Get the free Form 8868 (Rev. January 2017). Application for Automatic Extension of Time To File a...

Show details

Filing Form 8868, Application for. Automatic Extension of Time To File an. Exempt Organization Return. To receive the automatic extension, the trustee must file Form 8868 on or before the original

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 8868 rev january form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8868 rev january form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8868 rev january online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 8868 rev january. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

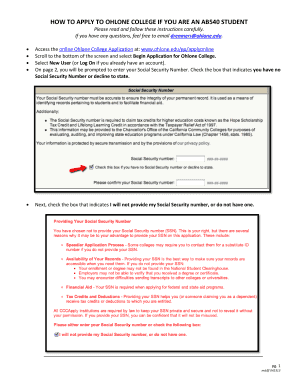

How to fill out form 8868 rev january

How to fill out form 8868 rev january?

01

Gather the necessary information: Before starting to fill out form 8868 rev January, make sure you have all the required information handy. This includes your organization's name, address, and tax identification number (EIN), as well as the tax year for which the extension is being filed.

02

Choose the appropriate boxes: Form 8868 provides several options for requesting an extension. Carefully select the option that best fits your organization's situation. For example, if you need an automatic 3-month extension, check Box 7a. If you need an additional non-automatic 3-month extension, check Box 7b.

03

Provide accurate details: In the designated sections of form 8868, accurately provide the required details. This may include the organization's address, EIN, tax year, and the specific months for which the extension is being requested.

04

Attach additional explanations if necessary: If there are any specific circumstances that require further explanation or clarification, you have the option to attach additional statements to form 8868. Use this opportunity to provide any necessary details that will help the IRS understand the need for the extension.

05

Check for accuracy and completeness: Before submitting the form, double-check all the information you provided for accuracy and completeness. Any errors or missing information can result in delays or complications in processing your extension request.

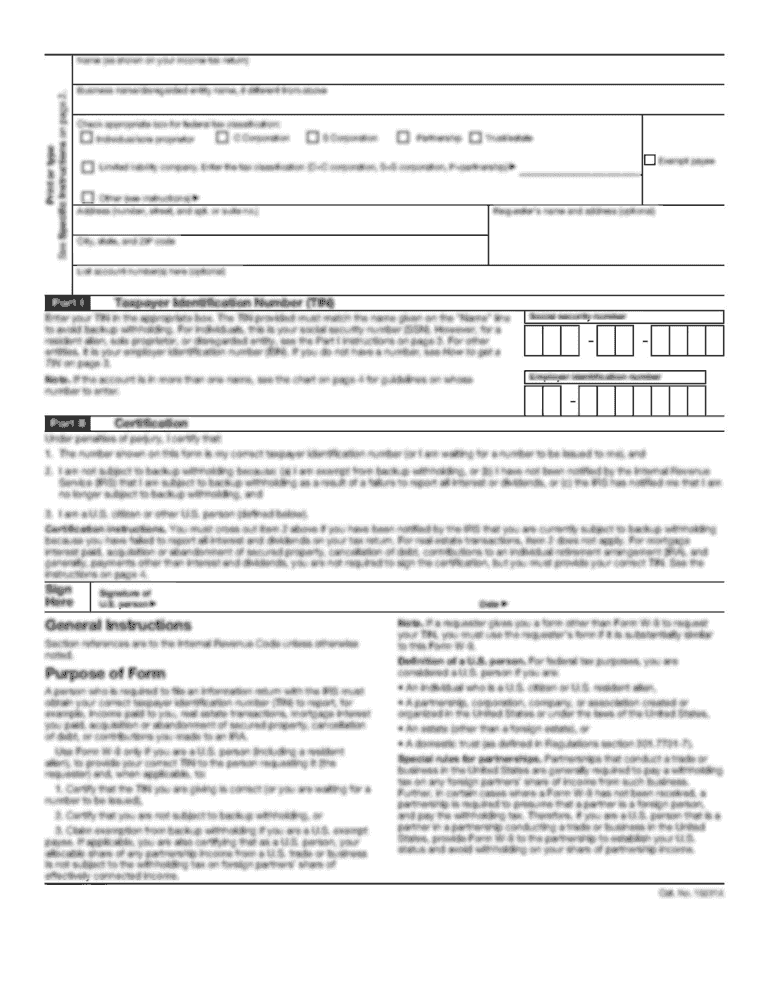

Who needs form 8868 rev January?

01

Tax-exempt organizations: Form 8868 rev January is primarily used by tax-exempt organizations, including those classified as 501(c)(3) organizations, to request an extension for filing their annual information returns (Form 990, Form 990-EZ, or Form 990-PF).

02

Organizations with valid reasons for extension: Organizations that are unable to meet the original deadline for filing their annual information returns due to valid reasons, such as unforeseen circumstances or difficulties in gathering necessary financial information, may need to utilize form 8868 rev January to request an extension.

03

Organizations seeking more time for accurate filing: Sometimes, organizations may require additional time to ensure the accuracy and completeness of their financial information before filing. Form 8868 provides a means for such organizations to request an extension and avoid potential penalties for late filing.

Note: It is always recommended to consult with a tax professional or refer to the official IRS guidelines to ensure compliance and accuracy while filling out form 8868 rev January.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 8868 rev january?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form 8868 rev january. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in form 8868 rev january without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing form 8868 rev january and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my form 8868 rev january in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your form 8868 rev january right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your form 8868 rev january online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.