Get the free L1120ES CITY OF LANSING 2014 CORPORATION ESTIMATED INCOME TAX PAYMENT VOUCHER FOURTH...

Show details

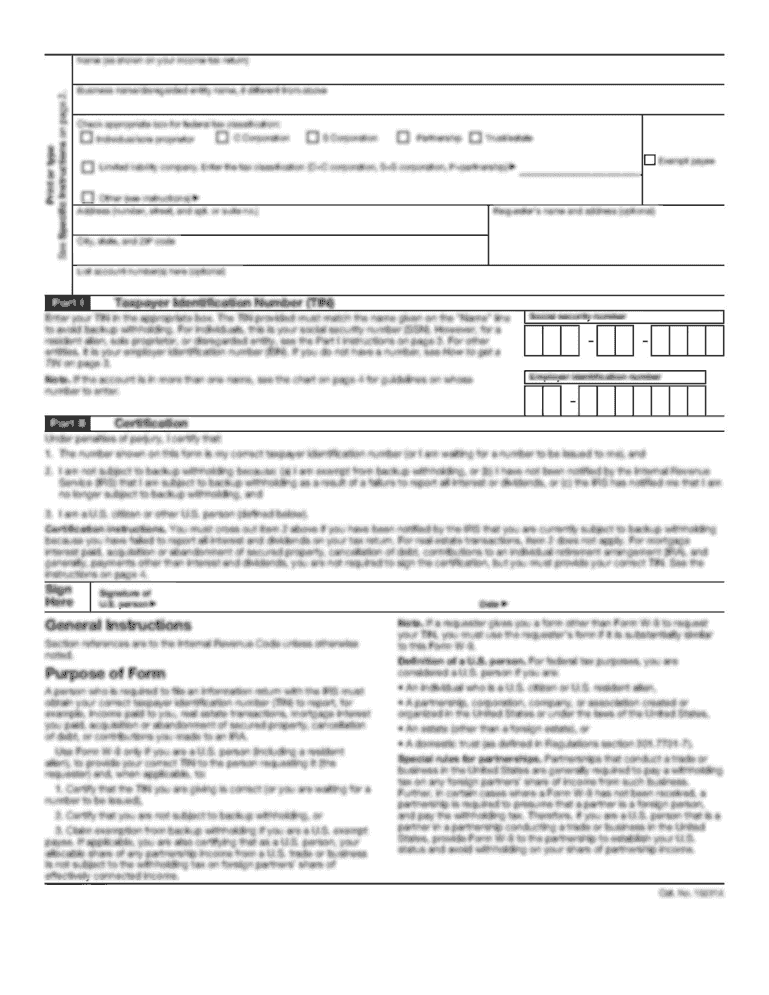

L1120ES CITY OF LANSING 2014 CORPORATION ESTIMATED INCOME TAX PAYMENT VOUCHER FOURTH QUARTERPAYMENT DUE JANUARY 31, 2015, Pay on or before: Calendar year due date is 01/31/2015, for 2014. Fiscal year:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your l1120es city of lansing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your l1120es city of lansing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit l1120es city of lansing online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit l1120es city of lansing. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out l1120es city of lansing

How to fill out l1120es city of lansing:

01

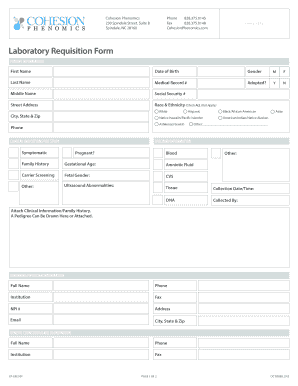

Begin by gathering all the necessary information and documents. Make sure you have your tax identification number, business information, and financial records ready.

02

Download and print the l1120es form from the City of Lansing website. Ensure you have the most up-to-date version of the form.

03

Read the instructions carefully before filling out the form. Understand the requirements and any specific guidelines provided.

04

Start filling out the form by entering your business information, such as the legal name, address, and tax identification number. Provide accurate details to avoid any discrepancies.

05

Move on to the income section, where you will report your business earnings. Carefully list all the sources of income and their respective amounts. Double-check for any errors or omissions.

06

Proceed to the deductions section. If applicable, include any eligible deductions that can help reduce your taxable income.

07

Calculate the taxable income by subtracting the deductions from the total income. Ensure your calculations are accurate and properly recorded.

08

Determine the tax liability based on the taxable income. Refer to the tax rate table provided in the instructions to calculate the correct amount.

09

Complete any additional sections or schedules that may apply to your business. Follow the instructions provided to accurately report any additional information required.

10

Once the form is fully filled out, review it for any errors or missing information. Proofread all the details to ensure accuracy.

11

Sign and date the form using the designated spaces. If applicable, have an authorized representative sign on behalf of the business.

12

Make a copy of the filled-out form for your records before submitting it to the City of Lansing. Retain the copy for future reference.

Who needs l1120es city of Lansing?

The l1120es City of Lansing form is required for businesses operating within the City of Lansing and are liable for income taxes. It is used to accurately report business income, deductions, and calculate the tax liability owed to the city. Any business, whether it is a sole proprietorship, partnership, corporation, or LLC, may need to fill out this form to comply with the tax regulations set by the City of Lansing. It is important to consult with a tax professional or refer to the city's guidelines to determine if your business is required to file the l1120es form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete l1120es city of lansing online?

With pdfFiller, you may easily complete and sign l1120es city of lansing online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in l1120es city of lansing?

The editing procedure is simple with pdfFiller. Open your l1120es city of lansing in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the l1120es city of lansing electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your l1120es city of lansing in seconds.

Fill out your l1120es city of lansing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.