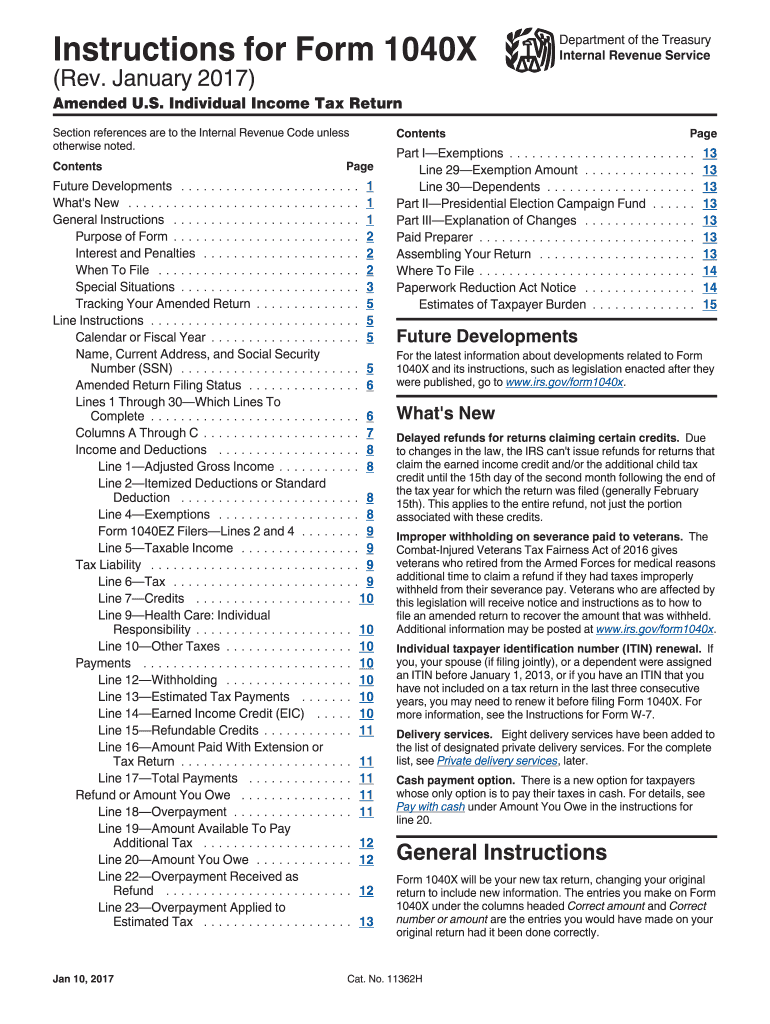

IRS Instructions 1040X 2017 free printable template

Instructions and Help about IRS Instructions 1040X

How to edit IRS Instructions 1040X

How to fill out IRS Instructions 1040X

About IRS Instructions 1040X 2017 previous version

What is IRS Instructions 1040X?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS Instructions 1040X

How can I track the status of my amended return using form 1040x instructions 2017?

To verify the receipt and processing of your amended return, you can use the IRS 'Where's My Amended Return?' tool online. It's important to allow up to three weeks after filing for the IRS to process your form 1040x instructions 2017. If you encounter e-file rejection codes, you should consult the IRS website for specific error explanations and remedies.

What should I do if I need to correct a mistake after filing my amended return?

If you discover an error after submitting your amended return, you should file another form 1040x instructions 2017 to correct the mistake. Ensure that you clearly indicate the changes and provide relevant documentation to support the corrections. Maintaining copies of all submitted forms for your personal records is advisable.

Are there specific fees associated with e-filing my form 1040x instructions 2017?

Yes, there may be service fees charged by various e-filing platforms when you submit your form 1040x instructions 2017 electronically. These fees can vary widely depending on the provider, so it is recommended to review and compare options before filing. Be sure to check if your service provider offers refunds in case your submission is rejected.

What should I do if I receive an IRS notice regarding my amended return?

If you receive an IRS notice or letter about your amended return, carefully review the information provided and gather any relevant documentation. Follow the steps outlined in the notice to respond appropriately, ensuring you address any issues or requests for additional information regarding your form 1040x instructions 2017.