Get the free 2015 IRS Verification of Non-Filing Information - www3 olivet

Show details

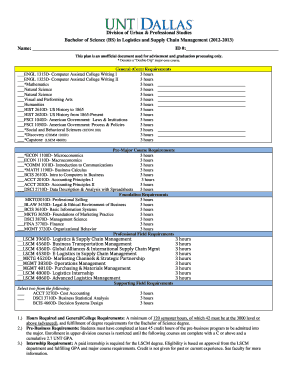

201718 FAFSA Verification 2015 IRS Verification of Confining Information Office of Financial Aid One University Avenue Bourbons, IL 609142345 (815) 9395249 Fax: (815) 9395074 Your Free Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2015 irs verification of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2015 irs verification of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2015 irs verification of online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2015 irs verification of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out 2015 irs verification of

How to fill out 2015 irs verification of

01

Step 1: Obtain the 2015 IRS Verification of form from the official IRS website.

02

Step 2: Read the instructions provided in the form carefully to understand the requirements.

03

Step 3: Gather all the necessary documents and information required to complete the form.

04

Step 4: Fill out the personal information section accurately, including your name, social security number, and contact details.

05

Step 5: Provide information about your income for the year 2015, including wages, tips, interest, dividends, and any other sources of income.

06

Step 6: Enter details about your deductions and credits if applicable, such as student loan interest, child tax credit, or earned income credit.

07

Step 7: Review the completed form for any errors or missing information.

08

Step 8: Sign and date the form to certify its accuracy.

09

Step 9: Make a copy of the completed form for your records.

10

Step 10: Submit the filled-out form to the relevant institution or authority as instructed.

Who needs 2015 irs verification of?

01

Individuals who need to verify their income for the year 2015 may require the 2015 IRS Verification of.

02

Some common situations where this verification may be needed include:

03

Applying for financial aid or student loans

04

Renting or leasing a property

05

Applying for mortgage loans

06

Applying for government assistance programs

07

Applying for certain types of jobs or professional licenses

08

It is recommended to check the specific requirements of the institution or organization requesting the verification to determine if the 2015 IRS Verification of is needed.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2015 irs verification of directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your 2015 irs verification of as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send 2015 irs verification of to be eSigned by others?

When your 2015 irs verification of is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in 2015 irs verification of?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 2015 irs verification of to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Fill out your 2015 irs verification of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.