Get the free IRCP 84.g. Payment of Fee - Preparation of Transcript. - STATE OF ... - isc idaho

Show details

I.R.C.P. 84.g. Payment of Fee Preparation of Transcript. Published on Supreme Court (http://isc.idaho.gov) I.R.C.P. 84.g. Payment of Fee Preparation of Transcript. Idaho Rules for Civil Procedures

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ircp 84g payment of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ircp 84g payment of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ircp 84g payment of online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ircp 84g payment of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out ircp 84g payment of

How to fill out ircp 84g payment of:

01

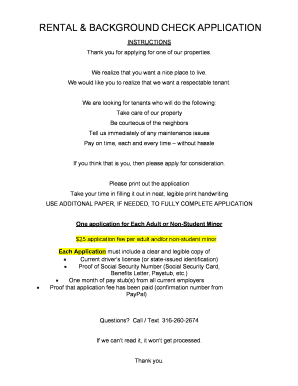

Obtain the proper form: Start by obtaining the ircp 84g payment form from the relevant authority or organization. This form is usually available online or can be requested physically.

02

Review the instructions: Before filling out the form, carefully read the instructions provided. Make sure you understand each section and the information required.

03

Gather necessary information: Collect all the important details needed for the form. This may include personal information, payment details, and any supporting documents or references required.

04

Fill out personal information: Begin by filling out your personal information accurately. This includes your full name, address, contact information, and any other details specifically requested.

05

Provide payment details: In the relevant section of the form, provide the payment details required. This may include the amount, purpose, and any reference numbers or codes associated with the payment.

06

Attach supporting documents: If there are any supporting documents required to accompany the payment form, make sure to attach them securely. These documents may vary depending on the purpose of the payment.

07

Review and double-check: Once you have completed filling out the form, take some time to review all the information provided. Ensure that everything is accurate and there are no spelling or numerical errors.

08

Submit the form: Once you are confident that the form is filled out correctly, submit it according to the instructions provided. This may involve mailing it, submitting it online, or delivering it to the relevant office in person.

Who needs ircp 84g payment of:

01

Individuals making charitable donations: Individuals who wish to make charitable donations to qualifying organizations may need to use ircp 84g payment forms. This enables them to report their donations accurately and potentially claim tax benefits.

02

Organizations receiving donations: Charitable organizations or non-profit entities that rely on donations to fund their activities may request ircp 84g payment forms from donors. This allows them to properly record and acknowledge the donations received.

03

Taxpayers claiming deductions: For tax purposes, individuals or businesses may need to use ircp 84g payment forms to report and claim deductions related to charitable donations. This ensures compliance with tax laws and maximizes eligible deductions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ircp 84g payment of directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ircp 84g payment of and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in ircp 84g payment of?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your ircp 84g payment of and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I edit ircp 84g payment of on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing ircp 84g payment of right away.

Fill out your ircp 84g payment of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.