Get the free D-403 2007 Partnership Income Tax Return - DOR Web Site - dor state nc

Show details

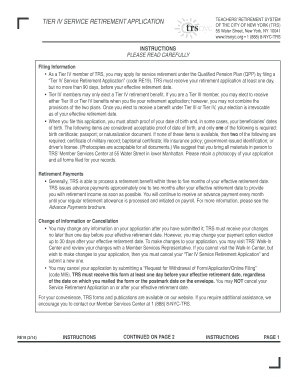

2007 Partnership Income Tax Return D-403 Web 11-07 North Carolina Department of Revenue 07 For calendar year 2007, or fiscal year beginning (MM-DD) Legal Name (USE CAPITAL LETTERS FOR NAME AND ADDRESS)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your d-403 2007 partnership income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your d-403 2007 partnership income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit d-403 2007 partnership income online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit d-403 2007 partnership income. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out d-403 2007 partnership income

How to fill out d-403 2007 partnership income?

01

Gather all necessary financial documents: Before filling out the d-403 2007 partnership income form, make sure you have all the relevant financial documents on hand. This may include income statements, expense records, and any other relevant financial information related to the partnership.

02

Understand the form's sections: Take some time to familiarize yourself with the different sections of the d-403 2007 partnership income form. This will help you navigate through the form more efficiently and ensure you provide accurate information in the right places.

03

Begin with basic information: Start by filling out the basic information section, which typically includes the partnership's name, address, federal Employer Identification Number (EIN), and the period the form covers. Ensure the information provided is accurate and up to date.

04

Calculate partnership income: One of the main sections of the d-403 2007 partnership income form requires you to report the partnership's income. This typically includes both ordinary business income and other income sources. Carefully calculate the total income and ensure you accurately report it on the form.

05

Deduct partnership expenses: Deductible expenses are an essential part of properly filling out the d-403 2007 partnership income form. Deductible expenses generally include costs directly related to the partnership's operations, such as rent, utilities, salaries, and other business expenses. Ensure you accurately report these expenses in the appropriate sections of the form.

06

Allocate partner shares: If your partnership has multiple partners, you'll need to allocate each partner's share of the income and expenses. This is typically done based on the partnership agreement or ownership percentages. Make sure to allocate the shares accurately and report them on the form accordingly.

07

Complete other sections: The d-403 2007 partnership income form consists of various sections that may require additional information, such as information on capital gains or losses, rental income, and other relevant details. Review each section carefully and provide the necessary information accurately.

08

Check for errors and review: Once you have filled out the entire form, take some time to review all the information you've provided. Double-check for any errors or discrepancies. Accuracy is crucial to avoid potential issues or audits in the future.

Who needs d-403 2007 partnership income?

01

Partnerships: Any partnership that operates during the tax year of 2007 is required to file the d-403 partnership income form. This includes both general partnerships and limited partnerships.

02

Partners/Shareholders: All partners or shareholders of the partnership need the d-403 2007 partnership income form to properly report their share of the partnership's income and losses. This is crucial for individual tax filing purposes.

03

Tax authorities: The d-403 2007 partnership income form is essential for tax authorities to accurately assess the partnership's tax liabilities. Filing this form ensures compliance with tax regulations and allows tax authorities to verify the correctness of reported income and expenses.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send d-403 2007 partnership income for eSignature?

d-403 2007 partnership income is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit d-403 2007 partnership income online?

With pdfFiller, it's easy to make changes. Open your d-403 2007 partnership income in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out d-403 2007 partnership income on an Android device?

Use the pdfFiller app for Android to finish your d-403 2007 partnership income. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your d-403 2007 partnership income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.