Get the free GENERAL RULES APPLICATION TOMICRO-CREDIT LOANS

Show details

GENERAL RULES APPLICATION MICROCREDIT LOANS

1. A member must be six (6) weeks old to qualify for a loan

2. A loan of ve times (X5) deposits must be guaranteed by all group members. Loaners plus guarantorsHotline

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your general rules application tomicro-credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general rules application tomicro-credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit general rules application tomicro-credit online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit general rules application tomicro-credit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

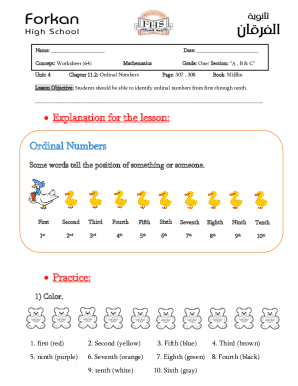

How to fill out general rules application tomicro-credit

How to fill out a general rules application for micro-credit?

01

Gather all necessary documents: Start by collecting all the required documents for filling out the general rules application for micro-credit. This may include identification proof, income statements, bank statements, and any other relevant financial documents.

02

Understand the eligibility criteria: Before filling out the application form, it is crucial to understand the eligibility criteria for micro-credit. Typically, micro-credit is designed for individuals or small businesses with limited access to traditional banking services. Ensure you meet the requirements before proceeding.

03

Fill out personal information: Begin the application process by filling out your personal information accurately. This may include your full name, address, contact details, and social security number or equivalent identification number.

04

Provide financial details: The application form will likely require you to provide detailed information about your financial situation. This may include your income, expenses, assets, liabilities, and any existing loans or debts. It is essential to provide accurate and honest information to increase your chances of approval.

05

Include business details (if applicable): If you are applying for micro-credit as a small business owner, you will need to provide specific details about your business. This may include the business name, address, nature of the business, years in operation, and financial details related to the business.

06

Answer additional questions: Apart from personal and financial information, the application form may include additional questions specific to micro-credit. These questions are designed to assess your understanding of the loan process and determine your suitability for micro-credit.

07

Review and double-check: Before submitting the application, it is crucial to review all the information you have provided. Make sure there are no errors or omissions. Double-check the form to ensure accuracy and completeness.

08

Submit the application: Once you are satisfied with the information provided, submit the application either online, through mail, or by visiting the respective micro-credit institution. Follow the specified instructions for submission.

Who needs a general rules application for micro-credit?

01

Individuals with limited access to traditional banking services: Micro-credit is primarily aimed at individuals who may not have access to traditional banking facilities due to various reasons, such as low income, lack of collateral, or limited credit history.

02

Small business owners: Micro-credit can be beneficial for small business owners who require financial assistance to start or expand their businesses. By providing access to credit, micro-credit allows these entrepreneurs to invest in their ventures and stimulate economic growth.

03

Entrepreneurs in underprivileged communities: Micro-credit programs often target individuals residing in underprivileged communities with the objective of poverty alleviation. By giving them access to micro-loans, these individuals can initiate income-generating activities and improve their financial situations.

04

Unbanked or underbanked individuals: Micro-credit serves those who are unbanked or underbanked, meaning they do not have a bank account or have limited access to financial services. Micro-credit institutions prioritize reaching out to these individuals and providing them with necessary financial support.

05

Individuals seeking to improve their credit history: Micro-credit can also be utilized by individuals who are looking to improve their credit history. By borrowing small amounts and repaying timely, borrowers can build a positive credit history, which can later help them access larger loans and better financial opportunities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit general rules application tomicro-credit in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your general rules application tomicro-credit, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the general rules application tomicro-credit electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your general rules application tomicro-credit in minutes.

How can I fill out general rules application tomicro-credit on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your general rules application tomicro-credit. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your general rules application tomicro-credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.