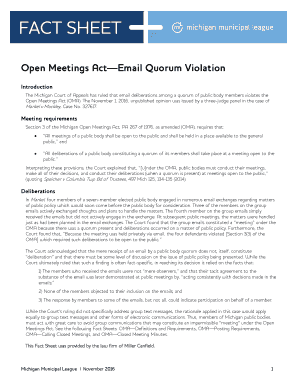

Get the free Ga s 5000 Each Association - bswdbab-bmixedbbcomb

Show details

Doubles(Pat & Mel HDCP classic) (One Man/ One Woman) 1. Name: 2. Name: All Event $10.00 Mixed HDCP $50.00 Senior 50 and over $50.00 Email: tangible yahoo.com Gayle Willing ham 3308 S. Roberson Ave

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ga s 5000 each form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ga s 5000 each form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ga s 5000 each online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ga s 5000 each. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out ga s 5000 each

How to fill out GA S-5000 each:

01

Start by gathering all the necessary information and documents required to fill out the GA S-5000 each form. This may include personal identification details, tax information, and any other relevant documentation.

02

Begin filling out the form by entering your full name, address, and Social Security number in the designated fields. Ensure that all the information provided is accurate and up to date.

03

Proceed to the income section of the form, where you will need to report your total income earned during the specified period. This may include wages, self-employment income, rental income, or any other applicable sources of income. Provide accurate figures and ensure that all income sources are accounted for.

04

Next, move on to the deductions section of the form. Here, you can list any eligible deductions or expenses that you are entitled to claim. Some common deductions include medical expenses, mortgage interest, or charitable donations. Make sure to properly calculate and report these deductions.

05

If you are claiming any tax credits, such as the Child Tax Credit or Earned Income Credit, indicate this in the appropriate section of the form. Provide the necessary information and follow the instructions carefully to ensure proper claim of these credits.

06

Once you have completed all the necessary sections of the form, review your entries thoroughly to check for any errors or omissions. It is essential to double-check all the information provided before submitting the form to avoid delays or potential issues.

Who needs GA S-5000 each?

01

Residents of the state of Georgia who meet certain income or filing requirements may need to file GA S-5000 each. This form is specifically designed for individuals to report their state income tax information accurately.

02

Self-employed individuals or those with non-standard sources of income may also need to file GA S-5000 each to fulfill their state tax obligations.

03

Additionally, individuals who qualify for certain tax credits or deductions available in Georgia may need to fill out the GA S-5000 each form to claim these benefits.

Note: It is always advisable to consult with a tax professional or refer to the Georgia Department of Revenue's guidelines to determine if you specifically need to fill out GA S-5000 each and to receive accurate instructions for your personal situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ga s 5000 each online?

pdfFiller has made it easy to fill out and sign ga s 5000 each. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the ga s 5000 each in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your ga s 5000 each and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit ga s 5000 each on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing ga s 5000 each right away.

Fill out your ga s 5000 each online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.