Get the free Irs form 941 schedule b instructions

Show details

Ir's form 941 schedule b instructions 04/19/2017 Windows phones that work on Verizon network 04/19/2017 Bigfoot motor homes for sale by owner 04/21/2017 Seal posturepedic mattress reviews Drag slot

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your irs form 941 schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 941 schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 941 schedule online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs form 941 schedule. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out irs form 941 schedule

How to fill out irs form 941 schedule

01

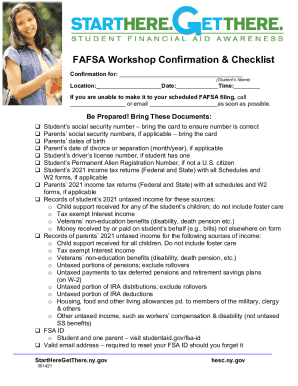

Gather all the necessary information and documents required for filling out the IRS Form 941 Schedule.

02

Ensure you have the Form 941 and its instructions handy as they will provide guidance on how to fill out the schedule.

03

Start filling out the Schedule by inputting your employer identification number (EIN) and business name.

04

Provide details of the tax period for which you are filing the Form 941 Schedule.

05

Fill in the total number of employees for the tax period, including both active and inactive employees.

06

Report the total wages paid to employees during the tax period, including wages subject to social security and Medicare taxes.

07

Calculate the employee tax liability by multiplying the reported wages with the respective tax rates.

08

Specify any adjustments to the taxes reported on Form 941 and provide a brief explanation for each adjustment.

09

Summarize the total tax liability after adjustments and report any deposits made during the tax period.

10

Complete the declaration section by signing and dating the Form 941 Schedule.

11

Make copies of the completed form for your records and submit it to the appropriate IRS address.

12

Ensure you retain a copy of the submitted form for future reference and potential audits.

Who needs irs form 941 schedule?

01

Employers who have employees working for them or have paid wages subject to social security and Medicare taxes are required to file IRS Form 941 Schedule.

02

This includes businesses, organizations, and government agencies that meet the criteria set by the IRS.

03

Form 941 Schedule ensures proper reporting and payment of employment taxes on a quarterly basis.

04

It is necessary for employers to accurately report their tax liability and wages paid to employees.

05

Filing this schedule helps the IRS track the funds withheld from employees' pay for income taxes, social security, and Medicare taxes.

06

By filing Form 941 Schedule, employers fulfill their obligations to the IRS and maintain compliance with tax laws.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find irs form 941 schedule?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific irs form 941 schedule and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in irs form 941 schedule without leaving Chrome?

irs form 941 schedule can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit irs form 941 schedule straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing irs form 941 schedule.

Fill out your irs form 941 schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.