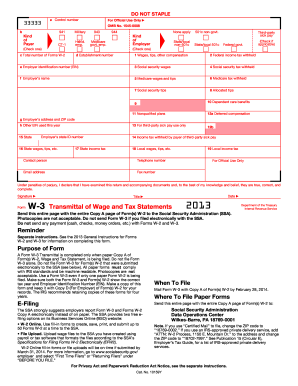

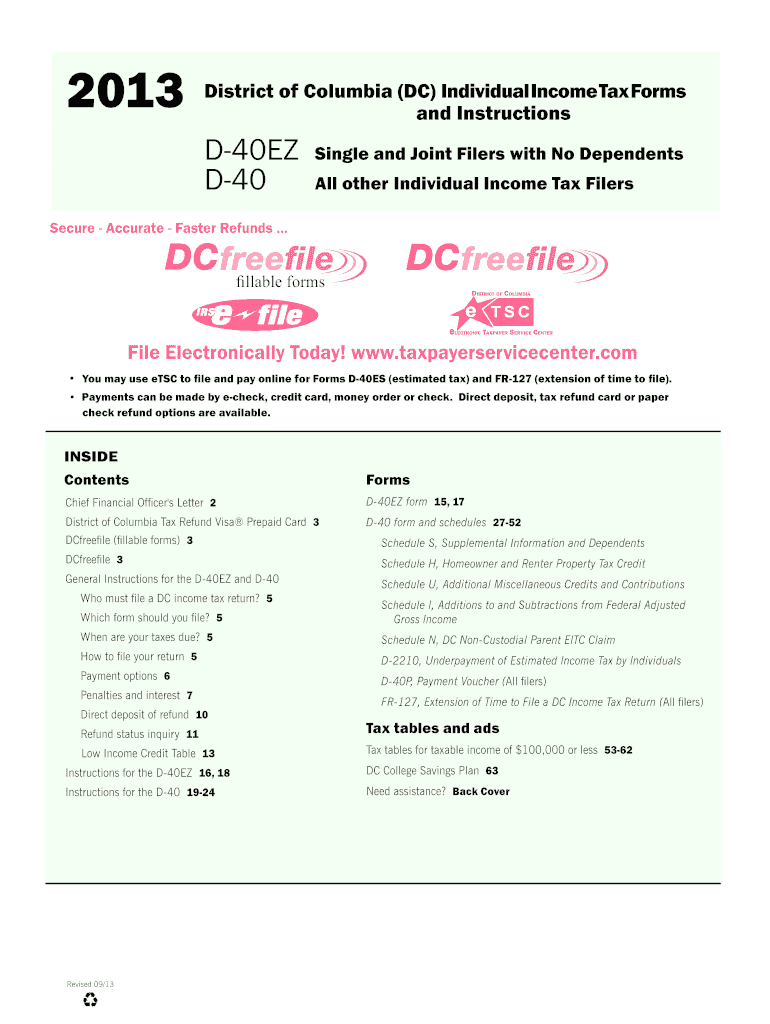

DC D-40EZ & D-40 2013 free printable template

Instructions and Help about DC D-40EZ D-40

How to edit DC D-40EZ D-40

How to fill out DC D-40EZ D-40

About DC D-40EZ D-40 2013 previous version

What is DC D-40EZ D-40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about DC D-40EZ D-40

What should I do if I realize I've made a mistake on my DC D-40EZ D-40 after submission?

If you've identified an error on your DC D-40EZ D-40 after filing, it's essential to submit an amended return as soon as possible. You can correct mistakes by filling out the appropriate form and marking it as an amendment. Ensure that you include a clear explanation of the change and any supporting documentation, as this will facilitate the processing of your correction.

How can I check the status of my submitted DC D-40EZ D-40?

To verify the status of your DC D-40EZ D-40 submission, you can visit the official website of the relevant tax authority and use their status tracking tools. You'll typically need details such as your Social Security number and filing year. If there are issues, you may receive notifications or corresponding rejection codes to address.

Are there any specific scenarios where filing the DC D-40EZ D-40 differs for nonresidents?

Nonresidents filing the DC D-40EZ D-40 should be aware that there are particular considerations surrounding their income sources and tax liabilities. It's crucial for nonresidents to understand which income needs to be reported and any potential tax agreements that may impact their filing. Consulting a tax professional can provide clarity on these legal nuances.

What are common errors to watch out for when filing the DC D-40EZ D-40?

When completing the DC D-40EZ D-40, common errors include miscalculation of income, incorrect identification of filing status, and missing signatures or dates. Double-checking your figures and ensuring that you've properly filled each section can minimize the risk of these issues, helping streamline the filing process.

What steps should I take if I receive a notice or letter after filing my DC D-40EZ D-40?

Upon receiving a notice concerning your DC D-40EZ D-40, it's crucial to read the document carefully to understand the nature of the concern, whether it's a request for additional information or clarification. Respond promptly, gathering all necessary documentation to support your case, and consider reaching out to a tax professional for assistance to ensure compliance.

See what our users say