Get the free Defunct corporations, small tax bills, and LLC regs top Spidells wish list

Show details

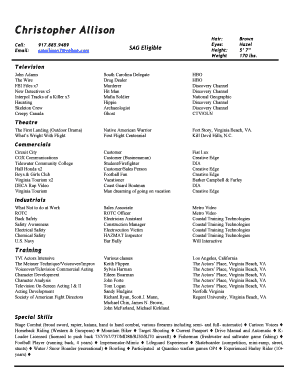

Volume 36.2 February?1, 2014 California T A X LETTER R Your California Solution Since 1975 Defunct corporations, small tax bills, and LLC reg stop Slidell s wish list Conformity was another Slidell

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your defunct corporations small tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your defunct corporations small tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit defunct corporations small tax online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit defunct corporations small tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out defunct corporations small tax

How to fill out defunct corporations small tax:

01

Gather all the necessary documents related to the defunct corporation, including financial records, tax filings, and any other relevant paperwork.

02

Identify the correct tax form to use for filing the defunct corporations small tax. In most cases, this would be the appropriate state tax form for dissolved or inactive corporations.

03

Fill out the tax form accurately and completely, providing all the requested information. This typically includes details such as the corporation's name, address, dates of operation, and any outstanding tax liability.

04

Ensure that you have properly calculated any tax owed or refunds due. Consult with a tax professional or utilize tax software to determine the correct amounts.

05

Attach any supporting documentation required by the tax form, such as financial statements or certificates of dissolution.

06

Review the filled-out tax form and supporting documents for accuracy and completeness. Make any necessary corrections or additions before submitting.

07

Submit the completed tax form and any required payment to the appropriate tax authority, following their specified instructions for filing defunct corporations small tax.

08

Keep a copy of the filed tax form and any related documents for your records.

Who needs defunct corporations small tax:

01

Individuals or entities that had previously operated a corporation which is no longer active or dissolved.

02

Those who have incurred tax liabilities or need to claim refunds for the defunct corporation.

03

Anyone required by the tax authority to file defunct corporations small tax forms based on specific jurisdictional requirements.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is defunct corporations small tax?

Defunct corporations small tax is a tax imposed on corporations that are no longer active or operating.

Who is required to file defunct corporations small tax?

Corporations that have ceased operations and are no longer active are required to file defunct corporations small tax.

How to fill out defunct corporations small tax?

To fill out defunct corporations small tax, corporations need to provide information about their defunct status, financial records, and any taxes owed.

What is the purpose of defunct corporations small tax?

The purpose of defunct corporations small tax is to ensure that corporations that have ceased operations still fulfill their tax obligations.

What information must be reported on defunct corporations small tax?

Information such as the corporation's defunct status, financial records, and any taxes owed must be reported on defunct corporations small tax.

When is the deadline to file defunct corporations small tax in 2023?

The deadline to file defunct corporations small tax in 2023 is typically the end of the tax year, but specific dates may vary depending on the jurisdiction.

What is the penalty for the late filing of defunct corporations small tax?

The penalty for the late filing of defunct corporations small tax may include fines, interest charges, and potential legal action.

Can I create an electronic signature for the defunct corporations small tax in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your defunct corporations small tax and you'll be done in minutes.

How do I fill out defunct corporations small tax using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign defunct corporations small tax and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit defunct corporations small tax on an Android device?

You can edit, sign, and distribute defunct corporations small tax on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your defunct corporations small tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.