Get the free This year, we will be leading Cluster Charge Conferences in Corsicana, Hillsboro, Me...

Show details

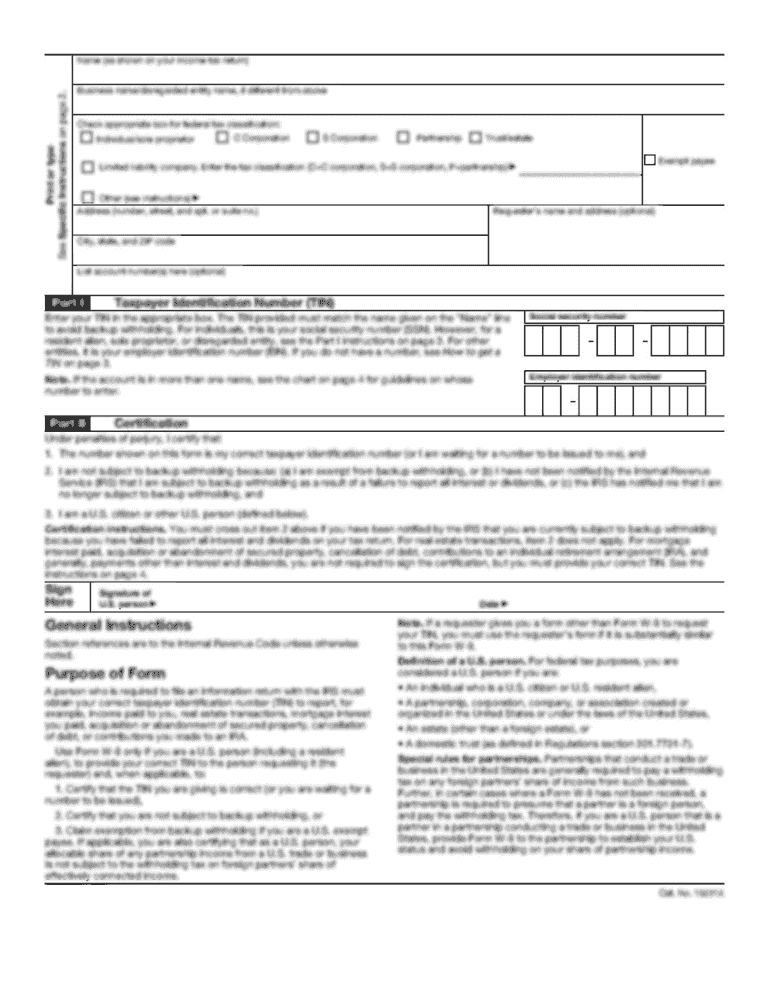

2012 CLUSTER CHARGE (CHURCH) CONFERENCE

This year, we will be leading Cluster Charge Conferences in Corsican, Hillsboro, Media

