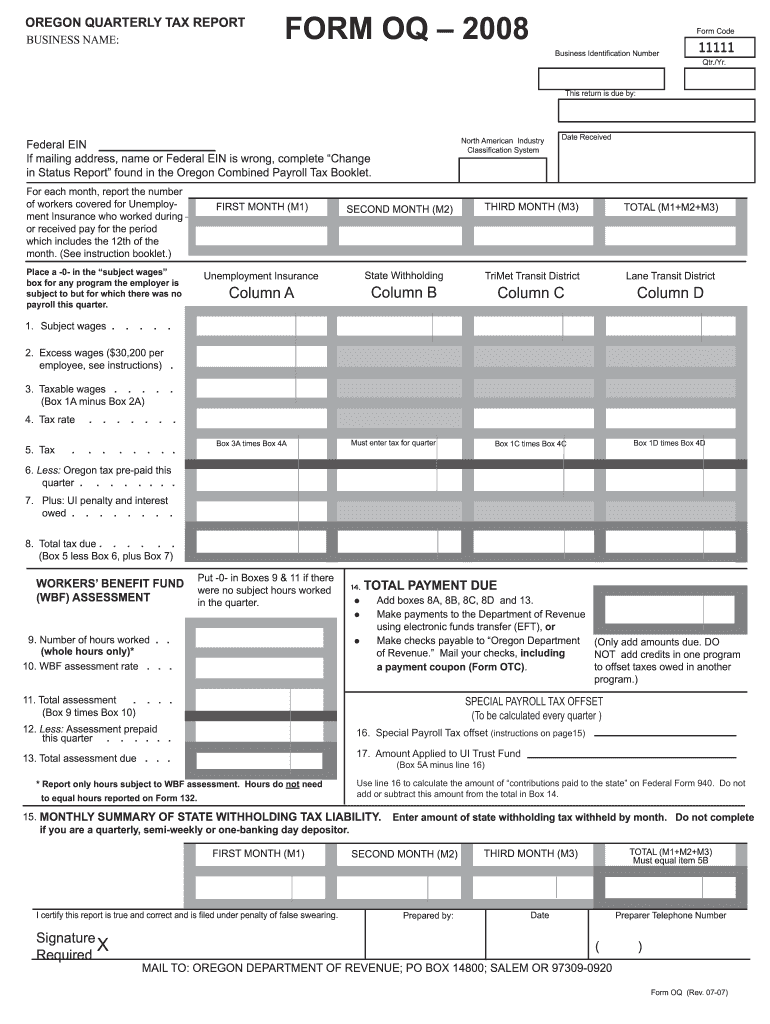

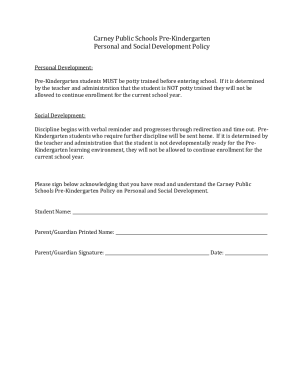

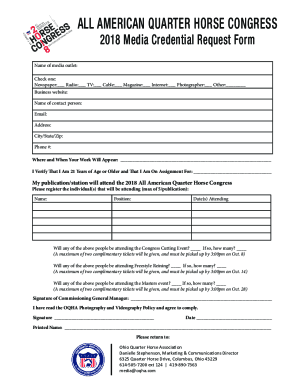

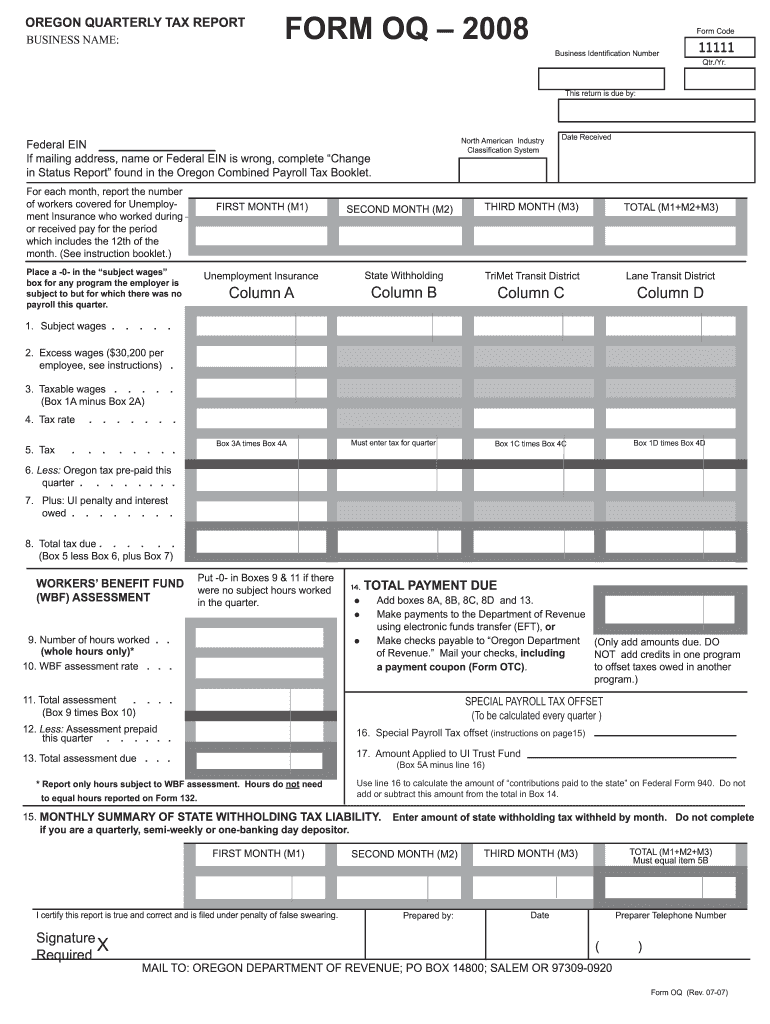

Get the free oregon form oq

Get, Create, Make and Sign

How to edit oregon form oq online

How to fill out oregon form oq

How to fill out Oregon Form OQ:

Who needs Oregon Form OQ:

Video instructions and help with filling out and completing oregon form oq

Instructions and Help about form oq

This video will discuss how to complete form i-9 it is for both employers and employees form i-9 is for employment eligibility verification and has three main parts section one will address employee information and attestation section two will address employer review and attestation and section three will address updating and reverification let's get started Music employers must complete form i-9 to verify the identity and employment authorization of new employees both US citizens and non-citizens employees complete section 1 and employers complete sections 2 & 3 this video shows how employees fill out section 1 when using a computer to complete a form i-9 obtained from the USCIS website first employers must ensure that employees have access to the form instructions and lists of acceptable documents employers must either provide employees with printed copies or ensure employees have access to them online anyone can access the instructions from the form i-9 web page when connected to the internet you can access these instructions directly from the form i-9 by clicking the instructions button at the top of each page even without internet access employers and employees using a computer can move the cursor over fields or click on the question marks to see instructions let's see how employees must complete section 1 employees must complete section 1 on or before their first day of employment they first enter their biographical information employees only need to provide their social security number if their employer uses verify entering an email address and telephone number are optional, but employees must enter Na if they choose to skip those fields next employees enter their citizenship or immigration status by checking one of the boxes once a selection is made fields related to a different selection will contain a lawful permanent residents must enter there a number or USCIS number than select alien number or USCIS number from the drop-down menu aliens authorized to work must enter either there is a number I 94 number or form passport number as well as the date their work authorization expires if employees enter a foreign passport number they also must choose the country that issued the passport from the drop-down menu employees must check the first box if they don't use a preparer or translator after that option is selected all fields in the section are locked employees may use a preparer or translator to help them complete the form the preparer or translator must check the second box in this section then choose from the drop-down menu the number of preparers and translators used if the employee uses more than one preparer or translator the form generates an extra page for them to enter their information if completing the form on paper extra preparers and translators must enter their information on an additional sheet that can be downloaded from the form i-9 web page once the employee completes all the fields and presses click to finish fields...

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your oregon form oq online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.