Get the free Tax Exempt Form - Ohio.pdf - Customer Service - Summit Racing

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tax exempt form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exempt form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax exempt form online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax exempt form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

How to fill out tax exempt form

How to fill out tax exempt form:

01

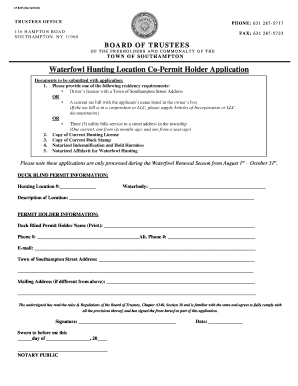

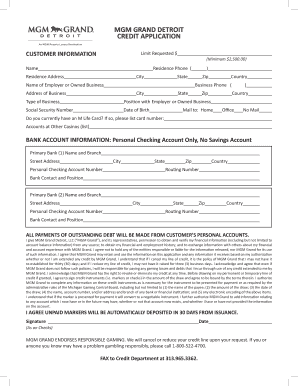

Start by obtaining the tax exempt form from the appropriate tax authority or organization. This form is usually available for download on their website or can be obtained in person.

02

Carefully read through the instructions provided on the form. Familiarize yourself with the requirements and eligibility criteria for claiming tax exemption.

03

Begin filling out the form by entering your personal information, such as your name, address, and contact details.

04

Provide your tax identification number, which may be your social security number or an employer identification number depending on the nature of your exemption.

05

Indicate the purpose of the exemption by selecting the relevant category or reason for your tax exemption. Common categories include religious, charitable, educational, or governmental purposes.

06

If applicable, provide any supporting documents or attachments required to validate your eligibility for tax exemption. This may include certificates of incorporation, letters of determination, or any other documentation specific to your exemption category.

07

Double-check your form for accuracy and completeness. Ensure that all fields are filled out correctly and that you have attached any necessary documents.

08

Sign and date the form as required. Some forms may require additional signatures from authorized individuals, such as board members or executives, so make sure to comply with any specific signing requirements.

09

Make copies of the completed form and any attachments for your records before submitting it to the appropriate tax authority or organization.

10

Retain a copy of the submitted form and any related correspondence for future reference.

Who needs tax exempt form:

01

Nonprofit organizations: Nonprofit entities, such as charities, religious institutions, or educational institutions, often need to obtain tax-exempt status to avoid paying certain taxes on income or resources.

02

Government entities: Government agencies and organizations at federal, state, or local levels may require tax exemption to carry out their operations or to be eligible for specific funding or grants.

03

Qualified individuals: In some cases, individuals may also be eligible for tax exemptions if they meet certain criteria, such as disabled individuals or those receiving specific types of government assistance. It is important to consult the tax laws and regulations of your jurisdiction to determine eligibility.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax exempt form directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your tax exempt form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for the tax exempt form in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your tax exempt form in seconds.

How do I fill out the tax exempt form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign tax exempt form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your tax exempt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.