Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

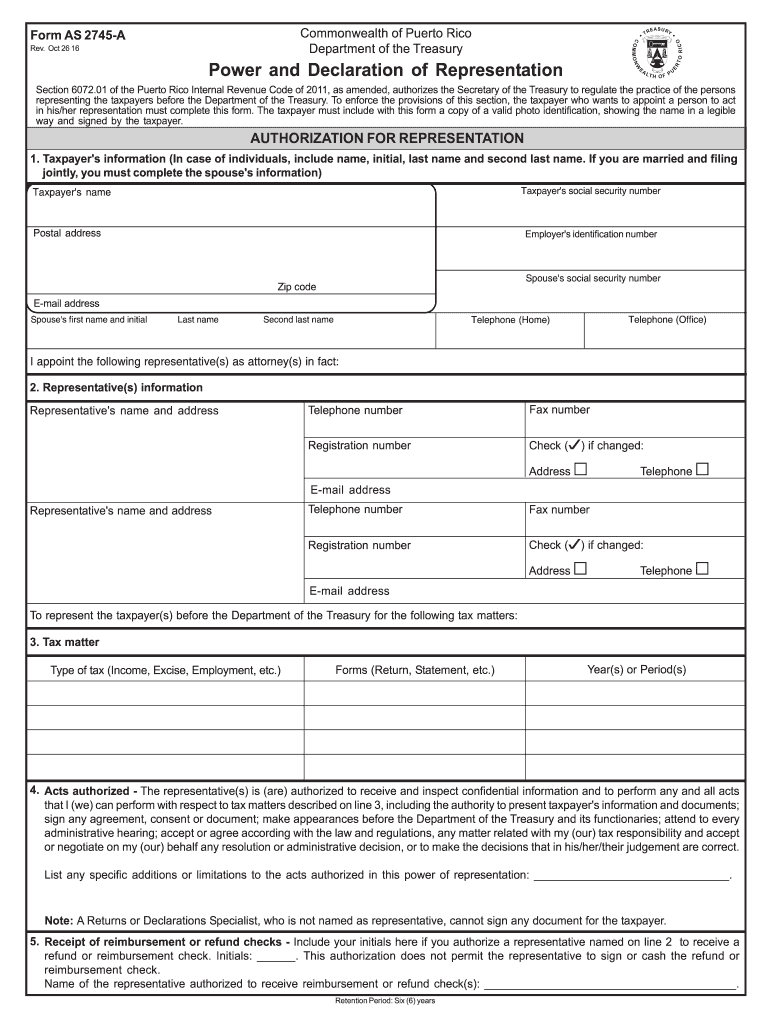

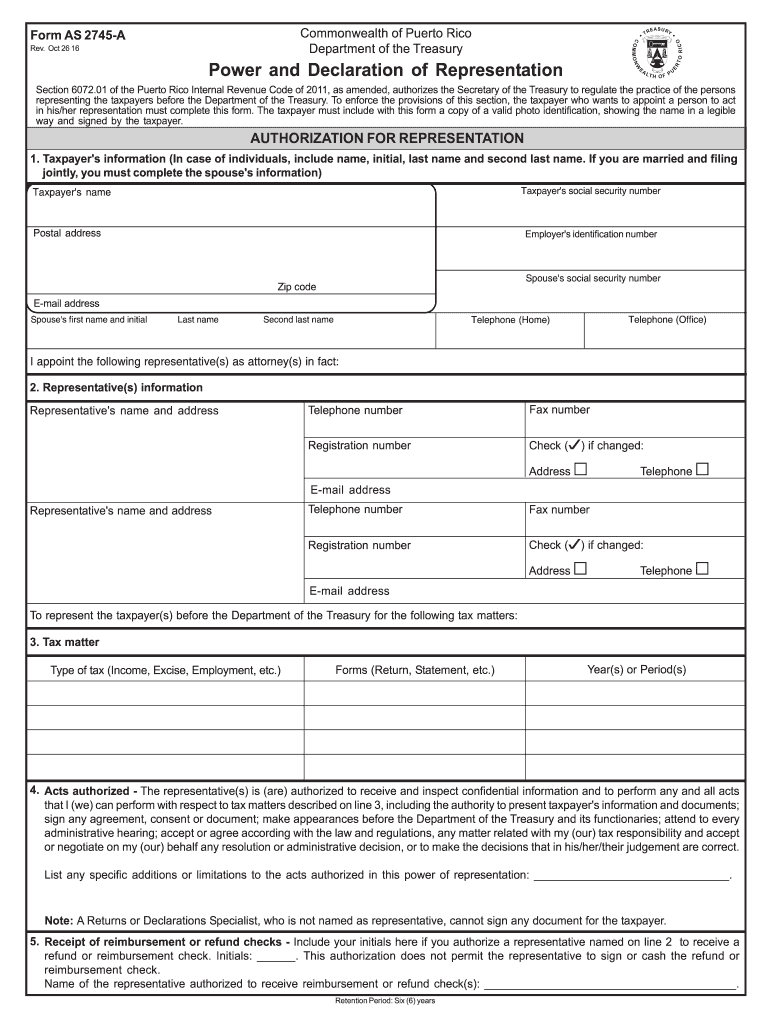

AS2745A is a U.S. government form used by the Department of the Treasury's Alcohol and Tobacco Tax and Trade Bureau (TTB). Specifically, the form is titled "Wine Bond - Brewer's Notice/Bond Under 26 U.S.C. 5352(b)(1) and 27 CFR Part 25 Subpart D". This form is used by breweries to apply for a brewer's notice and submit a bond to become eligible to produce or store wine for taxpaid or non-taxpaid purposes.

Who is required to file form as2745a?

Form AS2745A is not a standard form that is widely recognized. It is possible that you may be referring to a form specific to a particular organization or institution. Without further information, it is not possible to determine who would be required to file this form.

How to fill out form as2745a?

To fill out form AS2745A, you will need to follow these steps:

1. Obtain the AS2745A form: Make sure you have the correct version of the form AS2745A. You can usually find it on the official website of the organization or agency requiring the form.

2. Read the instructions: Go through the instructions that accompany the form carefully. This will help you understand the purpose of the form and the information needed to complete it.

3. Provide personal information: Begin by entering your personal details, such as your full name, contact information, address, and Social Security number or taxpayer identification number. Fill in all the required fields accurately.

4. Indicate filing status: Select your filing status, which could include single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Choose the option that applies to your situation.

5. Report income: Complete the sections related to your income. This could include wages, self-employment income, interest, dividends, rental income, or any other applicable income sources. Be sure to include all necessary documentation and accurately report your income.

6. Deductions and credits: If eligible, fill out any deductions or credits that could apply to you. This might include deductions for student loan interest, contributions to a retirement plan, or education-related expenses. Ensure proper documentation and correct calculations.

7. Sign and date: Once you have filled in all the relevant information, sign and date the form to confirm that the information provided is accurate to the best of your knowledge.

8. Attach required documents: If there are any supporting documents required by the form, ensure you attach them securely. This could include W-2 forms, 1099 forms, or additional statements supporting your income, deductions, or credits.

9. Review and double-check: Before submitting the form, carefully review all the entries you have made. Double-check for any errors, omissions, or missing information. It's essential to ensure accuracy to prevent delays or issues.

10. Submit the form: Once you have completed the form and attached all necessary documents, follow the submission instructions provided by the organization or agency. This may include mailing it to a specific address or submitting it electronically.

