Get the free cooperative loan policy sample form

Show details

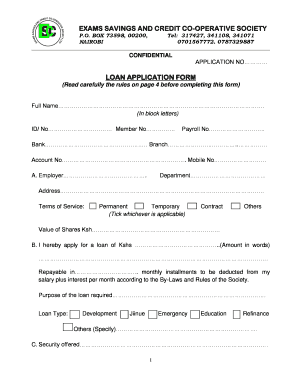

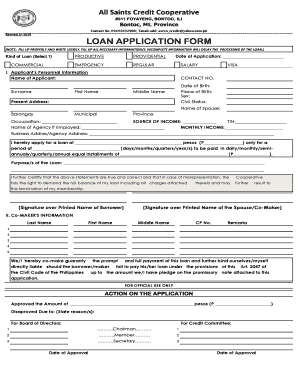

MET SACCO MET SAVINGS & CREDIT COOPERATIVE SOCIETY LTD LOAN APPLICATION & AGREEMENT FORM LOAN No... 1. Members Name 2. Members Address 3. Payroll Number 8. Present Net Income p.m. KSS 4. Members Number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your cooperative loan policy sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cooperative loan policy sample form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cooperative loan policy sample online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sample loan application form cooperative. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out cooperative loan policy sample

01

To fill out a cooperative loan policy sample, start by carefully reading the instructions or guidelines provided. Understand the purpose and requirements of the policy.

02

Begin by providing basic information such as the name of the cooperative, its address, and contact details. Include any registration or identification numbers required.

03

Clearly state the objectives and goals of the cooperative loan policy. Define the purpose for which the cooperative provides loans and the criteria for eligibility.

04

Create a section detailing the types of loans offered by the cooperative. Specify the amount range, interest rates, and repayment terms. Include any collateral requirements or conditions for loan approval.

05

Outline the application process for obtaining a loan. Clearly explain the documents or information required from applicants, such as proof of income, identification, or business plans.

06

Include a section on loan evaluation and approval procedures. Describe the steps involved in evaluating loan applications, such as credit checks, verification of documents, or assessment of financial viability.

07

Outline the decision-making process for loan approval or rejection. Specify who is responsible for making these decisions, whether it is a committee, manager, or board of directors.

08

If applicable, provide information on how loan disbursements are made. Explain the channels or methods used to transfer funds to approved applicants.

09

Include a section on loan repayment, specifying the payment schedule, methods of payment, and consequences of defaulting on payments. Detail any penalties, late fees, or legal actions that may be taken in case of non-payment.

10

Finally, consider including a section on loan renewal or extension procedures. Explain the criteria and process for extending or renewing loans for existing borrowers.

Who needs cooperative loan policy sample?

01

Cooperative officers or managers who are responsible for creating or updating loan policies within their cooperative.

02

Board members or directors of the cooperative who need to review and approve the loan policy.

03

Members or applicants of the cooperative who want to understand the criteria and requirements for obtaining a loan. They can refer to the policy sample to ensure they meet all the necessary conditions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

When is the deadline to file cooperative loan policy sample in 2023?

The deadline to file a cooperative loan policy sample for 2023 is typically determined by the cooperative itself. Contact your local cooperative to find out when the deadline is.

What is cooperative loan policy sample?

A cooperative loan policy is a set of guidelines and procedures that govern the process of lending money to members of a cooperative organization. It outlines the criteria for loan eligibility, the types of loans available, the terms and conditions for borrowing, and the repayment schedules.

Here is a sample cooperative loan policy:

1. Objective:

The objective of this cooperative loan policy is to provide financial support to our members in a fair and transparent manner, enabling them to meet their personal or business needs while ensuring the sustainability of the cooperative.

2. Eligibility Criteria:

a. Only active members of the cooperative are eligible for loans.

b. Members must have a minimum membership duration of 6 months to be eligible for a loan.

c. Members must have a good repayment history if they have previously borrowed from the cooperative.

d. Members must fulfill the applicable legal and regulatory requirements.

3. Types of Loans Available:

a. Personal Loans: These loans are for individual members' personal needs, such as education, medical expenses, or home improvements.

b. Business Loans: These loans are for members who require funds for starting or expanding their business ventures.

c. Emergency Loans: These loans are designed to provide quick financial assistance to members facing unexpected emergencies.

4. Loan Application Process:

a. Members should complete the loan application form and provide all necessary supporting documents.

b. Loan applications will be reviewed by the cooperative's loan committee within a specified timeframe.

c. The loan committee will assess the member's repayment capacity, credit history, and purpose of the loan.

d. Loan approval or rejection will be communicated to the member within a reasonable period.

5. Loan Terms and Conditions:

a. Loan amounts will be determined based on the member's repayment capacity and purpose of the loan.

b. The interest rate, repayment period, and installment schedule will be clearly stated in the loan agreement.

c. Collateral or guarantees may be required for certain loan amounts to mitigate credit risks.

d. Loan disbursement will occur after the member has duly executed the loan agreement.

6. Loan Repayment:

a. Members are required to make timely and regular loan repayments as per the agreed installment schedule.

b. Defaulters will be subject to penalties, including late payment fees or additional interest charges.

c. Members facing hardships in loan repayment should approach the cooperative to discuss possible rescheduling or restructuring options.

7. Confidentiality and Data Protection:

a. The cooperative will maintain strict confidentiality of members' loan applications and financial information.

b. Data protection measures will be in place to ensure the security of personal and financial data.

Please note that the above sample is for illustrative purposes and should be customized to reflect the specific loan policies and requirements of your cooperative.

