American Heart Association AHA W-9 2006-2024 free printable template

Show details

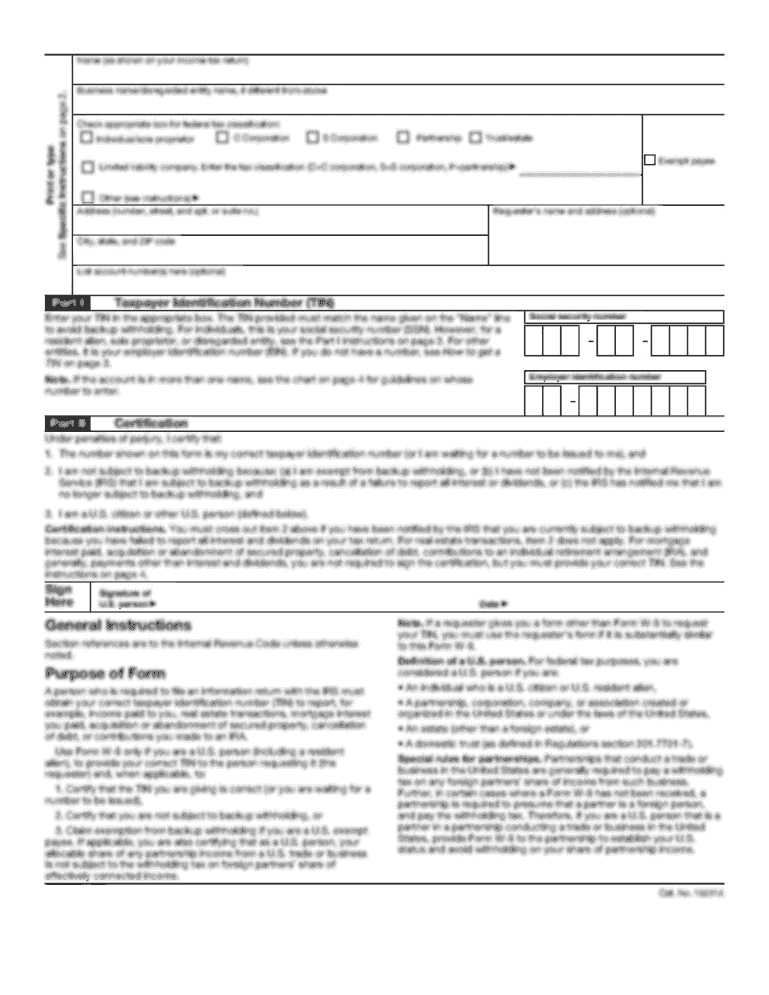

Form AHA W-9 Rev. January 2006 Request for Taxpayer Identification Number and Certification Please print or type Name Business name if different from above Check appropriate box Individual/Sole proprietor Partnership Other Requester s name and address American Heart Association NATIONAL CENTER 7272 Greenville Ave. Dallas Texas 75231 FAX 214-706-5238 Address number street and apt. or suite no. City State and ZIP code Part I Taxpayer Identification Number TIN Enter your TIN in the appropriate...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your american heart association w9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your american heart association w9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit american heart association w9 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit american heart association w9. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out american heart association w9

How to fill out American Heart Association W9:

01

Obtain a W9 form from the official American Heart Association website or request a copy from the organization.

02

Fill out your name, address, and Social Security Number or Taxpayer Identification Number in the appropriate fields.

03

If you are a sole proprietor, enter your name in the "Business name/disregarded entity name" field. If you have a registered business entity, enter the business name as it appears on your tax documents.

04

Check the appropriate box to indicate your federal tax classification (individual/sole proprietor, partnership, corporation, etc.).

05

If applicable, enter any exemption codes that are relevant to your situation.

06

Provide your signature, date, and contact information to certify the accuracy of the information provided.

07

Submit the completed and signed W9 form to the American Heart Association as required.

Who needs American Heart Association W9:

01

Individuals or businesses that have received payments from the American Heart Association for services rendered.

02

Independent contractors who have provided services to the American Heart Association and need to report their income for tax purposes.

