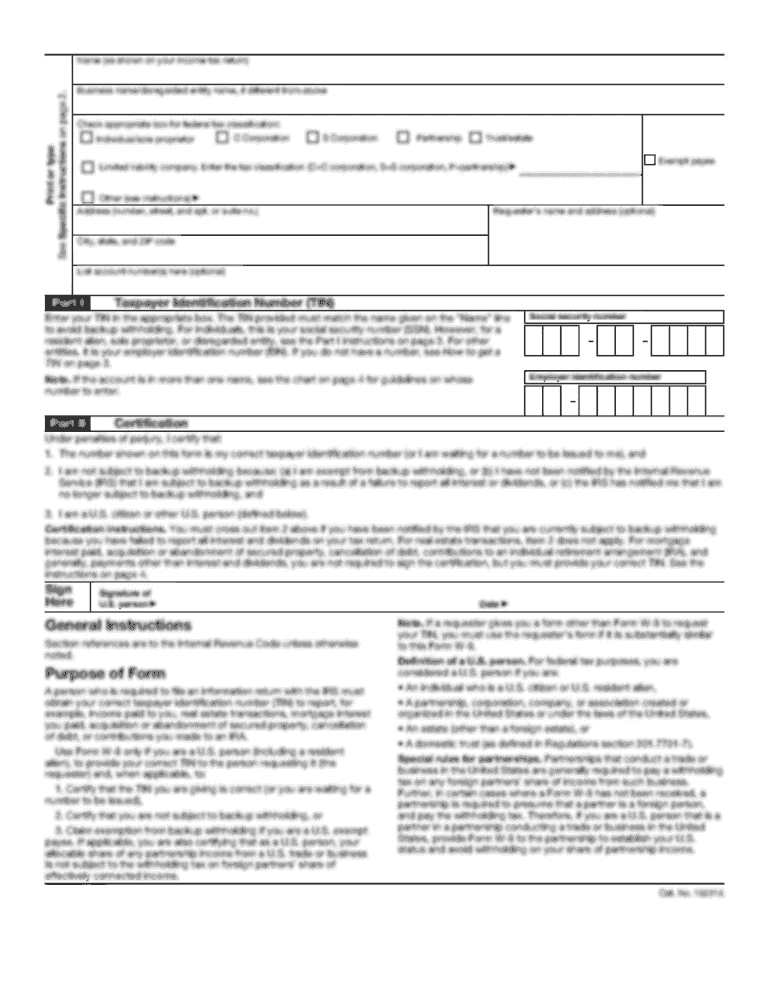

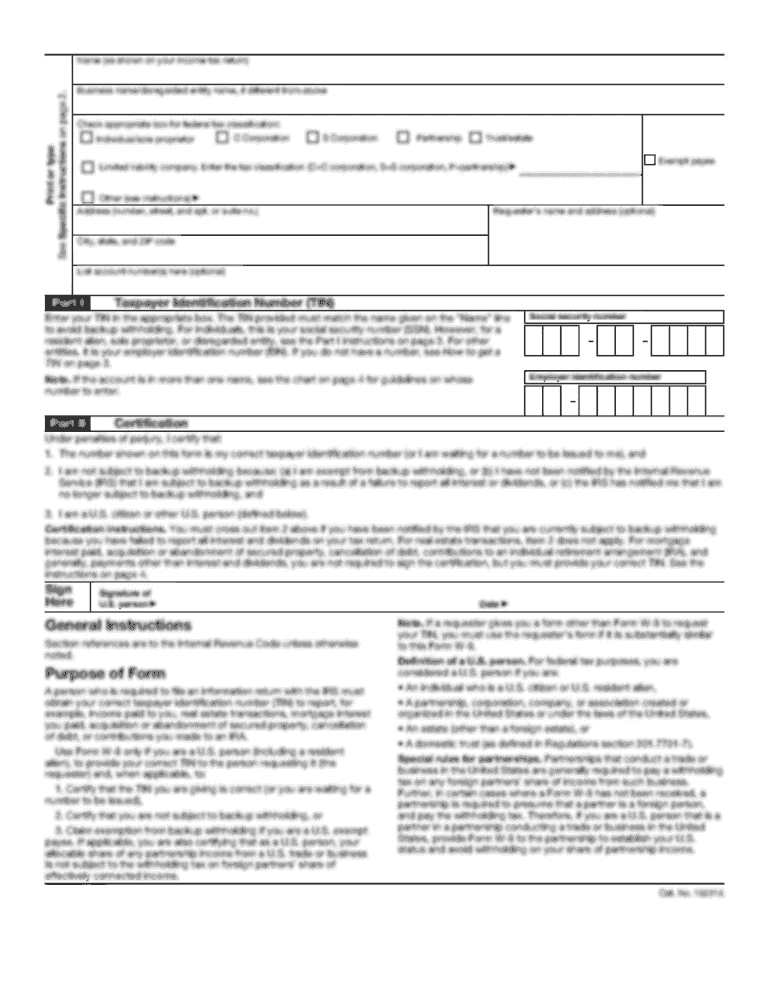

What information must be reported on liberia revenue authority forms?

The information required to be reported on Liberia Revenue Authority (LRA) forms includes:

-Name, address, and taxpayer identification number of the taxpayer

-Type of business or activity

-Nature of the goods or services provided

-Amount of income earned

-Tax liability

-Expenditure

-Payment details

-Tax period

-Gross and net income

-Deductible expenses

-Tax credits

-Taxable income

-Tax rate

-Tax due

-Payment due date

What is the penalty for the late filing of liberia revenue authority forms?

The Liberia Revenue Authority (LRA) has the right to impose penalties on any business or individual who fails to file their returns or payments by the due date. Penalties vary according to the type of return and the amount of time past the due date that the return is filed. The penalties imposed by the LRA can range from a flat penalty to a percentage of the amount due. Penalties can also be waived or reduced by the LRA based on mitigating circumstances.

What is liberia revenue authority forms?

The Liberia Revenue Authority (LRA) forms refer to various tax and customs declaration forms used by businesses and individuals in Liberia to comply with taxation and customs requirements. These forms are used to report income, calculate and pay taxes, request tax exemptions or refunds, and fulfill customs clearance processes for the import and export of goods. Some common LRA forms include income tax return forms, value-added tax (VAT) forms, import declaration forms, customs entry forms, and tax exemption application forms.

How to fill out liberia revenue authority forms?

To fill out Liberia Revenue Authority (LRA) forms, follow these general steps:

1. Obtain the correct form: Visit the official website of the Liberia Revenue Authority to find the specific form you need. Download and print a copy of the form.

2. Read the instructions: Carefully read the instructions or guidelines provided with the form. Understand the purpose of the form and the information required.