and Waco. The churches, times and places are attached. If you feel there

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

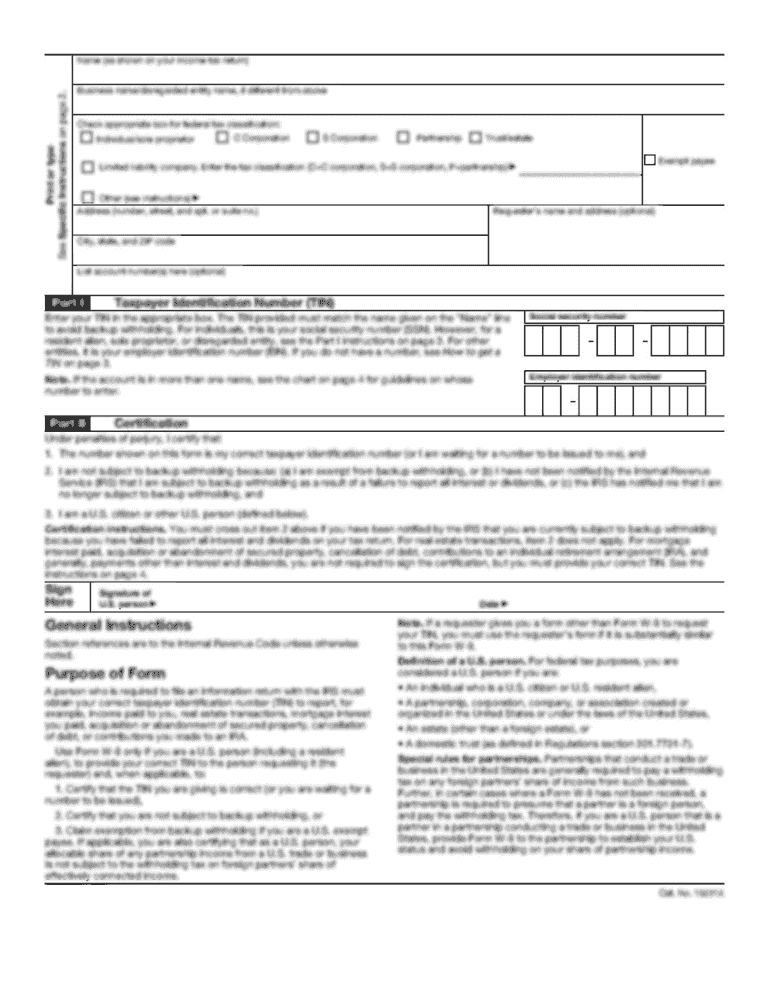

Edit your this year we will form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your this year we will form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit this year we will online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit this year we will. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

How to fill out this year we will

How to fill out "this year we will":

01

Start by setting clear goals: Begin by identifying what you want to achieve this year. Whether it's personal or professional goals, it's essential to have a clear direction.

02

Break down your goals into actionable steps: Once you have your goals, divide them into smaller, manageable tasks. This will make it easier to track progress and stay motivated throughout the year.

03

Create a timeline: Establish deadlines for each task to ensure that you stay on track. This will help you stay accountable and prevent procrastination.

04

Prioritize your goals: Determine which goals are most important to you and allocate your time and resources accordingly. This will prevent you from spreading yourself too thin and increase your chances of success.

05

Stay organized: Use a planner, digital tools, or any other system that works for you to keep track of your goals, tasks, and deadlines. This will help you stay focused and avoid feeling overwhelmed.

06

Review and adjust regularly: Regularly assess your progress towards your goals and make necessary adjustments. It's okay to modify your goals or deadlines if needed, as long as it aligns with your overall vision.

Who needs "this year we will":

01

Individuals: Anyone looking to make progress in their personal lives can benefit from setting goals for the year. Whether it's adopting healthier habits, learning new skills, or pursuing personal passions, setting goals can provide focus and motivation.

02

Professionals: Setting goals is crucial for professionals who want to advance in their careers or achieve success in their field. It helps identify areas for growth, develop specific skills, and track progress towards professional milestones.

03

Organizations: Companies and businesses also need to set goals for the year. Whether it's revenue targets, expanding market share, or improving customer satisfaction, setting clear objectives helps align the entire organization and drive performance.

In summary, filling out "this year we will" involves setting clear goals, breaking them down into actionable steps, creating a timeline, prioritizing, staying organized, and regularly reviewing and adjusting. This process applies to individuals, professionals, and organizations seeking growth and progress.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is this year we will?

This year we will have to file our annual tax returns.

Who is required to file this year we will?

Individuals and businesses meeting certain income thresholds are required to file their tax returns.

How to fill out this year we will?

Taxpayers can fill out their tax returns either electronically or by mail.

What is the purpose of this year we will?

The purpose of filing tax returns is to report income, deductions, and credits to determine the amount of tax owed or refund due.

What information must be reported on this year we will?

Taxpayers must report their income, deductions, credits, and any other relevant financial information on their tax returns.

When is the deadline to file this year we will in 2023?

The deadline to file tax returns in 2023 is April 18th.

What is the penalty for the late filing of this year we will?

The penalty for late filing of tax returns is typically a percentage of the unpaid taxes owed, increasing the longer the filing is delayed.

How do I modify my this year we will in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign this year we will and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an eSignature for the this year we will in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your this year we will and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit this year we will on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing this year we will, you can start right away.

Fill out your this year we will online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.