Get the free saba igc form

Show details

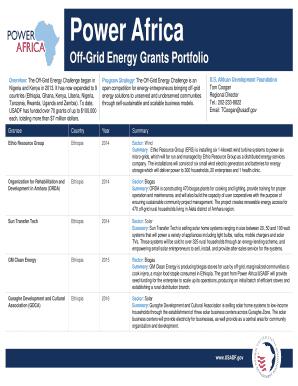

SHIA ASSOCIATION OF BAY AREA, Inc. Islamic Guidance Center 4415 FORTRAN Court San Jose, CA 95134 408.946.5700/5701 A non-profit religious corporation U.S. Federal EIN: 77-0050810 State of California

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your saba igc form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your saba igc form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit saba igc online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit saba center form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

How to fill out saba igc form

How to Fill Out SABA IGC:

01

Start by gathering all necessary information and documents required for completing the SABA IGC form. This may include personal details, employment information, and any relevant financial documentation.

02

Carefully read and understand each section of the form before starting to fill it out. Make sure to provide accurate and up-to-date information to avoid any potential issues or delays.

03

Begin by entering your personal information, such as your full name, date of birth, and contact details, in the designated fields. Double-check the accuracy of this information to ensure it matches your official records.

04

If applicable, provide your employment information, including your current job title, employer's name, and contact details. This section helps in assessing your financial stability and repayment capacity, so be sure to include accurate and relevant details.

05

Indicate the purpose of the SABA IGC application. Specify whether you are seeking funding for education, starting a business, purchasing a property, or any other valid reason. This helps the reviewing authority understand your needs and allocate resources accordingly.

06

Provide details of any co-applicants or co-borrowers, if applicable. Include their personal and financial information as required by the form. Make sure to inform the other parties involved and obtain their consent before including their information.

07

Declare your income and expenses accurately. This includes your monthly income from all sources, such as employment, investments, or rental properties, as well as your monthly expenditures. Ensure that the figures are realistic and reflective of your current financial situation.

08

If applying for a specific loan amount, clearly state the desired loan amount and the purpose for which it will be used. Include any supporting documents, such as estimates or invoices, to validate your request if necessary.

09

Review the filled-out form to ensure all fields are completed accurately and all required documents are attached. Any missing or inconsistent information can delay the processing of your SABA IGC application.

Who Needs SABA IGC:

01

Individuals looking for financial assistance to support their educational pursuits may need SABA IGC. This can include students seeking funding for tuition fees, study materials, or living expenses during their academic journey.

02

Entrepreneurs and business owners who require capital for starting or expanding their ventures may benefit from SABA IGC. This program can provide financial support, enabling them to invest in equipment, inventory, marketing, or other business-related expenses.

03

Individuals planning to purchase real estate, such as a house or property, may find SABA IGC useful. The funding can help cover the down payment, construction costs, or other expenses associated with property acquisition.

04

Those seeking to consolidate their existing debts or manage their finances more effectively can consider applying for SABA IGC. The loan amount can be used to pay off high-interest debts and streamline monthly payments, resulting in better financial management.

05

SABA IGC can also be beneficial for individuals facing unexpected expenses or financial emergencies. It provides a reliable financial option, allowing them to address urgent needs without resorting to high-interest borrowing or depleting their savings.

Overall, SABA IGC serves a wide range of individuals, including students, business owners, property buyers, and anyone in need of financial support.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is saba igc?

Saba IGC stands for Special Annual Business Activities Income Generating Cost.

Who is required to file saba igc?

Businesses that engage in special annual activities and generate income are required to file Saba IGC.

How to fill out saba igc?

To fill out Saba IGC, businesses need to report information about their special annual activities and income generating costs.

What is the purpose of saba igc?

The purpose of Saba IGC is to track and report the income generating costs associated with special annual activities.

What information must be reported on saba igc?

Businesses must report detailed information about their special annual activities, income generated, and associated costs on Saba IGC.

When is the deadline to file saba igc in 2023?

The deadline to file Saba IGC in 2023 is usually set by the tax authorities, typically in the first quarter of the following year.

What is the penalty for the late filing of saba igc?

The penalty for the late filing of Saba IGC can vary and is usually based on a percentage of the total income generated from special annual activities.

How do I edit saba igc online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your saba center form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the saba islamic center in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your saba igc in minutes.

How do I fill out saba igc on an Android device?

On Android, use the pdfFiller mobile app to finish your saba center form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your saba igc form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Saba Islamic Center is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.