Get the free STOCK CERTIFICATE TRANSFER AUTHORITY - infrcs.com

Show details

Zenith Research Group LLC Head Office: America 20 South Wacker Drive Chicago IL 60606, The United States of America Phone: +1-773-8314614 / Fax: +1-773-3043127 Website: www.zenithresearchgroup.com

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your stock certificate transfer authority form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stock certificate transfer authority form via URL. You can also download, print, or export forms to your preferred cloud storage service.

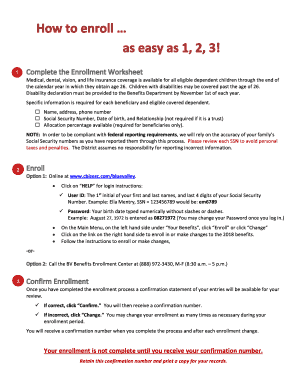

How to edit stock certificate transfer authority online

Follow the guidelines below to use a professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit stock certificate transfer authority. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

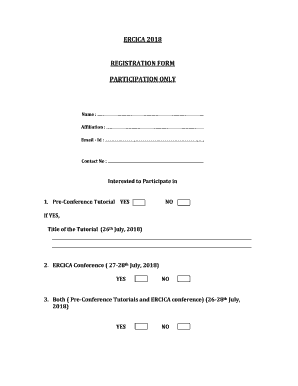

How to fill out stock certificate transfer authority

How to fill out stock certificate transfer authority:

01

Begin by obtaining a stock certificate transfer form from the appropriate authority or organization. This form is typically available online or can be obtained directly from the company whose stock you are transferring.

02

Fill out the necessary personal information on the form, including your full name, address, contact information, and any relevant identification numbers or account information associated with the stock certificates being transferred.

03

Specify the details of the stock certificate transfer, including the exact number of shares being transferred, the certificate numbers of the shares, and any additional information required by the company, such as the names and addresses of the new owners or beneficiaries.

04

Ensure that all required signatures are obtained. This may include your own signature as the current owner of the stock certificate, as well as the signatures of any other parties involved in the transfer, such as the new owners or beneficiaries. It is important to carefully follow any specific instructions provided by the company regarding the necessary signatures and their format.

05

Attach any necessary supporting documents to the form. This may include a copy of the original stock certificate(s) being transferred, a copy of any relevant identification or proof of ownership documents, or any other documentation required by the company.

06

Review the completed form and supporting documents to ensure accuracy and completeness. Double-check that all necessary fields have been filled out appropriately and that all required documents and signatures are attached.

07

Submit the completed stock certificate transfer authority form, along with any required fees or documentation, to the appropriate authority or organization. This may involve mailing the form to a specific address or submitting it electronically through an online platform provided by the company.

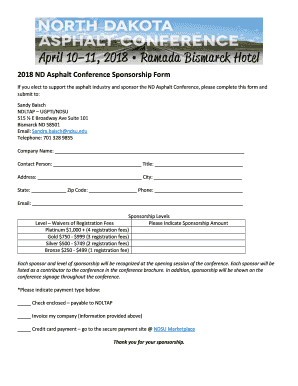

Who needs stock certificate transfer authority:

01

Individuals or entities who wish to transfer ownership of their stock certificates to another party.

02

Shareholders or investors looking to gift or sell their stock holdings to another individual or organization.

03

Executors or administrators of estates who need to transfer stock certificates as part of the probate process or in accordance with the deceased's will.

Ultimately, anyone who holds stock certificates and wishes to transfer ownership to another party will need to complete a stock certificate transfer authority form. The specific requirements and procedures may vary depending on the company and jurisdiction, so it is important to consult the appropriate resources or seek professional advice when necessary.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is stock certificate transfer authority?

Stock certificate transfer authority is a document that authorizes the transfer of ownership of stock certificates from one party to another.

Who is required to file stock certificate transfer authority?

The party transferring ownership of the stock certificates is required to file the stock certificate transfer authority.

How to fill out stock certificate transfer authority?

Stock certificate transfer authority can be filled out by providing the relevant information about the transfer of ownership, including the names of the parties involved and the details of the stock certificates.

What is the purpose of stock certificate transfer authority?

The purpose of stock certificate transfer authority is to formally authorize the transfer of ownership of stock certificates from one party to another.

What information must be reported on stock certificate transfer authority?

The stock certificate transfer authority must include details of the parties involved, such as their names and contact information, as well as information about the stock certificates being transferred.

When is the deadline to file stock certificate transfer authority in 2023?

The deadline to file stock certificate transfer authority in 2023 is typically determined by the relevant regulatory authority or governing body.

What is the penalty for the late filing of stock certificate transfer authority?

The penalty for the late filing of stock certificate transfer authority may include fines or other consequences determined by the regulatory authority or governing body.

How can I send stock certificate transfer authority for eSignature?

Once you are ready to share your stock certificate transfer authority, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete stock certificate transfer authority online?

Completing and signing stock certificate transfer authority online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit stock certificate transfer authority straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit stock certificate transfer authority.

Fill out your stock certificate transfer authority online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.