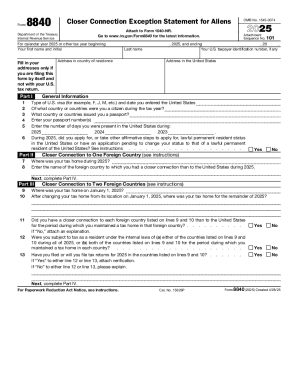

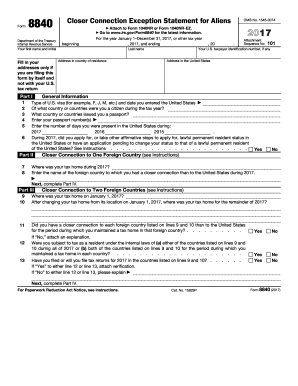

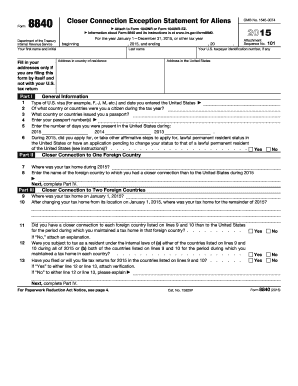

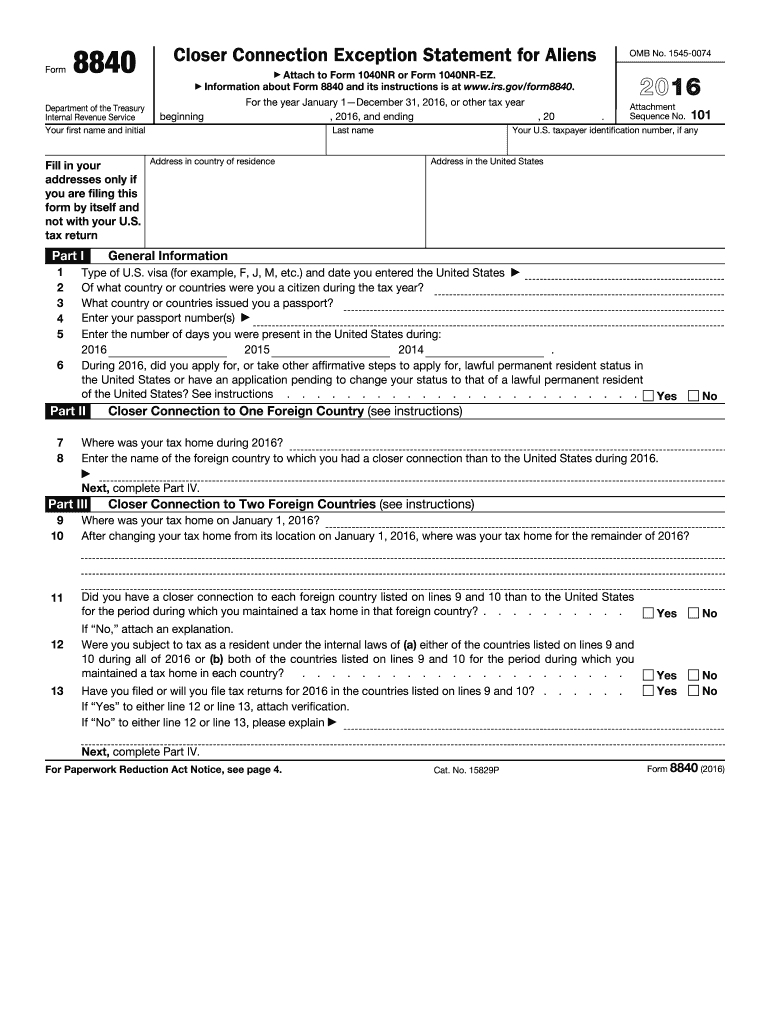

IRS 8840 2016 free printable template

Instructions and Help about IRS 8840

How to edit IRS 8840

How to fill out IRS 8840

About IRS 8 previous version

What is IRS 8840?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8840

What should I do if I realize I made a mistake on my IRS 8840?

If you identify an error after submitting your IRS 8840, you should file an amended return using Form 8840X, along with a brief explanation of the corrections made. This will help ensure that your filing accurately reflects your tax situation and prevents potential issues in the future.

How can I track the status of my IRS 8840 filing?

To verify the status of your submitted IRS 8840, you can use the IRS's online tool or contact their customer service. Be sure to have your personal information and any relevant details accessible, as this will assist in tracking down your form processing status.

What common mistakes should I be aware of when filing IRS 8840?

Common errors on the IRS 8840 include incorrect Social Security numbers, filing under the wrong category, and omitting required signatures. To avoid these mistakes, double-check all entries for accuracy before submitting your form.

What are the privacy considerations when submitting my IRS 8840 electronically?

When e-filing your IRS 8840, consider using reputable tax software that protects your data. Ensure you have strong passwords and that your devices are secure, as electronic submissions involve sharing sensitive personal information.

How will I be notified if there is an issue with my IRS 8840 submission?

If the IRS encounters any issues with your IRS 8840 submission, you will receive a notice or letter outlining the problem. It’s important to respond promptly with any requested documentation or clarification to resolve the issue efficiently.

See what our users say