Get the free SEP Account Application - American Century

Show details

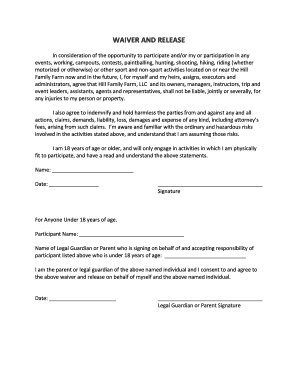

Account Application for SEP, SAR SEP and SIMPLE IRA Investors SST If you are a non-resident alien, call us before completing this application. If you are an employer establishing a new SIMPLE IRA

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sep account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sep account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sep account application online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sep account application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out sep account application

How to fill out a SEP account application:

01

Start by obtaining the necessary forms: To fill out a SEP account application, you will need to obtain the specific forms from the financial institution or provider where you plan to open the account. These forms may be available on their website or can be requested directly from them.

02

Provide personal information: The application will require you to provide personal information, including your full name, address, social security number, and contact details. Be sure to fill in this information accurately and completely.

03

Choose an account type: Depending on the financial institution, you may have different options for SEP account types. Select the one that aligns with your goals and needs, whether it's a traditional SEP IRA or a SEP 401(k).

04

Determine contribution amount: Decide on the amount you want to contribute to your SEP account. This can be a percentage of your income or a fixed dollar amount. Ensure that your contributions stay within the annual contribution limits set by the IRS.

05

Understand eligibility requirements: SEP accounts have specific eligibility requirements, and it's crucial to understand them before filling out the application. Generally, any eligible employer can establish a SEP plan, and eligible employees include those who are at least 21 years old, have worked for the employer in three of the last five years, and have earned at least a specific minimum amount.

06

Consider tax implications: SEP contributions are typically tax-deductible, so it's essential to understand the potential tax benefits and implications. Consult with a tax advisor or accountant if you have any questions or need further guidance.

Who needs a SEP account application:

01

Self-employed individuals: SEP accounts are primarily designed for self-employed individuals, including sole proprietors, freelancers, consultants, and independent contractors. It allows them to contribute towards their retirement savings with potentially significant tax benefits.

02

Small business owners: SEP accounts can also be beneficial for small business owners who wish to offer retirement benefits to their employees. Employers can open SEP accounts for themselves and contribute to their employees' accounts based on a defined formula.

03

Individuals with fluctuating income: SEP accounts can be advantageous for individuals with variable income, as contributions can be scaled according to income levels. This flexibility allows individuals to save more during prosperous periods and less during leaner times.

04

Those looking for tax deductions: SEP contributions are tax-deductible, which means they can help reduce your taxable income for the year, potentially lowering your overall tax liability. This feature can be appealing to individuals who want to maximize their tax savings.

Remember, it is always a good idea to consult with a financial advisor or retirement specialist to ensure that a SEP account aligns with your specific financial situation and retirement goals.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sep account application?

SEP account application is a form that individuals or businesses use to open a Simplified Employee Pension (SEP) account, which is a type of retirement plan for self-employed individuals or small businesses.

Who is required to file sep account application?

Self-employed individuals or small businesses that want to establish a Simplified Employee Pension (SEP) plan are required to file a SEP account application.

How to fill out sep account application?

To fill out a SEP account application, individuals or businesses must provide personal information, employment details, financial information, and any other required documentation as specified in the application form.

What is the purpose of sep account application?

The purpose of a SEP account application is to establish a retirement plan for self-employed individuals or small businesses, which allows them to save for retirement in a tax-advantaged way.

What information must be reported on sep account application?

The information that must be reported on a SEP account application includes personal details, employment information, financial statements, and any other relevant information required to establish a SEP plan.

When is the deadline to file sep account application in 2023?

The deadline to file a SEP account application for the year 2023 is typically April 15th of the following year, unless an extension has been granted.

What is the penalty for the late filing of sep account application?

The penalty for the late filing of a SEP account application can vary depending on the circumstances, but typically includes fines and potential loss of tax benefits associated with the SEP plan.

How can I send sep account application for eSignature?

Once your sep account application is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit sep account application online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your sep account application to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete sep account application on an Android device?

Complete your sep account application and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your sep account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.