Get the free 4212011 13521 PM - 10265406074 - 35 - PIT - DRUE HEINZ TRUST

Show details

4/21/2011 1:35:21 PM — 10265406074 3 — PIT — DUE HEINZ TRUST Form Return of Private Foundation 990-PF OMB No 1545-0052 or Section 4947 (a)(1) Nonexempt Charitable Trust Treated as a Private

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 4212011 13521 pm form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 4212011 13521 pm form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 4212011 13521 pm online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 4212011 13521 pm. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

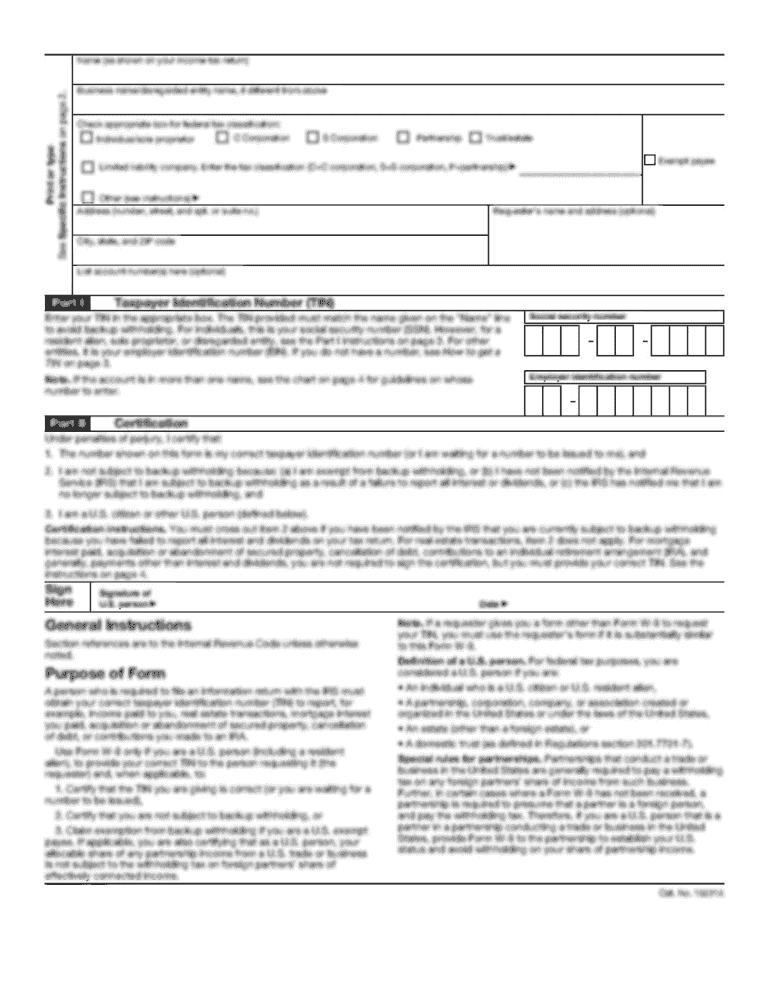

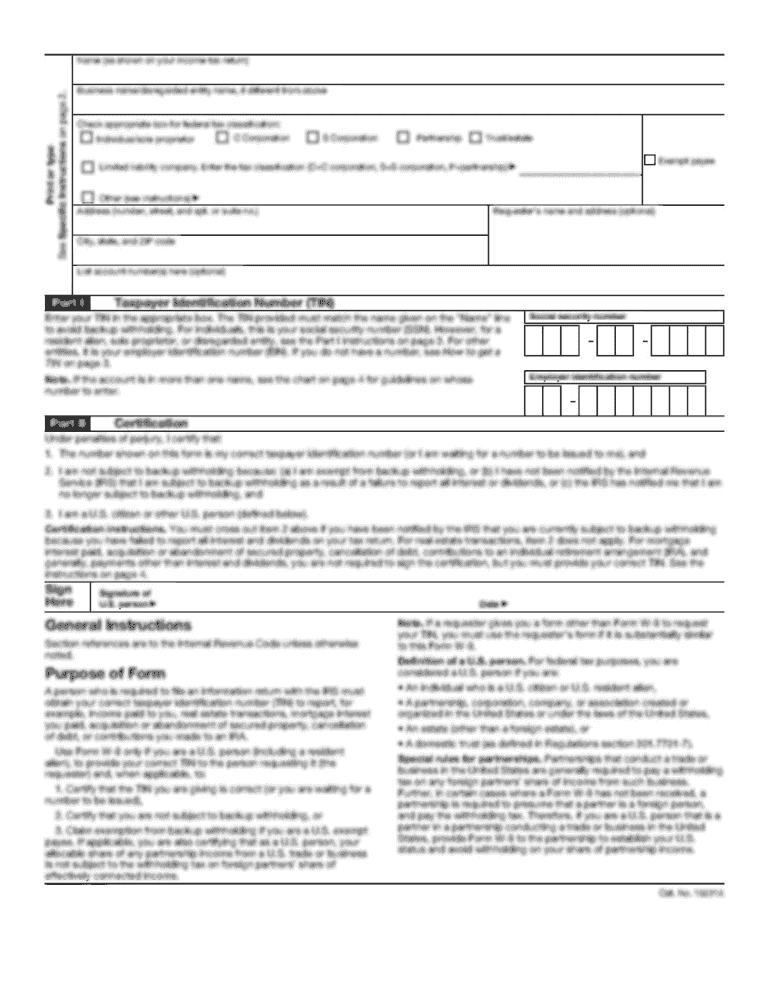

How to fill out 4212011 13521 pm

How to fill out Form 4212011 13521 PM:

01

Start by reading the instructions provided with the form. It is important to understand the purpose of the form and the information it requires.

02

Gather all the necessary documents and information needed to complete the form. This may include personal details such as name, address, and social security number, as well as any relevant financial or legal information.

03

Carefully review each section of the form and provide the requested information accurately. Double-check your entries to ensure they are correct and legible.

04

If there are any specific instructions or requirements for certain sections of the form, make sure to follow them precisely. This may include providing supporting documentation or attaching additional forms.

05

Be mindful of any deadlines associated with the form. If there is a due date or submission timeline, make sure to submit the completed form within the specified timeframe.

06

Once you have filled out all the required fields, review the entire form again to ensure it is complete and error-free. Make any necessary corrections before finalizing it.

07

Sign and date the form where required. If applicable, have any necessary witnesses or notaries also sign the form.

08

Make a copy of the completed form for your records before submitting it. This can serve as proof of your submission and help with future reference if needed.

Who needs Form 4212011 13521 PM:

01

Individuals or entities who have been instructed to fill out this specific form by a relevant authority or organization.