Remember, it is always recommended to consult with a tax professional or seek additional guidance if you have any specific questions or concerns about filling out form AS2745A.

What is the purpose of form as2745a?

Form AS2745A, also known as the "Employee Health Benefits Election Form," is used by federal government employees to select and enroll in health insurance coverage. The purpose of this form is to indicate the employee's choice for health insurance plans, such as the Federal Employees Health Benefits (FEHB) Program or other available health insurance options offered by the government. It allows employees to make changes to their existing health plans during specific enrollment periods or qualifying life events. The form provides the necessary information for the employee to enroll in or modify their health benefits coverage and communicates this choice to the appropriate government agency responsible for managing employee benefits.

What information must be reported on form as2745a?

Form AS2745A, also known as the Personal Property Summary, is used by military personnel to report their personal property to the Defense Property Accountability System (DPAS). The information required to be reported on this form includes:

1. Personal details: Name, rank, social security number, and contact information of the reporting military personnel.

2. Reporting period: The specific period for which the personal property is being reported (typically a fiscal year).

3. Location: The military installation or base where the personal property is located.

4. Classification: The type of personal property being reported, such as household goods, furniture, appliances, electronics, vehicles, and other items.

5. Description: Detailed descriptions of each item, including make, model, serial number, and any other unique identifiers.

6. Quantity: The number of each item being reported.

7. Acquisition cost: The original purchase price or the estimated value of each item when acquired.

8. Current value: The estimated current value of each item.

9. Disposition: If any items have been sold, donated, misplaced, or otherwise disposed of, this section should include details of their disposition.

10. Remarks: Any additional information or relevant comments related to the personal property being reported.

It is important for military personnel to accurately report their personal property on Form AS2745A to ensure proper accountability and management within the Defense Property Accountability System.

How can I send form as2745a to be eSigned by others?

When your form 2745 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out the puerto rico form as 2745 a form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign form as 2745 a and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete 2745 a on an Android device?

Use the pdfFiller app for Android to finish your form as2745 a. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.