Get the free flynn payroll form

Show details

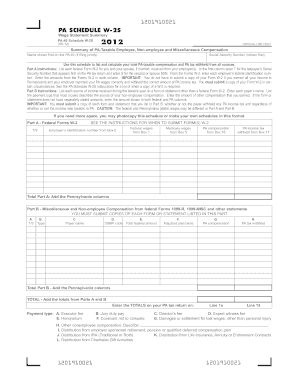

Electronic W2 Registration To view and print your electronic W2, follow the steps below to register with ADP: Step 1) Go to https://my.adp.com. Step 2) Click Register Now (If you registered in the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your flynn payroll form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flynn payroll form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit flynn payroll online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit applebees pay stubs form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out flynn payroll form

How to fill out flynn payroll:

01

Gather all necessary information: Start by collecting relevant employee data, such as their names, social security numbers, addresses, and employee identification numbers. Additionally, compile details about their wages, hours worked, deductions, and any other relevant information.

02

Input employee information: Open the flynn payroll software or platform and enter the collected employee data into the designated fields. Ensure accuracy when entering this information to avoid any errors or discrepancies later.

03

Calculate wages and deductions: Use the flynn payroll system to calculate wages based on the hours worked and any applicable pay rates or salary agreements. Additionally, factor in deductions such as taxes, insurance premiums, retirement contributions, and other withholdings.

04

Validate and review: Double-check all inputted data and calculated figures to ensure accuracy and compliance with company policies and applicable employment laws. Verify that all necessary information has been included and that any necessary adjustments or corrections have been made.

05

Generate payroll reports: Utilize the flynn payroll system to generate payroll reports, which usually include details about employee wages, taxes withheld, deductions, and net pay. These reports can be used for record-keeping purposes, tax filings, and other payroll-related documentation.

06

Process payments: Once you have reviewed and validated the payroll information, proceed to process the payments. Depending on your company's policy, you may issue physical checks or provide direct deposit to employees' bank accounts. Make sure to follow any necessary steps or procedures to complete the payment process accurately.

Who needs flynn payroll:

01

Small to large businesses: Companies of all sizes, from small startups to large corporations, can benefit from using the flynn payroll system. It provides a user-friendly platform to streamline payroll processes and ensure accurate and timely payments to employees.

02

HR and payroll professionals: Human resources (HR) and payroll professionals are the primary users of flynn payroll. They are responsible for managing employee data, calculating wages, deductions, and taxes, and ensuring compliance with labor regulations. The flynn payroll system becomes a valuable tool for these professionals to simplify their workload and enhance payroll efficiency.

03

Employees: While employees may not directly use the flynn payroll system, they greatly benefit from its use. Accurate and timely payroll processing ensures that employees receive their due wages and benefits. It also helps in maintaining transparency and trust between the company and its workforce.

Fill flynn restaurant group pay stubs : Try Risk Free

People Also Ask about flynn payroll

Who is the owner of Flynn Restaurant Group?

Who is the largest Applebee's franchisee?

What does Flynn Restaurant Group own?

How much does Greg Flynn make per year?

Who is Greg Flynn?

What is Flynn Restaurant Group worth?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is flynn payroll?

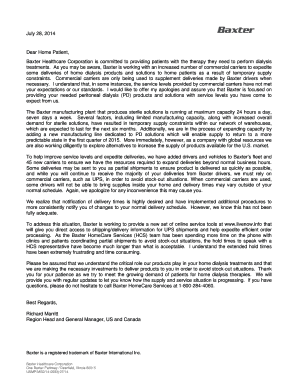

Flynn Payroll is likely a reference to Flynn Restaurant Group, which is one of the largest restaurant franchisees in the United States. They operate several popular brands, including Applebee's, Taco Bell, Panera Bread, and Arby's. Flynn Payroll would thus refer to the payroll processing and administration for employees working at the various restaurants owned and operated by Flynn Restaurant Group.

Who is required to file flynn payroll?

Flynn payroll filing usually refers to the filing of payroll taxes for employees of the Flynn company. The responsibility of filing Flynn payroll taxes lies with the employer or the designated person within the company's payroll department. This individual is responsible for withholding the necessary payroll taxes from employee wages and submitting those taxes to the appropriate government agencies, such as the Internal Revenue Service (IRS) in the United States.

How to fill out flynn payroll?

To fill out the Flynn Payroll form, you can follow these steps:

1. Start by downloading the Flynn Payroll form from the official website or obtain a paper copy from your employer.

2. Gather all the necessary information required to complete the form. This usually includes your personal details such as name, address, Social Security number, and contact information.

3. Enter the pay period start and end dates. This is the time period for which you are submitting the payroll information.

4. Provide the hours you worked during the pay period. Fill in the appropriate fields for regular hours worked, overtime hours, and any other special categories mentioned in the form.

5. Calculate the total hours worked for each category and enter the respective totals in the designated fields.

6. Indicate your tax filing status by selecting the appropriate option (e.g. single, married filing jointly, etc.).

7. Depending on your situation, you may need to specify any deductions or exemptions you are claiming. This may include federal or state income tax withholding, Social Security tax, Medicare tax, or any other applicable deductions.

8. Ensure that you accurately input all the information requested, double-checking for any errors or omissions.

9. Sign and date the form in the designated area to certify the accuracy of the provided information.

10. Once completed, submit the filled-out Flynn Payroll form to your employer or follow their instructions on how to submit it.

Remember, if you have any doubts or questions regarding specific fields or calculations on the form, reach out to your employer or the HR department for assistance.

What information must be reported on flynn payroll?

The information that must be reported on Flynn payroll typically includes:

1. Employee details: This includes the employee's full name, address, social security number (SSN), date of birth, and contact information.

2. Hours worked: The number of hours worked by each employee during the specific pay period. This may include regular hours, overtime hours, and any other types of hours worked (e.g., vacation, sick leave).

3. Wages and earnings: The total wages earned by each employee for the pay period. This would include regular pay, overtime pay, bonuses, commissions, and any other additional earnings.

4. Deductions: The various deductions made from an employee's wages, such as federal and state income tax withholdings, Social Security and Medicare taxes, health insurance premiums, retirement contributions, and any other voluntary deductions requested by the employee (e.g., garnishments, child support).

5. Net pay: The net amount of wages that an employee receives after all deductions have been taken out.

6. Employer information: The employer's name, address, employer identification number (EIN), and any other relevant identification information.

It is important to note that the exact information required on payroll may vary depending on the specific reporting requirements set forth by the applicable tax and labor laws in a particular jurisdiction. Additionally, some companies may have additional reporting requirements specific to their industry or internal payroll policies.

How do I make edits in flynn payroll without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing applebees pay stubs form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out the flynn restaurant group payroll form on my smartphone?

Use the pdfFiller mobile app to complete and sign w2 applebee's on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit flynn payroll on an iOS device?

You certainly can. You can quickly edit, distribute, and sign flynn restaurant group pay stubs form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your flynn payroll form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flynn Restaurant Group Payroll is not the form you're looking for?Search for another form here.

Keywords relevant to payroll flynnrg com form

Related to flynn restaurant group pay stubs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.