Get the free Iowa Department of Revenue IA 2848 Iowa Power of Attorney ...

Show details

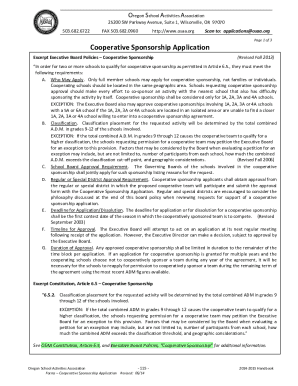

Iowa Department of Revenue www.iowa.gov/tax Please type or print IA 2848 Iowa Power of Attorney Form NOTE: A power of attorney may be effective for no more than three years from the date it is received

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your iowa department of revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iowa department of revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit iowa department of revenue online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit iowa department of revenue. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out iowa department of revenue

How to fill out Iowa Department of Revenue:

01

Gather all necessary documents - Before filling out any forms, make sure you have all the required documents handy. This may include your W-2 forms, 1099 forms, receipts, and any other relevant financial records.

02

Download the appropriate forms - Visit the Iowa Department of Revenue's official website and locate the specific forms you need to fill out. Make sure to download the most up-to-date version of each form to avoid any discrepancies or rejections.

03

Read the instructions carefully - Take the time to thoroughly read through the instructions provided with each form. This will help you understand the requirements and correctly fill out the necessary fields.

04

Provide accurate personal information - Start by filling in your personal information accurately. This may include your name, address, Social Security number, and other identifying details. Double-check all the information for any errors before proceeding.

05

Report your income - Depending on the type of form you are filling out, you may need to report different types of income (e.g., wages, self-employment income, interest, dividends). Follow the instructions provided to accurately report your income on the form.

06

Deductions and credits - If you qualify for any deductions or credits, make sure to include them on the appropriate section of the form. Read the instructions carefully to understand which deductions or credits you may be eligible for.

07

Review and double-check - Once you have completed all the required fields, review the form thoroughly. Make sure all the information is accurate and complete. Double-check for any mistakes, missing details, or inconsistencies.

08

Submit the form - After reviewing, sign and date the form. Depending on the form, you may need to attach additional documents or schedules. Ensure that you follow the submission instructions provided on the form to avoid any delays or complications.

Who needs Iowa Department of Revenue?

01

Individuals and households - Any individual residing in Iowa who has taxable income, regardless of the source, must file with the Iowa Department of Revenue. This includes full-time workers, self-employed individuals, retirees with taxable income, and those receiving income from investments.

02

Businesses - Corporations, partnerships, limited liability companies (LLCs), and sole proprietors operating in Iowa are required to file with the Iowa Department of Revenue. The specific forms and requirements may vary depending on the business entity type and activities.

03

Non-residents with Iowa income - Non-residents who earn income from Iowa, such as wages, rental income, or sales of real property, may also need to file with the Iowa Department of Revenue. It is essential to determine tax liability based on residency status and type of income earned.

Please note that this information is intended as a general guide, and it is always recommended to consult with a tax professional or visit the official Iowa Department of Revenue website for specific guidelines and instructions based on your individual circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit iowa department of revenue from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your iowa department of revenue into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for signing my iowa department of revenue in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your iowa department of revenue directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit iowa department of revenue straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing iowa department of revenue right away.

Fill out your iowa department of revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.