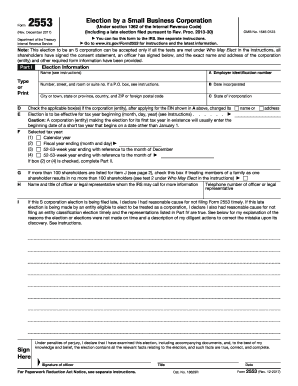

Who needs a Form IRS 2553?

A corporation or other entity eligible to choose to be treated as a corporation should file the form 2553 IRS to make an election to be an S corporation. An applicant who filed the 2553 form treated as S corporation does not need to file Form 8832, Entity Classification Election.

What is the IRS form 2553 for?

The income of an S corporation generally is taxed to the shareholders of the corporation rather than to the corporation itself. However, an S corporation may still owe tax on certain income.

This provides the following information:

- - Election information and employer identification number;

- - Reasons for not filing IRS 2553 timely, if so;

- - Personal information on each shareholder required to consent the election and their consent statements;

- - Selection of fiscal tax year;

- - S Trust (SST) Election Under Section 1361.

Is the IRS 2553 form accompanied by other forms?

Certain late elections can be filed attached to Form 1120S.

When is tax Form 2553 due?

- - No more than two months and 15 days after the beginning of the tax year the election is to take effect, or

- - At any time during the tax year preceding the tax year it is to take effect.

How do I fill out the fillable Form 2553?

The list of items that you have to fill out was specified above.

Where do I send the IRS form 2553 PDF?

For the latest mailing address of 2553 form, go to IRS.gov and enter “Where to file Form 2553” in the search box. Addresses may differ depending on the state in which the head office of the corporation is situated.