Get the free KPMGs Indirect Tax

Show details

001001101001001001101

0110100100100110100101101001001001101001100100110100100100110100100100110100100100110100110010011010010010011010011010011KPMGs Indirect Tax

Compliance Center10011010010010011010010010011010010010011010011001001101001001001101001010011010010100111010011010010100110100100100110100101001100100110100100100110100100100110100100100110100110010011010010010011010011010011010011010010011001001101001001001001

010011010010010011010

010011010010010011010

Center

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your kpmgs indirect tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kpmgs indirect tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kpmgs indirect tax online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit kpmgs indirect tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out kpmgs indirect tax

How to fill out KPMG's indirect tax:

01

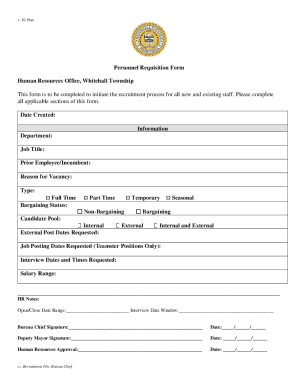

Gather all relevant financial information: Before filling out KPMG's indirect tax forms, make sure to gather all the necessary financial data related to your business transactions. This may include sales records, purchases, expenses, and any other information needed to calculate indirect taxes.

02

Understand the applicable indirect tax regulations: Familiarize yourself with the regulations and laws governing indirect taxes in your jurisdiction. This will help you determine which specific forms need to be filled out and what information is required for each.

03

Identify the appropriate KPMG's indirect tax forms: KPMG provides different forms for various indirect tax purposes, such as VAT, GST, or sales tax. Identify the specific form that corresponds to your business's tax obligations.

04

Fill in the required information accurately: Carefully fill out the KPMG's indirect tax forms, ensuring that all the required information is provided accurately. This may include details such as the amount of taxable sales, input tax credits, and any exemptions or deductions applicable to your business.

05

Review and double-check the filled forms: Once you have completed filling out the forms, review them thoroughly to ensure that all the information is accurate and complete. Mistakes or omissions could lead to errors or penalties, so take the time to double-check everything.

06

Seek professional advice if needed: If you're uncertain about any aspect of filling out KPMG's indirect tax forms, it's advisable to seek professional advice from a tax expert or a KPMG representative. They can provide guidance specific to your business and jurisdiction, ensuring compliance with the applicable indirect tax regulations.

Who needs KPMG's indirect tax?

01

Businesses subject to indirect taxes: Any business that operates in a jurisdiction that imposes indirect taxes, such as value-added tax (VAT), goods and services tax (GST), or sales tax, may need KPMG's indirect tax services. These taxes are typically levied on the purchase or consumption of goods and services rather than directly on income.

02

Businesses with complex tax obligations: Companies that have complex tax obligations due to factors such as cross-border transactions, multiple jurisdictions, or industry-specific regulations may benefit from KPMG's expertise in handling indirect taxes. KPMG can provide guidance and assistance in navigating the complexities of indirect tax compliance.

03

Businesses looking to optimize their indirect tax position: KPMG's indirect tax services can also be valuable for businesses seeking to optimize their indirect tax position. This involves identifying opportunities for savings, such as reclaiming input tax credits or leveraging available exemptions and deductions allowed under the applicable indirect tax regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find kpmgs indirect tax?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific kpmgs indirect tax and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the kpmgs indirect tax in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit kpmgs indirect tax straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit kpmgs indirect tax.

Fill out your kpmgs indirect tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.