Get the free 401K Enrollment/Change Form - Onondaga Employee Leasing ...

Show details

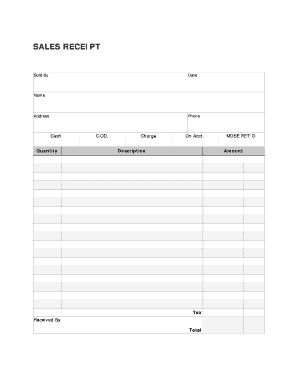

401(k) SAVINGS PLAN DEFERRED SALARY AGREEMENT NEW PARTICIPANT ELECTION CHANGE Participant s Name First MI Last Social Security No — This Deferred Salary Agreement is effective for the first payroll

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 401k enrollmentchange form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k enrollmentchange form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 401k enrollmentchange form online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 401k enrollmentchange form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

How to fill out 401k enrollmentchange form

How to fill out a 401k enrollment change form:

01

Start by filling in your personal information such as your full name, address, and social security number. This information is necessary for the 401k plan administrator to identify you correctly.

02

Next, provide your employment details, including your job title, department, and the date you began working for the company. This helps the administrator link your 401k enrollment to your employment status.

03

Indicate whether you are a new employee enrolling in the 401k plan for the first time or if you are an existing employee making changes to your existing enrollment. This ensures that the administrator can process your request correctly.

04

Select the investment options for your 401k contributions. Typically, you will be provided with a list of investment funds or portfolios to choose from. Consider your risk tolerance and long-term financial goals when making these selections.

05

Determine the percentage or amount of your salary that you wish to contribute to your 401k plan. Some employers may have contribution limits, so be mindful of any restrictions. Additionally, you may have 401k contribution options like traditional pre-tax contributions or Roth after-tax contributions to choose from.

06

If applicable, select any additional features or services you'd like to include with your 401k plan, such as a loan provision or the option for catch-up contributions if you are age 50 or older.

07

Review the completed form thoroughly to ensure that all the information provided is accurate and complete. Mistakes or missing information may delay the processing of your enrollment change.

Who needs a 401k enrollment change form:

01

New employees - Those who are joining a company and wish to enroll in the 401k plan for the first time need to complete a 401k enrollment change form. This form serves as their official request to start contributing to the plan.

02

Existing employees - Employees who are already enrolled in a 401k plan may need to fill out an enrollment change form if they want to make changes to their existing contributions. This could include adjusting the contribution percentage, changing investment options, or utilizing additional 401k features.

03

Employees experiencing a qualifying life event - Certain life events, such as marriage, divorce, birth or adoption of a child, or the death of a spouse, may provide opportunities to modify your 401k enrollment. In these cases, an enrollment change form allows you to update your information to reflect the new circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 401k enrollmentchange form?

The 401k enrollmentchange form is a document used to make changes to an individual's contributions, investments, or beneficiaries in their 401k retirement account.

Who is required to file 401k enrollmentchange form?

Any individual who participates in a 401k retirement plan and wishes to make changes to their account is required to file a 401k enrollmentchange form.

How to fill out 401k enrollmentchange form?

To fill out a 401k enrollmentchange form, individuals must provide personal information, select desired changes to their account, and submit the form to their plan administrator.

What is the purpose of 401k enrollmentchange form?

The purpose of the 401k enrollmentchange form is to allow individuals to make changes to their 401k retirement account, such as adjusting contribution amounts, updating beneficiary information, or changing investment options.

What information must be reported on 401k enrollmentchange form?

Information such as the individual's name, account number, desired changes to the account, and any supporting documentation must be reported on the 401k enrollmentchange form.

When is the deadline to file 401k enrollmentchange form in 2023?

The deadline to file the 401k enrollmentchange form in 2023 is typically determined by the specific plan administrator, but it is usually within a specified timeframe after the desired changes need to be made.

What is the penalty for the late filing of 401k enrollmentchange form?

Penalties for late filing of the 401k enrollmentchange form can vary depending on the plan rules, but it may result in missed investment opportunities, delayed account changes, or other consequences determined by the plan administrator.

How do I edit 401k enrollmentchange form in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your 401k enrollmentchange form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an eSignature for the 401k enrollmentchange form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your 401k enrollmentchange form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out 401k enrollmentchange form using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 401k enrollmentchange form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your 401k enrollmentchange form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.