Get the free 2005 Form W-5 - rider

Show details

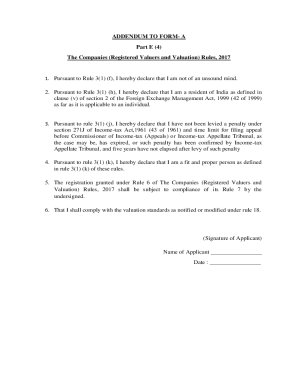

5 TLS, have you transmitted all R text files for this cycle update? I.R.S. SPECIFICATIONS TO BE REMOVED BEFORE PRINTING INSTRUCTIONS TO PRINTERS FORM W-5, PAGE 1 of 4 MARGINS: TOP 13 mm (1 2 “),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2005 form w-5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2005 form w-5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2005 form w-5 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2005 form w-5. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out 2005 form w-5

How to fill out 2005 form w-5?

01

Start by obtaining the form. You can either download it from the IRS website or request a copy from your local IRS office.

02

Carefully read the instructions provided with the form to understand the requirements and the information that needs to be filled in.

03

Begin by entering your personal information in the designated spaces. This includes your name, address, Social Security number, and other relevant details.

04

Provide the necessary information regarding your employer or payer, such as their name, address, and employer identification number.

05

Indicate the tax year and the specific period covered by the form.

06

Fill out the allowances and additional withholding amounts, if applicable. This will determine the amount of federal income tax withheld from your paycheck.

07

Sign and date the form once you have completed all the required sections.

08

Keep a copy of the filled-out form for your records and submit the original to your employer or payer.

Who needs 2005 form w-5?

01

Employees who want to adjust the amount of federal income tax withheld from their wages throughout the year may need to fill out Form W-5.

02

This form is particularly beneficial for individuals who experience significant life changes or have additional tax deductions or credits, as it allows them to customize their tax withholding amounts.

03

Self-employed individuals or those with income from other sources may also need to use Form W-5 to determine their estimated tax payments.

04

It is essential to consult with a tax professional or the IRS website to determine if filing Form W-5 is necessary for your specific situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form w-5?

Form W-5 is a form used by employees to request withholding allowances from their wages for federal income tax purposes.

Who is required to file form w-5?

Employees who want to adjust the amount of federal income tax withheld from their wages are required to file Form W-5.

How to fill out form w-5?

To fill out Form W-5, employees need to provide their personal information, including their name, Social Security Number, address, filing status, and the number of withholding allowances they are claiming.

What is the purpose of form w-5?

The purpose of Form W-5 is to allow employees to adjust their federal income tax withholding to better match their expected tax liability for the year.

What information must be reported on form w-5?

Form W-5 requires employees to report their personal information, such as their name, Social Security Number, address, filing status, and the number of withholding allowances they are claiming.

When is the deadline to file form w-5 in 2023?

The deadline to file Form W-5 in 2023 is usually April 15th, which is the same deadline for filing federal income tax returns.

What is the penalty for the late filing of form w-5?

The penalty for the late filing of Form W-5 may vary based on individual circumstances and can result in additional taxes owed and potential interest charges. It is advisable to file the form on time to avoid penalties.

How do I execute 2005 form w-5 online?

pdfFiller has made it simple to fill out and eSign 2005 form w-5. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the 2005 form w-5 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 2005 form w-5 in seconds.

How do I edit 2005 form w-5 on an iOS device?

Create, edit, and share 2005 form w-5 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your 2005 form w-5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.