Get the free Individual 401(k) Plans

Show details

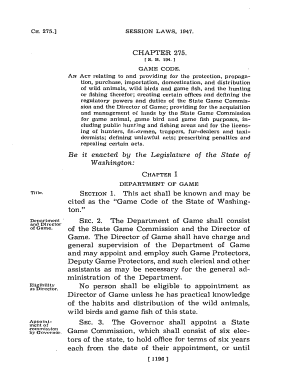

Individual 401(k) Plans

Who qualify for an Individual 401(k) plan? Any business or enterprise that employs

only the owner(s) and/or spouse(s) of owners corporations, partnerships, sole

proprietorship,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your individual 401k plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual 401k plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit individual 401k plans online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit individual 401k plans. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

How to fill out individual 401k plans

How to fill out individual 401k plans:

01

Start by gathering all required documentation such as your personal identification information, Social Security number, and relevant financial records.

02

Research different individual 401k providers and compare their features, fees, and investment options. Choose the one that aligns with your investment goals and offers the best benefits.

03

Contact the chosen provider and request the necessary forms to open an individual 401k plan. Fill out the forms accurately and provide any additional requested information or documentation.

04

Determine your contribution amount based on your financial situation and the annual contribution limits set by the IRS. Consider consulting with a financial advisor to determine the right contribution strategy for your retirement goals.

05

Choose your investment options from the available funds or investment products offered by your individual 401k provider. Consider your risk tolerance, time horizon, and investment objectives while making these decisions.

06

Once your individual 401k plan is set up, establish a contribution schedule to ensure regular contributions are made. This can be done through automatic payroll deductions or manual contributions.

07

Review your individual 401k plan periodically to track its performance and make any necessary adjustments. Stay updated on the IRS regulations and changes related to individual 401k plans to ensure compliance.

Who needs individual 401k plans:

01

Self-employed individuals: Individuals who are self-employed, including freelancers, independent contractors, sole proprietors, and small business owners, can benefit from having an individual 401k plan. It provides an opportunity to save for retirement and potentially receive tax advantages.

02

Business owners with no employees: If you are a business owner without any full-time employees, an individual 401k plan can be an attractive retirement savings option. It allows you to make higher contributions compared to other retirement plans, such as Traditional or Roth IRAs.

03

Individuals seeking higher contribution limits: Compared to other retirement plans, individual 401k plans often offer higher contribution limits. This can be beneficial for individuals who wish to maximize their retirement savings through higher annual contributions.

04

Individuals looking for investment flexibility: Individual 401k plans typically offer a wide range of investment options, including stocks, bonds, mutual funds, real estate, and more. This flexibility allows individuals to diversify their investments and potentially earn higher returns.

05

Those aiming for tax advantages: Individual 401k plans offer the potential for tax advantages such as tax-deferred growth on investments and potential tax deductions on contributions. This can help individuals lower their taxable income and maximize their retirement savings.

In conclusion, filling out an individual 401k plan involves gathering documentation, researching providers, filling out forms, deciding on contributions and investments, establishing a contribution schedule, and periodically reviewing the plan. Individual 401k plans are suitable for self-employed individuals, business owners with no employees, those seeking higher contribution limits, individuals looking for investment flexibility, and those aiming for tax advantages.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my individual 401k plans directly from Gmail?

individual 401k plans and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get individual 401k plans?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific individual 401k plans and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit individual 401k plans on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign individual 401k plans on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your individual 401k plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.