Get the free SCANNED S o 6 - Foundation Center

Show details

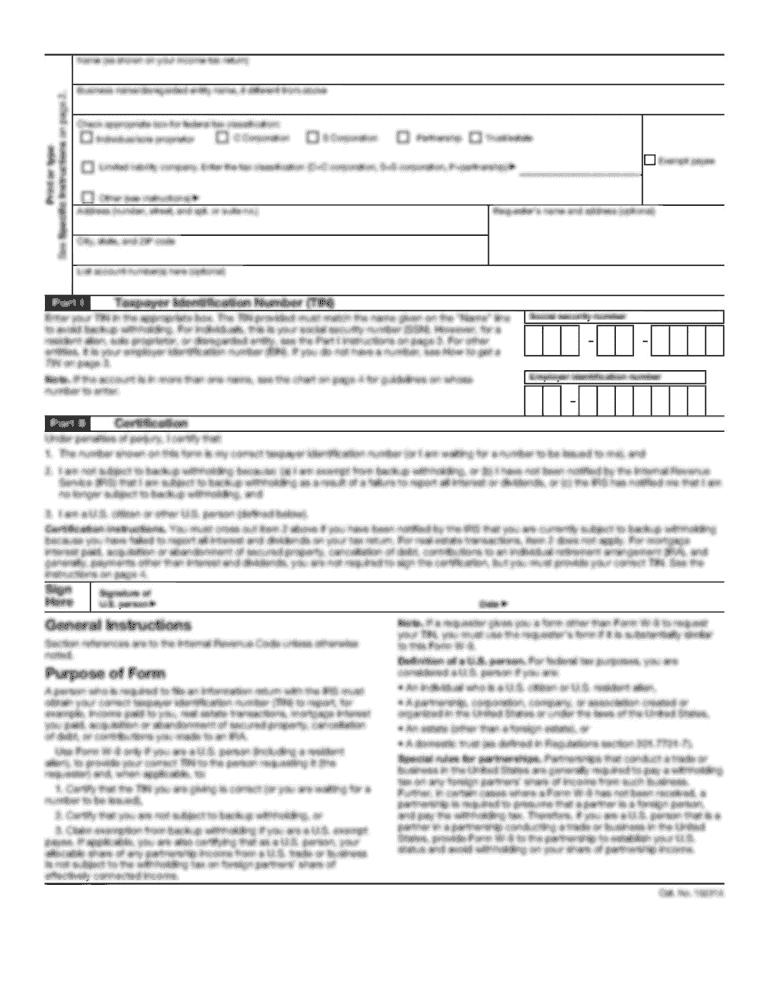

X90 PF Form Return of Private Foundation reporting requirements For calendar ear 2003, or tax ear beginning G Check a ll that a p pl y Name of organization initial return Indiana. Helen V. or type,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your scanned s o 6 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your scanned s o 6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit scanned s o 6 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit scanned s o 6. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out scanned s o 6

How to Fill Out Scanned S O 6:

01

Obtain the scanned copy of the S O 6 form. Ensure that the document is clear and legible.

02

Begin by entering the required information in Section 1 of the form. This typically includes the name of the applicant, their address, contact details, and any relevant identification numbers.

03

In Section 2, provide details about the specific purpose for which the S O 6 form is required. This might include information about the type of transaction or activity that necessitates the form.

04

Proceed to Section 3, where you will need to fill out the related information regarding the government agency or authority involved. This may include their name, address, contact information, and any references or codes provided.

05

Move on to Section 4, where you should carefully provide details about the goods or items involved in the transaction. This could include their description, quantity, value, and any other relevant information.

06

For Section 5, only complete this portion if you have been directed to do so by the government agency or authority. It may involve providing additional supporting documents or explanations.

07

Review the completed form for any errors or missing information. Make sure that all entries are accurate and corresponding to the provided guidelines.

08

Finally, sign and date the form as requested. Insert your name and indicate your position or capacity, if necessary.

09

Once you have filled out the scanned S O 6 form completely, save it and ensure it is ready for submission or further processing.

Who needs scanned S O 6:

01

Importers and exporters: Individuals or businesses involved in international trade may require a scanned S O 6 form when conducting transactions related to the import or export of goods.

02

Customs agencies: Government customs agencies often request scanned S O 6 forms to monitor and regulate the movement of goods across borders, ensuring compliance with trade regulations.

03

Shipping or logistics companies: Companies engaged in transportation and logistics services may need scanned S O 6 forms to facilitate the movement of goods and comply with customs procedures.

04

Banks and financial institutions: Some financial institutions may request scanned S O 6 forms as part of their due diligence processes when handling international trade transactions or providing financial services to importers/exporters.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is scanned s o 6?

Scanned s o 6 refers to a specific form or document that needs to be digitized for electronic submission.

Who is required to file scanned s o 6?

Certain individuals or entities, depending on their tax or regulatory requirements, are required to file scanned s o 6.

How to fill out scanned s o 6?

To fill out scanned s o 6, one must follow the instructions provided on the form and accurately input the required information.

What is the purpose of scanned s o 6?

The purpose of scanned s o 6 is to gather specific data or information for regulatory or compliance purposes.

What information must be reported on scanned s o 6?

Scanned s o 6 typically requires information such as identification details, financial data, and other relevant information.

When is the deadline to file scanned s o 6 in 2023?

The deadline to file scanned s o 6 in 2023 is typically set by the relevant authorities or agencies and may vary depending on the jurisdiction.

What is the penalty for the late filing of scanned s o 6?

The penalty for the late filing of scanned s o 6 may include fines, interest charges, or other sanctions as determined by the regulatory authorities.

How can I send scanned s o 6 for eSignature?

To distribute your scanned s o 6, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in scanned s o 6?

With pdfFiller, the editing process is straightforward. Open your scanned s o 6 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit scanned s o 6 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit scanned s o 6.

Fill out your scanned s o 6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.