Who is required to file cooperative loan policy sample?

The person or organization administering the cooperative loan policy would be required to file it. This could be a credit union, a cooperative society, a government agency, or any other entity responsible for providing loans to cooperatives.

How to fill out cooperative loan policy sample?

When filling out a cooperative loan policy sample, it is important to follow these steps:

1. Header: Start by adding the name and contact information of the cooperatives, such as the name of the cooperative, address, phone number, and email.

2. Policy Title: Give a title to the document, such as "Cooperative Loan Policy."

3. Policy Date: Include the date when the policy is created or last updated.

4. Policy Statement: Provide a clear statement outlining the purpose and goals of the cooperative loan policy. This statement should specify the objectives, target audience, and the types of loans offered by the cooperative.

5. Eligibility Criteria: Clearly define the eligibility requirements for cooperative loans. Outline any specific criteria such as membership, creditworthiness, income range, or collateral requirements.

6. Loan Application Process: Explain the step-by-step process for applying for a cooperative loan. Include information on where the application forms can be obtained, required documentation, and any specific deadlines for submission.

7. Loan Approval Process: Describe how loan applications are evaluated, reviewed, and approved. This should include information on the criteria used for evaluation, the roles of different parties involved in the approval process, and the time frame for approval.

8. Loan Terms and Conditions: Provide detailed information on the terms and conditions of cooperative loans. This should include interest rates, repayment periods, repayment methods, and any penalties or fees associated with late payments or loan defaults.

9. Loan Disbursement: Explain how the loan funds will be disbursed to borrowers. Outline the process and timeframe for loan disbursement upon approval.

10. Loan Monitoring: Detail the cooperative's process for monitoring loan repayments, including any required reports or documentation from borrowers. Explain the consequences of defaulting on loan repayments and the procedures for addressing delinquencies.

11. Loan Restructuring/Rescheduling: Outline the cooperative's policy and procedures for loan restructuring or rescheduling in case a borrower is unable to meet the loan repayment terms. Include any associated fees or requirements.

12. Loan Closure: Explain the process for closing loans, including the completion of all repayments, documentation, and the release of any collateral upon loan satisfaction.

13. Amendments and Updates: Provide information on how the cooperative loan policy can be amended in the future and how updates will be communicated to the cooperative members.

14. Signature and Approval: Leave space for signatures of the relevant authority, such as the cooperative's board of directors or management team, to signify approval of the policy.

Remember to consider the specific needs and requirements of your cooperative when filling out the loan policy sample, customizing it to fit the unique circumstances and goals of your organization.

What is the purpose of cooperative loan policy sample?

The purpose of a cooperative loan policy sample is to provide guidelines and procedures for granting loans to cooperative societies. It serves as a reference document for the cooperative society and its members, laying out the criteria, terms, and conditions for availing loans from the society. The policy sample helps in standardizing the loan application process, ensuring fairness, transparency, and adherence to established rules. It also outlines the responsibilities of the cooperative society, borrowers, and the loan committee, helping to streamline the loan approval and disbursement process. Furthermore, the cooperative loan policy sample helps mitigate risks associated with lending, identifies the types of loans offered, stipulates the interest rates, repayment schedules, and any penalties or charges in case of default. Overall, the policy sample contributes to the efficient management of loans and promotes the financial stability and growth of the cooperative society.

What information must be reported on cooperative loan policy sample?

The information that must be reported on a cooperative loan policy sample may vary depending on the specific requirements of the cooperative and the lending institution. However, some common information that is typically included in a cooperative loan policy sample may include:

1. Purpose of the policy: This section explains the purpose and objective of the policy, which is to establish guidelines and procedures for providing loans to cooperative members.

2. Eligibility criteria: This section outlines the eligibility criteria for cooperative members to qualify for loans. It may include factors such as membership status, length of membership, and compliance with cooperative bylaws.

3. Loan terms and conditions: This section details the specific terms and conditions of the loans, including interest rates, repayment periods, loan amounts, and any collateral requirements.

4. Loan application process: This section describes the process through which cooperative members can apply for loans, including the required documentation, application forms, and deadlines.

5. Loan approval process: This section explains the steps involved in the loan approval process, including the roles and responsibilities of the loan committee or board of directors.

6. Loan disbursement: This section outlines the procedures for loan disbursement, including the methods of payment and any additional requirements before funds are released to the borrower.

7. Loan servicing and repayment: This section provides information on loan servicing, including loan repayment schedules, penalties for late payments, and any other applicable terms and conditions.

8. Loan default and collections: This section outlines the actions that will be taken in the event of loan default, including the procedures for collection efforts, possible legal actions, and potential consequences for defaulting on the loan.

9. Loan monitoring and reporting: This section describes the monitoring and reporting mechanisms to ensure compliance with loan terms and conditions, including regular reporting requirements and financial statement obligations.

It is important to note that the specific information included in a cooperative loan policy sample may vary depending on the organization's specific needs and requirements.

What is the penalty for the late filing of cooperative loan policy sample?

I am not a legal expert, but generally speaking, the penalty for the late filing of a cooperative loan policy may vary depending on the specific jurisdiction and the terms outlined in the policy itself. It is advisable to refer to the policy document or consult with a legal professional to determine the exact penalties for late filing in a specific situation or jurisdiction.

How can I modify cooperative loan policy sample without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your sample loan application form cooperative into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an eSignature for the cooperative loan form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your cooperative loan form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete cooperative loan policy sample on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your cooperative loan policy sample, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your cooperative loan policy sample online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cooperative Loan Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.