Get the free ABCs OF CREDIT SCORING

Show details

ABCs OF CREDIT SCORING

A credit score is a number of lenders used to help them decide: If I give this person a loan or credit card, how likely is

it that I will get paid back on time? A score is a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your abcs of credit scoring form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your abcs of credit scoring form via URL. You can also download, print, or export forms to your preferred cloud storage service.

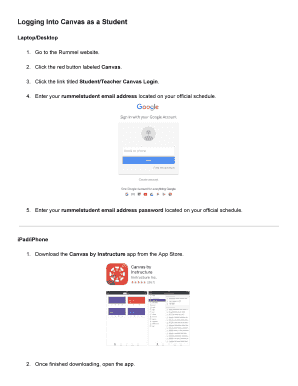

Editing abcs of credit scoring online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit abcs of credit scoring. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out abcs of credit scoring

How to fill out abcs of credit scoring:

01

Understand the basics: Start by familiarizing yourself with the key components of credit scoring. Learn about factors such as payment history, credit utilization, length of credit history, types of credit, and recent inquiries.

02

Obtain your credit report: Request a copy of your credit report from one or all of the major credit bureaus - Equifax, Experian, and TransUnion. Review the report carefully to ensure that all the information is accurate and up to date.

03

Check for errors: Look for any discrepancies or errors in your credit report. If you find any, you have the right to dispute them and have them corrected. This can potentially improve your credit score.

04

Pay your bills on time: Payment history is a crucial factor in credit scoring. Make sure to pay all your bills, including credit card payments, loans, and utilities, on time. Late payments can negatively impact your credit score.

05

Manage your credit utilization: Keep your credit utilization ratio low. This means using only a small percentage of your available credit. Aim to keep it below 30%. High credit card balances can lower your credit score.

06

Maintain a healthy credit mix: Having a mix of different types of credit, such as credit cards, loans, and mortgages, can reflect positively on your credit score. However, only take on credit that you can manage responsibly.

07

Avoid opening too many accounts: While having a good credit mix is important, avoid opening too many accounts within a short period. Numerous credit inquiries can raise concerns for lenders and negatively impact your score.

08

Monitor your credit regularly: Keep a close eye on your credit score and credit report. This way, you can identify any changes or potential issues promptly. Use free credit monitoring tools or sign up for credit monitoring services.

Who needs abcs of credit scoring?

01

Individuals looking to improve their credit: If you have a low credit score or have experienced credit issues in the past, understanding the ABCs of credit scoring can help you take steps to improve your score and overall creditworthiness.

02

First-time credit applicants: If you are applying for credit for the first time, having knowledge of credit scoring basics can be beneficial. It can help you establish good credit habits from the start, giving you a better chance of being approved for future credit applications.

03

Those seeking loans or credit: Lenders use credit scores to assess the risk associated with lending money. By understanding credit scoring, you can present yourself as a more creditworthy borrower, increasing your chances of getting approved for loans or credit at favorable terms.

04

Individuals wanting to maintain good credit: Even if you already have a good credit score, it's essential to stay informed about credit scoring. This knowledge will help you maintain your creditworthiness and possibly even improve your score further.

In summary, understanding the ABCs of credit scoring is crucial for individuals looking to improve their credit, first-time credit applicants, those seeking loans or credit, and anyone wanting to maintain good credit. By following the steps to fill out the ABCs of credit scoring and applying this knowledge, individuals can take control of their credit and work towards a healthier financial future.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my abcs of credit scoring directly from Gmail?

abcs of credit scoring and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send abcs of credit scoring for eSignature?

When you're ready to share your abcs of credit scoring, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my abcs of credit scoring in Gmail?

Create your eSignature using pdfFiller and then eSign your abcs of credit scoring immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your abcs of credit scoring online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.