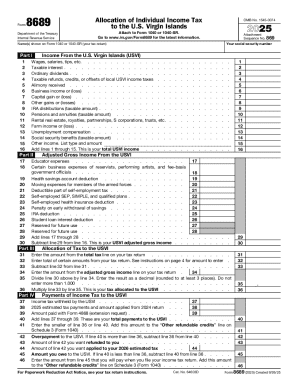

IRS 8689 2016 free printable template

Instructions and Help about IRS 8689

How to edit IRS 8689

How to fill out IRS 8689

About IRS 8 previous version

What is IRS 8689?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8689

What should I do if I notice mistakes after submitting form 8689pdffillercom 2016?

If you realize there are errors in your submitted form 8689pdffillercom 2016, it is crucial to file an amended form to correct those mistakes. This can typically be done by completing the appropriate correction form and submitting it according to the guidelines set by the IRS. Ensure that you provide an explanation for the amendments to avoid processing delays.

How can I check the status of my form 8689pdffillercom 2016 submission?

To verify the status of your form 8689pdffillercom 2016, you can utilize the IRS's online tracking system or contact their support. Keep your submission details handy for reference in case you encounter any common e-file rejection codes that may require additional action on your part.

Are e-signatures accepted on form 8689pdffillercom 2016?

Yes, e-signatures are generally accepted for form 8689pdffillercom 2016 when filed electronically. However, it is essential to ensure that the e-signature is compliant with all IRS regulations to avoid issues during processing. Also, consider keeping records of your submission for your personal reference and security.

What should I do if I receive a notice regarding my form 8689pdffillercom 2016?

Receiving a notice concerning your form 8689pdffillercom 2016 usually requires prompt attention. Carefully read the notice to understand the issue raised, gather pertinent documentation, and respond accordingly within the timeframe specified in the notice to resolve any issues effectively.

What common errors should I avoid when submitting form 8689pdffillercom 2016?

Some common errors to avoid when filing form 8689pdffillercom 2016 include incorrect social security numbers, mismatched names, and failure to sign the form if required. Double-check all entries for accuracy as such mistakes can lead to delays and additional penalties.