Get the free Guide to annual allowance tapering - AJ Bell Youinvest

Show details

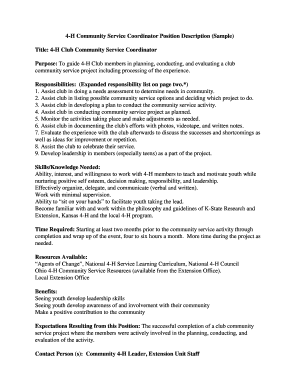

Guide to annual allowance tapering Overview The annual allowance for pension contributions is 40,000. However, for higher earners this allowance is tapered. This guide outlines the rules and includes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your guide to annual allowance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guide to annual allowance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

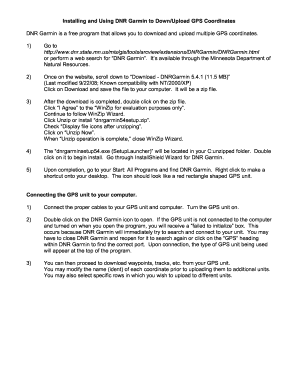

How to edit guide to annual allowance online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit guide to annual allowance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

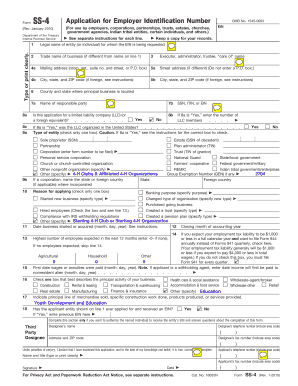

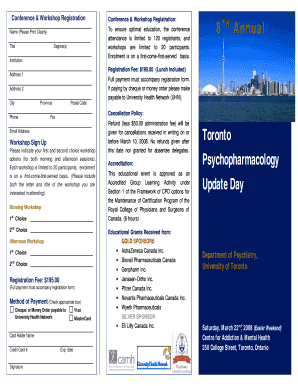

How to fill out guide to annual allowance

How to fill out guide to annual allowance

01

Step 1: Gather all the necessary financial information including your income, savings, and investments.

02

Step 2: Determine the maximum annual allowance for the current tax year. This information can be obtained from the HM Revenue and Customs (HMRC) website.

03

Step 3: Calculate your current pension input amount by considering any contributions made to your pension scheme(s) during the tax year.

04

Step 4: Compare your current pension input amount to the annual allowance. If it exceeds the annual allowance, you may be subject to a tax charge.

05

Step 5: If your pension input amount exceeds the annual allowance, consider carrying forward any unused allowance from the previous three tax years.

06

Step 6: Complete the guide to annual allowance form provided by HMRC. Make sure to accurately report your pension input amount and any carried forward allowance.

07

Step 7: Submit the completed form to HMRC before the deadline, typically January 31st following the end of the tax year.

08

Step 8: Keep a copy of the submitted form and any supporting documents for your records.

Who needs guide to annual allowance?

01

Individuals who are actively contributing to a pension scheme

02

People who want to ensure they are utilizing their annual allowance effectively to maximize their pension savings

03

Anyone who has made pension contributions that may exceed the annual allowance and wants to avoid potential tax charges

04

Individuals who want to carry forward any unused allowance from previous tax years

05

Those who need to report their pension input amount to HMRC for tax purposes

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify guide to annual allowance without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including guide to annual allowance. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find guide to annual allowance?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the guide to annual allowance. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out guide to annual allowance on an Android device?

Use the pdfFiller app for Android to finish your guide to annual allowance. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your guide to annual allowance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.