03

Vendors and suppliers who have engaged in business transactions with the American Heart Association and need to provide their tax information for reporting purposes.

Fill form : Try Risk Free

People Also Ask about american heart association w9

Why would an insurance company ask for a W9?

Does a W-9 go to the IRS?

What is a w9 form for healthcare?

Where do I find my w9?

Who is required to fill out a W9?

Is W-9 required for reimbursement?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is american heart association w9?

The American Heart Association W9 is a form that the American Heart Association (AHA) uses to provide their taxpayer identification number (TIN) to entities that request it. The W9 form is a request for taxpayer identification number and certification form used in the United States. The AHA is a non-profit organization that promotes cardiovascular health and provides resources and education related to heart diseases and stroke prevention.

Who is required to file american heart association w9?

The American Heart Association does not typically require individuals or organizations to file a W9 form. The W9 form is usually required by businesses or individuals who are paying vendors, freelancers, contractors, or other entities for their services. It is used to collect the taxpayer identification number (TIN) of the payee for tax reporting purposes.

How to fill out american heart association w9?

To fill out the American Heart Association W-9 form, follow these steps:

1. Download the W-9 form from the American Heart Association website or the official IRS website.

2. Provide your business name or individual name in the "Name" field. If you're an individual, you can use your legal name. If you're a business, use the official business name.

3. In the "Business name/disregarded entity name, if different from above" field, provide the name of your business if it is different from the name mentioned in step 2. If there is no difference, leave it blank.

4. Indicate your business tax classification by checking the appropriate box in Part I. Common choices include "Individual/Sole Proprietor," "C Corporation," "S Corporation," "Partnership," "Limited Liability Company (LLC)," etc. Consult with a tax professional if you are unsure about your tax classification.

5. Provide your business address in the "Address" field, including street, city, state, and ZIP code.

6. Enter your TIN (Taxpayer Identification Number) in the "Social Security Number (SSN) or Employer Identification Number (EIN)" field. If you're an individual, use your SSN. If you're a business entity, use your EIN.

7. If you are subject to backup withholding, check the second box in Part II and provide the required information.

8. Sign and date the form in the designated fields at the bottom.

9. Lastly, mail the completed W-9 form to the American Heart Association address specified on the form.

It is important to note that this information is a general guide, and it is always recommended to consult with a tax professional or the IRS instructions if you have any specific questions or concerns about filling out the W-9 form.

What is the purpose of american heart association w9?

The American Heart Association (AHA) does not have a specific form W9, as that form is used by the Internal Revenue Service (IRS) in the United States for requesting taxpayer identification information from vendors. However, the AHA, being a non-profit organization, may be required to provide a W9 to vendors or other entities that need their taxpayer identification number for tax reporting purposes. The purpose of submitting a W9 is to ensure proper reporting and compliance with tax laws and regulations.

What information must be reported on american heart association w9?

On the American Heart Association W-9 form, the following information must be reported:

1. Name: The legal name of the organization or individual requesting a W-9 form.

2. Business Name (if applicable): If the organization has a separate business name, it should be included here.

3. Address: The mailing address of the organization or individual.

4. Taxpayer Identification Number (TIN): The Social Security Number (SSN) or Employer Identification Number (EIN) associated with the organization or individual.

5. Federal tax classification: This section requires the organization or individual to select their federal tax classification status, such as sole proprietorship, partnership, corporation, etc.

6. Exemptions: If the organization is exempt from backup withholding or has other specific exemptions, it should be mentioned in this section.

7. Internal Revenue Service (IRS) certification: A signature and date are required to certify that the information provided is correct.

It's important to note that this information may vary slightly based on the specific W-9 form used by the American Heart Association.

What is the penalty for the late filing of american heart association w9?

The American Heart Association does not publicly disclose specific information regarding penalties for the late filing of W9 forms. It is advisable to contact the American Heart Association directly or consult with a tax professional for accurate and up-to-date information concerning penalties for late filing.

How can I get american heart association w9?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific american heart association w9 and other forms. Find the template you need and change it using powerful tools.

How can I fill out american heart association w9 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your american heart association w9. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Can I edit american heart association w9 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like american heart association w9. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your american heart association w9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.