Get the free 2011 Tax & Financial Planning Guide

Show details

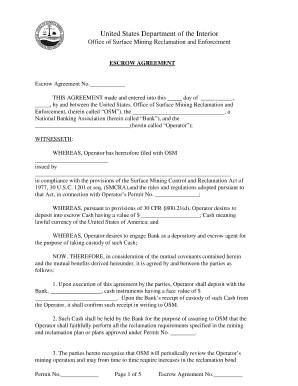

2011 Tax & Financial Planning Guide Guide2012A Fairground, YearEndContents 1The Big Picture2Quick Reference22 Real EstateWhats New for 2011Home Loans Moving Expenses 4You and Your Family Rental InvestmentsWhats

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2011 tax amp financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 tax amp financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 tax amp financial online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2011 tax amp financial. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out 2011 tax amp financial

How to fill out 2011 tax and financial documents:

01

Gather all necessary documents: Before starting to fill out your 2011 tax and financial forms, make sure you have all the required documents in hand. These may include W-2 forms, 1099s for any additional income, bank statements, receipts, and any other relevant financial records.

02

Understand the forms: Familiarize yourself with the specific forms you need to fill out for 2011 tax and financial purposes. This could include Form 1040, Schedule A for itemized deductions, and any other applicable schedules or forms depending on your financial situation.

03

Report your income: Begin by accurately reporting your income for the 2011 tax year. This includes wages, salaries, tips, interest, dividends, rental income, and any other sources of income you may have received during that year.

04

Deductions and credits: Determine if you qualify for any deductions or credits that can reduce your taxable income. Some common deductions and credits include mortgage interest, student loan interest, medical expenses, and the child tax credit. Refer to the instructions of each form to ensure you are eligible for these deductions and credits.

05

Fill out the forms: Using the information you have gathered, proceed to fill out the necessary forms accurately. Make sure to double-check all the information you provide, as any errors or omissions can result in delays or complications with your tax and financial filings.

06

Seek assistance if needed: If you find the process challenging or encounter any complex financial situations, consider seeking assistance from a tax professional or accountant. They can provide expert guidance, help you maximize your deductions, and ensure your forms are filled out correctly.

07

Review and submit: Once you have completed the forms, carefully review them to ensure accuracy. Check for any errors, missing information, or inconsistencies. Once you are confident that everything is correct, sign and submit your 2011 tax and financial documents as instructed by the relevant tax authorities.

Who needs 2011 tax and financial documents:

01

Individuals who earned income in the year 2011 are required to fill out and submit their tax and financial documents for that year. This includes employees, self-employed individuals, freelancers, and independent contractors.

02

Anyone who wants to claim deductions or credits for the 2011 tax year should also complete the necessary forms. These deductions and credits can help reduce the amount of taxes owed or lead to potential refunds.

03

Individuals who anticipate financial transactions or situations that may require proof of their 2011 financial standing, such as applying for a loan or mortgage, may also need to maintain or provide their 2011 tax and financial documents as part of their application process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax & financial planning?

Tax and financial planning involves the assessment of an individual's financial situation to develop a strategy for achieving financial goals while minimizing tax liabilities.

Who is required to file tax & financial planning?

Anyone with income and financial assets is encouraged to engage in tax and financial planning to optimize their financial situation and comply with tax laws.

How to fill out tax & financial planning?

Tax and financial planning typically involve working with financial advisors, accountants, and tax professionals to analyze income, assets, expenses, and liabilities to create a comprehensive financial plan.

What is the purpose of tax & financial planning?

The purpose of tax and financial planning is to maximize financial resources, minimize tax liabilities, and achieve long-term financial goals such as retirement savings, investments, and estate planning.

What information must be reported on tax & financial planning?

Information such as income sources, deductions, investments, retirement accounts, debts, properties, and any other financial assets must be reported on tax and financial planning documents.

When is the deadline to file tax & financial planning in 2023?

The deadline to file tax and financial planning in 2023 is typically April 15th for individual tax returns, unless an extension is requested.

What is the penalty for the late filing of tax & financial planning?

The penalty for late filing of tax and financial planning may result in fines, interest charges, and potential audits by tax authorities.

Where do I find 2011 tax amp financial?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the 2011 tax amp financial in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an eSignature for the 2011 tax amp financial in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 2011 tax amp financial right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete 2011 tax amp financial on an Android device?

Use the pdfFiller app for Android to finish your 2011 tax amp financial. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your 2011 tax amp financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.