Get the free Paying Inter-Corporate Dividends

Show details

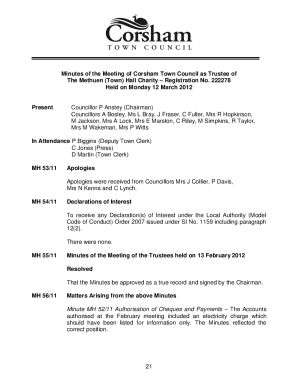

Paying Incorporate Dividends?

Proceed with Caution

May 16, 2016,

No. 201628Canadian corporations that receive dividends from other Canadian corporations now have

more guidance from the CRA about the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your paying inter-corporate dividends form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paying inter-corporate dividends form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit paying inter-corporate dividends online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit paying inter-corporate dividends. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

How to fill out paying inter-corporate dividends

How to fill out paying inter-corporate dividends?

01

Firstly, gather all the necessary financial documents and information related to the dividends you wish to pay. This includes the company's financial statements, shareholder records, and other relevant information.

02

Determine the amount of dividends to be paid to each shareholder. This can be calculated based on the company's earnings, financial performance, and any applicable laws or regulations.

03

Draft a dividend declaration or resolution, which formally states the intention of the company to pay dividends to its shareholders. This document should include the date of declaration, the amount to be paid per share, and any other relevant details.

04

Distribute the dividend declaration to all shareholders. This can be done through physical mail, email, or other secure communication methods.

05

Prepare the dividend vouchers or checks for each shareholder. Ensure that the correct amount is written and that the vouchers are properly signed by authorized individuals within the company.

06

Follow any legal or regulatory requirements for paying dividends, such as withholding taxes or reporting obligations.

07

Finally, distribute the dividends to the shareholders according to their proportionate ownership in the company. This can be done through electronic transfers, physical checks, or any other agreed-upon payment method.

Who needs paying inter-corporate dividends?

01

Companies with multiple subsidiary companies or divisions may need to pay inter-corporate dividends. These dividends are paid between different entities within the same corporate group.

02

Shareholders of the parent company who have invested in the subsidiary companies may also be recipients of inter-corporate dividends.

03

Inter-corporate dividends can serve various purposes, such as redistributing profits between different entities within the group, optimizing tax planning, or consolidating financial resources. Therefore, businesses engaged in these activities may have a need for paying inter-corporate dividends.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit paying inter-corporate dividends from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your paying inter-corporate dividends into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in paying inter-corporate dividends without leaving Chrome?

paying inter-corporate dividends can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out paying inter-corporate dividends using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign paying inter-corporate dividends and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your paying inter-corporate dividends online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.