Get the free VAN APELDOORN and :

Show details

UNITED STATES DISTRICT COURT

DISTRICT OF NEW JERSEY

CIVIL ACTION NO. 04CV3026 (JCL)

J.C. VAN APELDOORN and :

E.T. MEIER, in Their Capacity :

Honorable John C. Highland

as Trustees in Bankruptcy for

:

United

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your van apeldoorn and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your van apeldoorn and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

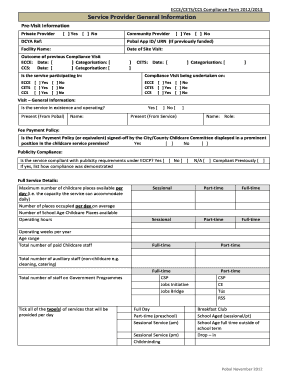

Editing van apeldoorn and online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit van apeldoorn and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

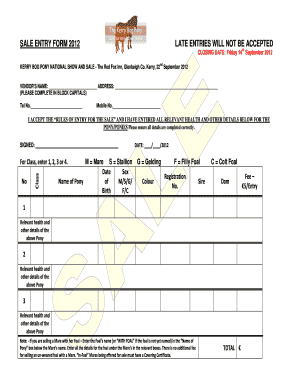

How to fill out van apeldoorn and

How to fill out van Apeldoorn and:

01

Start by gathering all the necessary information and documents such as identification, contact details, and any relevant financial information.

02

Carefully read through the instructions provided on the application form to understand the specific requirements and sections that need to be filled out.

03

Begin filling out the form, making sure to provide accurate and up-to-date information. Pay close attention to any required fields or sections that may need additional attachments or supporting documents.

04

Double-check all the information entered before submitting the form to avoid any errors or mistakes. It may be helpful to review the form multiple times or have someone else proofread it for accuracy.

05

If you have any doubts or questions, consult the instructions or reach out to the relevant authority for clarification. It's better to seek assistance and ensure the form is filled out correctly rather than risking rejection or delays.

Who needs van Apeldoorn and:

01

Individuals who are looking to apply for a specific service or program offered by van Apeldoorn and. This could include financial assistance, insurance coverage, or investment opportunities.

02

Companies or organizations that require assistance with financial planning, insurance policies, or investment strategies may also need the services provided by van Apeldoorn and.

03

People or businesses looking for professional advice or expertise in the field of finance, insurance, or investments may seek out van Apeldoorn and to meet their needs.

Overall, van Apeldoorn and caters to individuals, companies, and organizations seeking financial support, insurance coverage, or expert guidance in managing their finances or investments.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is van apeldoorn and?

Van Apeldoorn is a tax form used in the Netherlands to report income and assets.

Who is required to file van apeldoorn and?

Individuals and businesses in the Netherlands are required to file Van Apeldoorn if they meet certain income or asset thresholds.

How to fill out van apeldoorn and?

Van Apeldoorn can be filled out online or on paper, and requires reporting of income, assets, and other financial information.

What is the purpose of van apeldoorn and?

The purpose of Van Apeldoorn is to ensure that individuals and businesses are accurately reporting their income and assets for tax purposes.

What information must be reported on van apeldoorn and?

On Van Apeldoorn, individuals and businesses must report their income, assets, deductions, and any other relevant financial information.

When is the deadline to file van apeldoorn and in 2023?

The deadline to file Van Apeldoorn in 2023 is April 1st.

What is the penalty for the late filing of van apeldoorn and?

The penalty for late filing of Van Apeldoorn is a fine of up to €5,514.

How can I send van apeldoorn and to be eSigned by others?

When you're ready to share your van apeldoorn and, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the van apeldoorn and electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your van apeldoorn and in minutes.

How do I complete van apeldoorn and on an Android device?

On Android, use the pdfFiller mobile app to finish your van apeldoorn and. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your van apeldoorn and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.