Get the free Valuation for solvency purposes

Show details

Allianz Insurance insolvency

and Financial

Condition

Report 2016Solvency and Financial Condition Report 2016Solvency and Financial Condition Report 2016Contents

Summary1A. Business and Performance3B.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

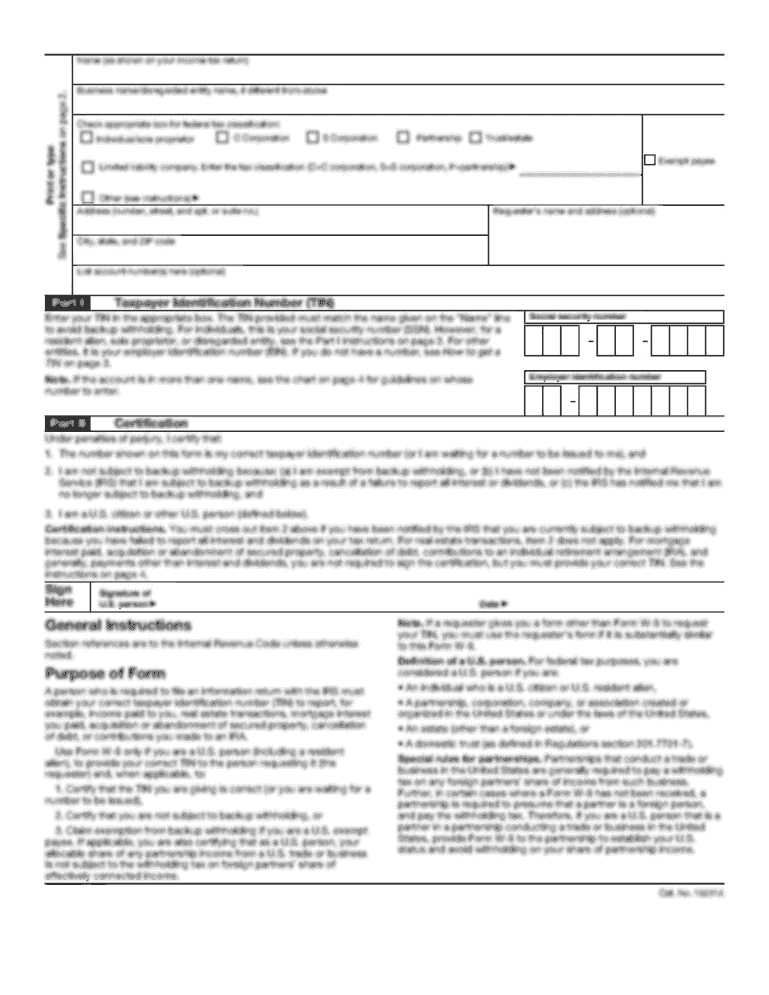

Edit your valuation for solvency purposes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your valuation for solvency purposes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing valuation for solvency purposes online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit valuation for solvency purposes. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out valuation for solvency purposes

How to fill out valuation for solvency purposes

01

Begin by gathering all relevant financial information, including balance sheets, income statements, and cash flow statements for the company.

02

Calculate the company's total assets and liabilities. This includes both current and long-term assets and liabilities.

03

Determine the market value of the company's assets, including any fixed assets such as property, plant, and equipment.

04

Assess the company's cash flow and profitability. This can be done by analyzing the company's income statement and identifying any potential risks or challenges.

05

Consider any outstanding debts that the company may have, including loans or bonds.

06

Evaluate the company's ability to generate sufficient cash flow to meet its financial obligations. This includes assessing the company's liquidity and solvency ratios.

07

Perform a sensitivity analysis to identify any potential risks or scenarios that could impact the company's solvency.

08

Use the gathered information to determine the company's solvency ratio. The solvency ratio measures the company's ability to meet long-term debt obligations.

09

Prepare a comprehensive valuation report outlining the findings and recommendations based on the analysis.

10

Review the valuation report with relevant stakeholders, including management, investors, and creditors.

Who needs valuation for solvency purposes?

01

Financial institutions such as banks and lending organizations may require a valuation for solvency purposes before approving loans or credit extensions.

02

Investors and shareholders may need a valuation for solvency purposes to assess the financial health and stability of a company before making investment decisions.

03

Insurance companies may require a valuation for solvency purposes to determine the risk profile and financial stability of an insured company.

04

Regulatory bodies and government agencies may request valuations for solvency purposes to ensure compliance with financial regulations and protect consumers and stakeholders.

05

Companies undergoing mergers or acquisitions may require a valuation for solvency purposes to assess the financial viability and compatibility of the target company.

06

Non-profit organizations may need a valuation for solvency purposes to demonstrate financial stability and attract potential donors or funding.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in valuation for solvency purposes?

The editing procedure is simple with pdfFiller. Open your valuation for solvency purposes in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my valuation for solvency purposes in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your valuation for solvency purposes right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit valuation for solvency purposes on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing valuation for solvency purposes.

Fill out your valuation for solvency purposes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.