02

Individuals or entities who are involved in the specific process or situation that the form pertains to. For example, if the form is related to a legal matter, it may be required by the court or legal professionals involved.

03

Individuals or entities who are seeking certain benefits, services, or permissions that require the submission of this form. This could include applications for licenses, permits, or financial assistance.

04

It is important to consult the instructions or reach out to the relevant authority to determine if you specifically need to fill out Form 4212011 13521 PM based on your unique circumstances and requirements.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 4212011 13521 pm?

4212011 13521 pm is a specific time and date format which appears to be incorrect or misspelled.

Who is required to file 4212011 13521 pm?

There is no specific information available on who is required to file 4212011 13521 pm.

How to fill out 4212011 13521 pm?

Without further context or clarification, it is not possible to provide guidance on how to fill out 4212011 13521 pm.

What is the purpose of 4212011 13521 pm?

The purpose of 4212011 13521 pm is unclear without additional information or context.

What information must be reported on 4212011 13521 pm?

There is no specific information available on what information must be reported on 4212011 13521 pm.

When is the deadline to file 4212011 13521 pm in 2023?

The deadline to file 4212011 13521 pm in 2023 is not specified.

What is the penalty for the late filing of 4212011 13521 pm?

There is no information available on the penalty for the late filing of 4212011 13521 pm.

Can I sign the 4212011 13521 pm electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your 4212011 13521 pm in seconds.

Can I create an electronic signature for signing my 4212011 13521 pm in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 4212011 13521 pm directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete 4212011 13521 pm on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 4212011 13521 pm by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your 4212011 13521 pm online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.