Who needs the Schedule K-1 (Form 1065)?

This particular type of the Schedule K-1 (Form 1065) is a United States Internal Revenue Service form, which is required to be used by partnerships. This Form is to be issued by a partnership to each partner involved in business.

What is the purpose of the Schedule K-1 (Form 1065)?

The partnership uses Schedule K-1 to report each partner’s share of the partnership's income, deductions, credits, etc. Each partner should keep it for his records and should not file it with his tax return unless the partner is specifically required to do so. The partnership files a copy of Schedule K-1 (Form 1065) with the IRS.

Is the Schedule K-1 (Form 1065) accompanied by other forms?

The information a partner provides on the Schedule K-1 (Form 1065) is mandatory to be indicated on the appropriate personal or corporate income tax return as well.

When is the IRS Form K-1 due?

Generally, the partnership is required to prepare and give a Schedule K-1 to each person who was a partner in the partnership at any time during the year. Schedule K-1 must be provided to each partner on or before the day on which the partnership return is required to be filed.

How do I fill out the Schedule K-1 (Form 1065) 2016?

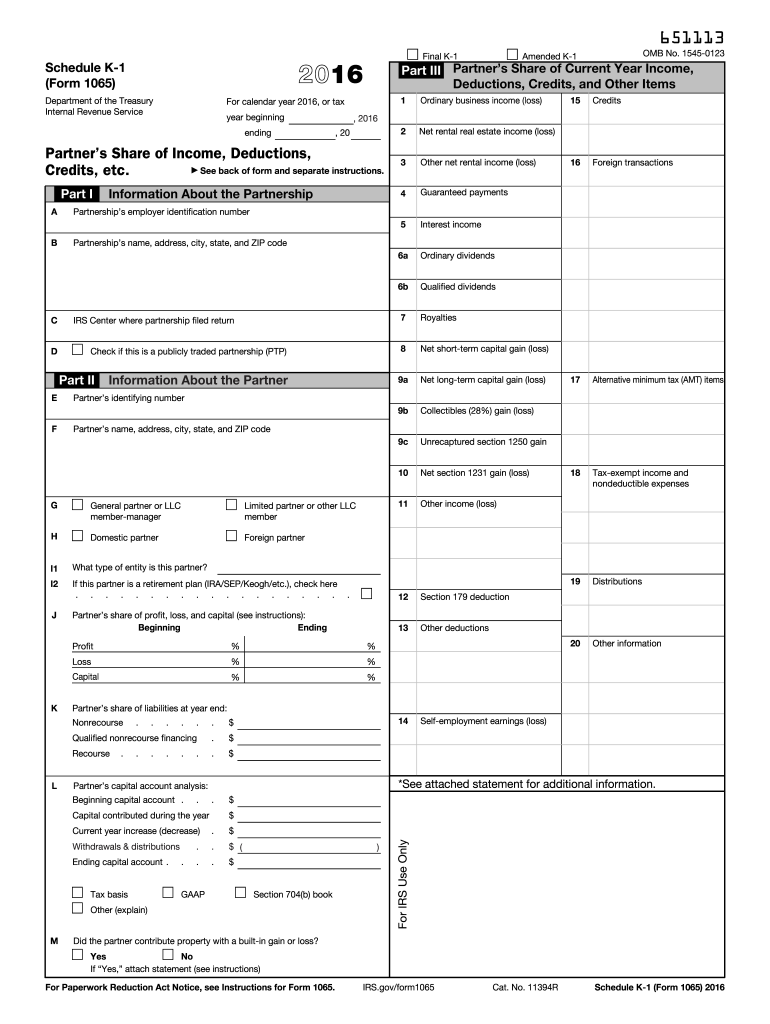

The information that must be given on the Schedule K-1 form includes the following:

1. Information about the partnership (employer identification number, name, and address, etc.)

2. The partner’s data (partner’s identifying number, name, address, type of partner, their share of profit, loss and capital, etc.)

3. Partner’s share of income, credits, deductions, etc. over the current year

The filer should pay attention that the lower box in the right corner is to be used by the IRS

For more details on how to fill out Form 1065, you can check up instructions from the IRS:

https://www.irs.gov/pub/irs-pdf/i1065sk1.pdf

Where do I send the Schedule K-1 (Form 1065)?

The partnership must attach a copy of each Schedule K-1 to the Form 1065 filed with the IRS and keep a copy with a copy of the partnership return as a part of the partnership's records and furnish a copy to each partner. If a partnership interest is held by a nominee on behalf of another person, the partnership may be required to furnish Schedule K-1 to the nominee.