Get the free Guardian University Class-Tax Deductible Life Insurance via ...

Show details

GUARDIAN UNIVERSITY Thursday, November 17, 2011, presents How to Help Your Clients Obtain Tax-Deductible Life Insurance in a Qualified Plan (3 hours CE credit approved) Speakers: Jerry Salish, National

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your guardian university class-tax deductible form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guardian university class-tax deductible form via URL. You can also download, print, or export forms to your preferred cloud storage service.

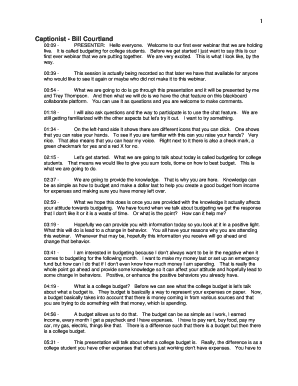

How to edit guardian university class-tax deductible online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit guardian university class-tax deductible. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

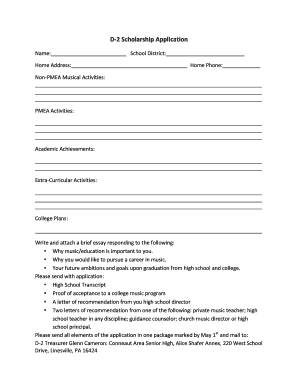

How to fill out guardian university class-tax deductible

How to fill out guardian university class-tax deductible:

01

Gather all necessary documents: Before filling out the guardian university class-tax deductible form, make sure you have all the relevant documents such as receipts, invoices, and any other supporting documents regarding the expenses incurred for the class.

02

Understand the eligibility criteria: Familiarize yourself with the eligibility criteria for claiming the guardian university class-tax deductible. Ensure that you meet all the requirements to avoid any discrepancies in your tax filing.

03

Complete the form accurately: Fill out the form with accurate information regarding your expenses for the guardian university class. Double-check all the details to ensure accuracy and to avoid any potential issues during the tax filing process.

04

Attach supporting documents: Along with the form, attach all the supporting documents that validate your expenses for the guardian university class. This may include receipts, invoices, or any other relevant documentation.

05

Review and submit: Before submitting the form, review all the information provided to ensure its accuracy. Make sure you haven't missed any important details. Once you are confident in the accuracy of the information, submit the form as per the guidelines provided by the relevant tax authority.

Who needs guardian university class-tax deductible?

01

Students: Students who are pursuing higher education at a guardian university may be eligible for claiming the class-tax deductible. This can help them reduce their tax liability by deducting the expenses incurred for the class from their taxable income.

02

Parents or guardians: Parents or guardians who are financially responsible for a student's education expenses may also need to be aware of the guardian university class-tax deductible. They can claim the deduction if they meet the eligibility criteria and have incurred the expenses for the class.

03

Education professionals: Teachers or educators who are attending guardian university classes for professional development purposes may also need to fill out the class-tax deductible form. By claiming the deduction, they can reduce their tax burden incurred from such educational expenses.

Overall, anyone who meets the eligibility criteria and has incurred expenses for a guardian university class may need to fill out the class-tax deductible form. It is important to consult the relevant tax authority or a tax professional for accurate guidance and to ensure compliance with the tax regulations in your jurisdiction.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is guardian university class-tax deductible?

Guardian university class-tax deductible refers to expenses related to education that can be deducted from taxable income.

Who is required to file guardian university class-tax deductible?

Individuals who have incurred eligible education expenses and wish to lower their taxable income may file for guardian university class-tax deductible.

How to fill out guardian university class-tax deductible?

To fill out guardian university class-tax deductible, individuals must gather documentation of eligible education expenses and report them accurately on the appropriate tax forms.

What is the purpose of guardian university class-tax deductible?

The purpose of guardian university class-tax deductible is to provide tax relief to individuals who have incurred education expenses in pursuit of furthering their education.

What information must be reported on guardian university class-tax deductible?

Information such as tuition fees, textbooks, and other education-related expenses must be reported on guardian university class-tax deductible forms.

When is the deadline to file guardian university class-tax deductible in 2023?

The deadline to file guardian university class-tax deductible in 2023 is typically April 15th, but individuals should consult with a tax professional or refer to the IRS website for specific dates.

What is the penalty for the late filing of guardian university class-tax deductible?

The penalty for late filing of guardian university class-tax deductible may result in fines or interest charges on the unpaid tax amount.

How do I execute guardian university class-tax deductible online?

Filling out and eSigning guardian university class-tax deductible is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the guardian university class-tax deductible in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your guardian university class-tax deductible in seconds.

How can I edit guardian university class-tax deductible on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing guardian university class-tax deductible.

Fill out your guardian university class-tax deductible online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.