Get the free W EST

Show details

State of Iowa

Administrative

Code

Supplement

Biweekly

April 27, 2005KATHLEEN K. W EST

ADMINISTRATIVE CODE EDITORSTEPHANIE A. HOFF

ASSISTANT EDITORPU13LISHED 13Y TH ESTATE OF IOWA

UNDER AUTHORITY OF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your w est form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w est form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w est online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit w est. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

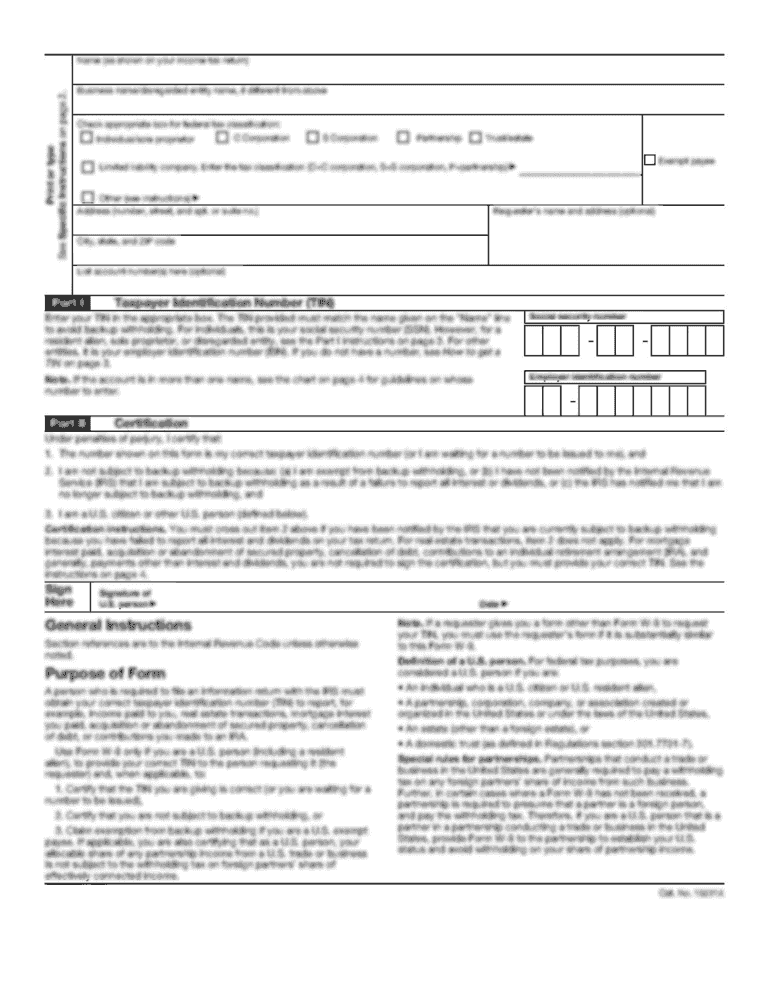

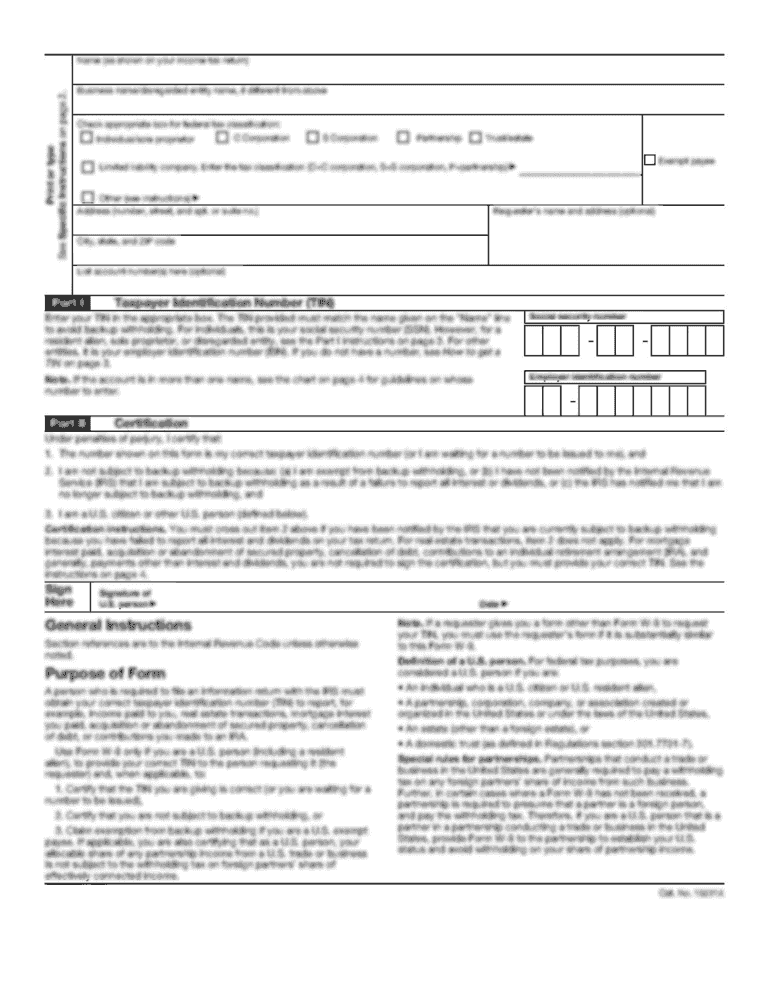

How to fill out w est

How to fill out w est

01

Step 1: Gather all the required documents for filling out W-EST, such as your personal information, income statements, and any relevant tax documents.

02

Step 2: Start by providing your personal information, including your name, Social Security Number, and contact details.

03

Step 3: Next, proceed to enter your income details, including wages, tips, and any other sources of income.

04

Step 4: Provide information about any deductions or credits that apply to you, such as education expenses or child tax credits.

05

Step 5: Review all the information you have entered to ensure its accuracy and completeness.

06

Step 6: Sign and date the form to certify that all the information provided is accurate to the best of your knowledge.

07

Step 7: Make a copy of the completed W-EST form for your records.

08

Step 8: Submit the filled-out W-EST form to the respective tax authority as per their guidelines or requirements.

Who needs w est?

01

Anyone who is earning income in the United States and is required to file taxes needs to fill out a W-EST form.

02

Employees who receive wages or salaries from an employer need to fill out W-EST to report their earnings and pay the appropriate income taxes.

03

Self-employed individuals, freelancers, and independent contractors also need to fill out W-EST to report their income and fulfill their tax obligations.

04

Students or scholars receiving scholarships or grants might need to fill out W-EST to report any taxable portion of their financial aid.

05

Anyone who receives income from rental property or investments, such as dividends or interest, may need to fill out W-EST to report their earnings.

06

Individuals who receive certain types of government payments or benefits may also need to fill out W-EST to determine their tax liability.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w est to be eSigned by others?

To distribute your w est, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute w est online?

Completing and signing w est online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out w est on an Android device?

Use the pdfFiller mobile app to complete your w est on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your w est online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.