Get the free Ontario retail sales tax (rst) transitional new ... - CCH Site Builder

Show details

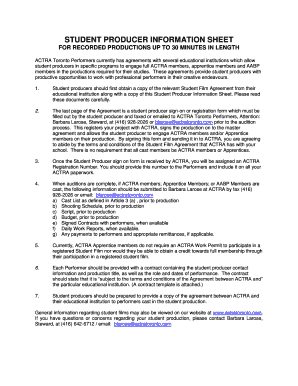

ONTARIO RETAIL SALES TAX (RST) TRANSITIONAL NEW HOUSING

REBATE FOR NON-REGISTRANT FIRST RESELLERS

Use this form if you are a non-registrant first reseller of new housing in Ontario that you purchased

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ontario retail sales tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ontario retail sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ontario retail sales tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ontario retail sales tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out ontario retail sales tax

How to fill out ontario retail sales tax:

01

Gather necessary information: Before starting to fill out the Ontario retail sales tax form, collect all the required information such as your business details, sales transactions, and any eligible exemptions or rebates.

02

Obtain the appropriate form: Visit the official website of the Ontario Ministry of Finance or contact your local tax office to obtain the correct form for reporting the retail sales tax. Ensure that you have the latest version of the form.

03

Fill in your business information: Begin by entering your business name, address, phone number, and any other relevant details requested on the form. Double-check for accuracy as any mistakes could lead to delays or penalties.

04

Report sales transactions: In this section, provide a detailed breakdown of all your sales transactions during the reporting period. Include the date of the transaction, description of the products or services sold, the total amount paid by the customer, and any applicable taxes charged.

05

Calculate the retail sales tax: Using the information provided in the previous step, calculate the amount of retail sales tax owed. Refer to the Ontario sales tax rates and any specific exemptions or rebates that may apply to your business.

06

Include any necessary documents: If required, attach supporting documentation such as sales invoices, receipts, or any exemption certificates to validate your reported sales transactions and tax calculations.

07

Review and sign: Before submitting the form, carefully review all the information provided to ensure accuracy. Once satisfied, sign the form to certify that the information provided is true and complete to the best of your knowledge.

Who needs ontario retail sales tax:

01

Businesses selling taxable goods: Any business that sells taxable goods in Ontario is required to charge and remit the retail sales tax. This includes both retail stores and online businesses.

02

Service providers: Certain services in Ontario are also subject to the retail sales tax. If your business provides services that fall under the taxable category, you will need to charge and remit the tax accordingly.

03

Businesses exceeding the annual threshold: Businesses that exceed a specific annual threshold of taxable sales are mandated to register for the Ontario retail sales tax and file regular reports. It is important to check the current threshold and ensure compliance with the requirements.

Please note that the information provided here is for general guidance purposes only, and it is recommended to consult with a tax professional or refer to the official guidelines provided by the Ontario Ministry of Finance for specific and up-to-date instructions on filling out the retail sales tax form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ontario retail sales tax from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your ontario retail sales tax into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I sign the ontario retail sales tax electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your ontario retail sales tax in minutes.

Can I create an electronic signature for signing my ontario retail sales tax in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your ontario retail sales tax right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your ontario retail sales tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.