Get the free wyso 990 form

Show details

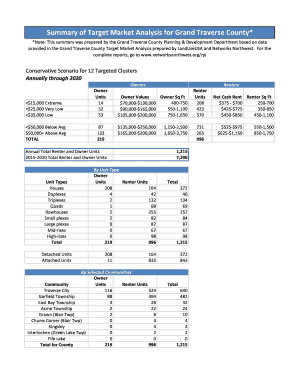

Form 990 2013 WYSO Part VII Compensation of Officers Directors Trustees Key Employees Highest Compensated Employees and Independent Contractors Section A. Name and Business Address None Independent Contractors Compensation in excess of 100 000 Description of Services N/A C Users dhull Desktop CPB 2014 WYSO Mock Form 990 Part VII Sheet1 1/14/2014. Officers Directors Trustees Key Employees and Highest Compensated Employees A B Name and Title Average Hours per Week Neenah Ellis WYSO General...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your wyso 990 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wyso 990 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wyso 990 form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wyso 990 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out wyso 990 form

How to fill out wyso 990 form:

01

Begin by gathering all necessary financial information. This includes details about your organization's income, expenses, assets, and liabilities. Make sure you have records of donations received, grants awarded, and any other relevant financial data.

02

Download the wyso 990 form from the official website or obtain a physical copy. The form is also known as "Form 990, Return of Organization Exempt From Income Tax." Ensure that you have the most recent version of the form to accurately report your organization's finances.

03

Start filling out the form by providing basic information about your organization. This includes your name, address, employer identification number (EIN), and the tax year being reported. Double-check the accuracy of this information to avoid any processing errors.

04

Proceed to Part I of the form, which gathers information about your organization's mission, activities, and governance. Answer the questions regarding your organization's purpose, programs, and leadership effectiveness. Be thorough in your responses to give a clear understanding of your organization's operations.

05

In Part II, report on your organization's revenue and support. This section requires you to provide details about contributions, grants, program service revenue, and other sources of income. Include accurate information regarding each type of revenue received during the tax year.

06

Move on to Part III, where you need to disclose your organization's program service accomplishments. This includes describing the nature of your organization's programs, the number of individuals served, and any significant achievements or outcomes. Provide sufficient details to demonstrate the impact of your organization's activities.

07

Next, complete Part IV, which focuses on your organization's balance sheet and financial statements. Report your assets, liabilities, and net assets at the beginning and end of the tax year. Include any additional required financial information, such as investments or other assets.

08

Part V requires you to provide detailed information about your organization's employees, independent contractors, and other compensation practices. This includes reporting salaries and benefits of your key personnel, as well as disclosing any potential conflicts of interest.

09

In Part VI, report on your organization's governance, management, and disclosure practices. Answer the questions regarding your board composition, policies, and procedures for financial oversight and accountability. Provide the necessary information to demonstrate your organization's compliance with nonprofit regulations.

10

Finally, review the completed form for accuracy and consistency. Ensure that all necessary schedules and attachments are included. Sign and date the form as required before submitting it to the appropriate tax authorities.

Who needs wyso 990 form?

01

Nonprofit organizations that are exempt from income tax under section 501(c)(3) of the Internal Revenue Code need to file wyso 990 form. These organizations include charitable, religious, educational, scientific, and other qualifying nonprofit entities.

02

Organizations that have gross receipts over a certain threshold are also required to file wyso 990 form. The specific threshold depends on the tax year, but generally, it applies to organizations with gross receipts equal to or exceeding $200,000 or total assets equal to or exceeding $500,000.

03

Even if an organization falls below the threshold, it may still choose to file wyso 990 form voluntarily. This can provide transparency to stakeholders, grantors, and the public regarding the organization's activities, finances, and governance.

In conclusion, anyone operating a qualifying nonprofit organization or meeting the gross receipt or asset thresholds should be familiar with how to fill out wyso 990 form. This form serves as an important tool for reporting financial information and ensuring compliance with nonprofit regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is wyso 990 form?

The wyso 990 form is a financial disclosure form that tax-exempt organizations must file with the IRS.

Who is required to file wyso 990 form?

Nonprofit organizations that are classified as tax-exempt under section 501(c)(3) of the Internal Revenue Code are required to file wyso 990 form.

How to fill out wyso 990 form?

To fill out wyso 990 form, organizations need to provide information about their finances, activities, and governance.

What is the purpose of wyso 990 form?

The purpose of wyso 990 form is to provide the IRS and the public with information about a tax-exempt organization's finances and operations.

What information must be reported on wyso 990 form?

Information such as revenue, expenses, assets, liabilities, program activities, and executive compensation must be reported on wyso 990 form.

When is the deadline to file wyso 990 form in 2023?

The deadline to file wyso 990 form in 2023 is typically May 15th for calendar year organizations.

What is the penalty for the late filing of wyso 990 form?

The penalty for the late filing of wyso 990 form can range from $20 to $100 per day, depending on the organization's size and how late the form is filed.

How can I modify wyso 990 form without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including wyso 990 form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out the wyso 990 form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign wyso 990 form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete wyso 990 form on an Android device?

Use the pdfFiller app for Android to finish your wyso 990 form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your wyso 990 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.