Get the free Homestead Tax Return Food Sales Tax Return - Linn County Kansas

Show details

Homestead Tax Return / Food Sales Tax Return

The Homestead Rental Refund, as well as the Food Sales Tax Refund opportunity has been discontinued. The Homestead

Tax Refund is now available only to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your homestead tax return food form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homestead tax return food form via URL. You can also download, print, or export forms to your preferred cloud storage service.

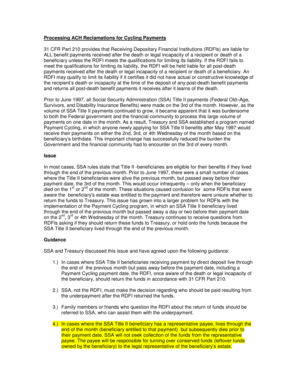

How to edit homestead tax return food online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit homestead tax return food. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out homestead tax return food

How to Fill Out Homestead Tax Return Food:

01

Gather all necessary documents and information, such as your personal identification, income statements, and any relevant deductions or exemptions.

02

Ensure that you qualify for the homestead tax return food program by meeting the designated criteria, such as being the owner and occupant of the homestead property.

03

Obtain the appropriate forms from your local tax authority or online. These forms may vary depending on your location and specific program requirements.

04

Carefully review the instructions provided with the forms to understand the specific details and requirements for completing the homestead tax return food.

05

Fill out the forms accurately and completely, providing all the required information. Pay attention to details such as income, expenses, and eligibility requirements for deductions or exemptions.

06

Double-check your entries for accuracy and completeness before submitting the forms. Errors or omissions can lead to delays or complications in the processing of your homestead tax return food.

07

Sign and date the forms as required, and make copies for your records. It is also advisable to keep copies of any supporting documents that you have submitted.

08

Submit the completed forms and any supporting documents to your local tax authority within the specified deadline. You may be required to file electronically or by mail, so be sure to follow the instructions given.

09

If you have any questions or need assistance with filling out the homestead tax return food, reach out to your local tax authority or seek help from a qualified tax professional.

10

Regularly monitor the progress of your homestead tax return food to ensure its processing and potential reimbursement or benefits.

Who Needs Homestead Tax Return Food:

01

Individuals or families who own and occupy a homestead property may qualify for the homestead tax return food program.

02

The program is usually designed to assist low-income households with their food expenses by providing tax relief or direct financial assistance.

03

Eligibility criteria may vary depending on the specific program and location, but usually include factors such as income level, residency, and property ownership.

04

Some programs may also consider additional factors like age, disability status, or the presence of dependents.

05

It is essential to consult your local tax authority or research the specific guidelines for your area to determine if you qualify for the homestead tax return food program.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my homestead tax return food in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your homestead tax return food as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit homestead tax return food straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit homestead tax return food.

How do I complete homestead tax return food on an Android device?

On an Android device, use the pdfFiller mobile app to finish your homestead tax return food. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your homestead tax return food online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.