3. Gather necessary information: Collect all the relevant information and supporting documents required to complete the form. This may include personal details, income statements, tax identification numbers, and any other specific information requested.

4. Complete the form: Fill in the form using legible handwriting or type the information directly into digital versions of the form. Ensure accuracy and provide all required information. If any section does not apply to you, write "N/A" or "Not Applicable."

5. Use black or blue ink: When completing a paper form, use a dark-colored pen like black or blue ink to ensure clarity.

6. Review and double-check: Once you have filled out the form, review all the information provided for accuracy and completeness. Make sure you have not missed any sections or attached necessary additional documents.

7. Sign and date: If required, sign and date the form at the designated areas. Ensure your signature matches the one on file, such as the one on your tax identification card.

8. Submit the form: Follow the instructions provided by the LRA on where and how to submit the completed form. This may include options like online submission, mailing, or delivering it to an LRA office in person.

Remember, it is important to consult with a tax professional or contact the Liberia Revenue Authority directly if you have any specific questions or need assistance with filling out their forms.

How can I edit liberia revenue authority forms on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit liberia revenue authority website form.

Can I edit liberia revenue authority app on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share liberia revenue authority forms from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit lra tax return forms on an Android device?

You can make any changes to PDF files, like liberia revenue authority liberia form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your liberia revenue authority forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Liberia Revenue Authority App is not the form you're looking for?Search for another form here.

Keywords relevant to lra tax return forms

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.