Get the free small business revolving loan fund applicant checklist - Roscommon ...

Show details

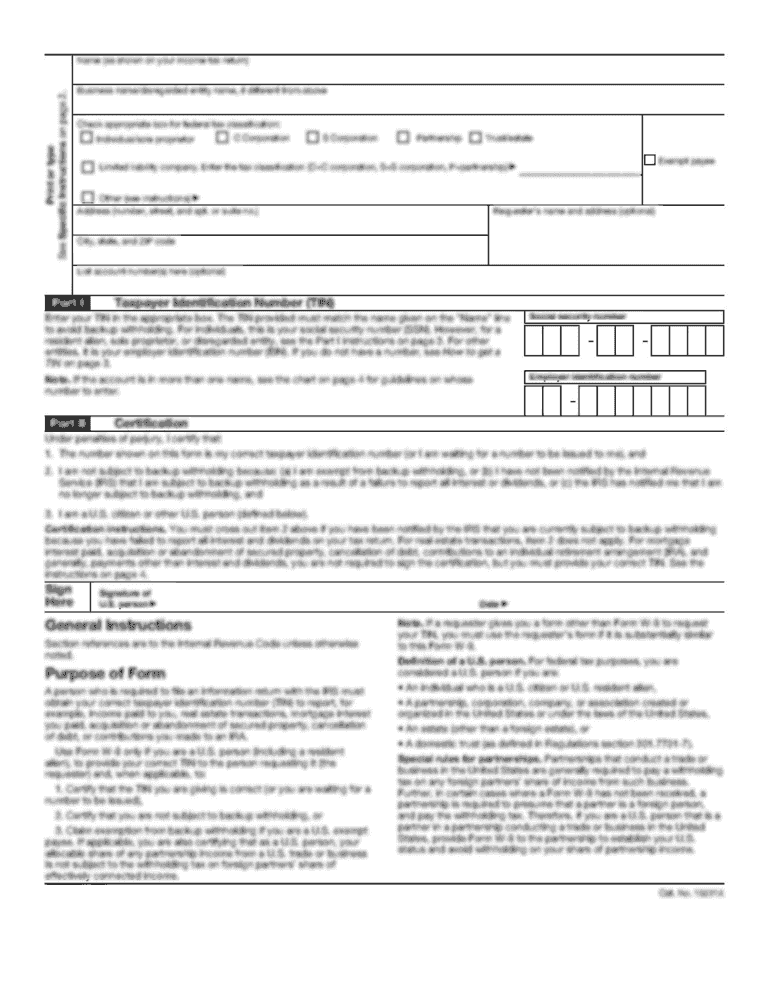

Do you have a grantor for this loan No Yes If Yes Print Name of Grantor Signature of Grantor Date Signed Page Four RCEDC RLF Application 20. SMALL BUSINESS REVOLVING LOAN FUND APPLICANT CHECKLIST The following can be mailed or dropped off to Roscommon County EDC Attn Rosalie Myers 500 Lake Street Roscommon Michigan 48653 Loan Application Business Plan You can contact Josh Billington Sr. Business DUNS Number 6. Owners and Key Personnel Name Percent of Ownership Title US Citizen Yes No Page Two...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your small business revolving loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business revolving loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small business revolving loan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit small business revolving loan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

How to fill out small business revolving loan

How to fill out small business revolving loan

01

Gather all the necessary documentation such as financial statements, tax returns, and business plan.

02

Research and identify lenders or financial institutions that offer small business revolving loans.

03

Contact the chosen lender and inquire about their application process and requirements.

04

Fill out the loan application form accurately and completely, providing all the requested information.

05

Attach the required documentation to support your loan application.

06

Double-check all the information provided before submitting the application to ensure its accuracy.

07

Submit the loan application to the lender along with all the supporting documents.

08

Wait for the lender to review and evaluate your application.

09

If approved, carefully read and understand the terms and conditions of the loan offer.

10

Accept the loan offer only if you fully understand and agree to the terms presented.

11

Follow any additional instructions provided by the lender, such as signing additional documents or providing additional information.

12

Start utilizing the revolving loan for your small business as per the agreed terms and repayment schedule.

13

Maintain a good credit record by making timely payments towards the loan.

14

Monitor and manage the revolving loan effectively to ensure optimal use and efficient repayment.

Who needs small business revolving loan?

01

Small business owners who require flexible financing options and access to capital for their business operations.

02

Entrepreneurs looking to expand their small businesses or invest in new opportunities.

03

Businesses experiencing seasonal fluctuations or irregular cash flow who need a safety net for financial stability.

04

Startups and new ventures in need of initial funding to establish and grow their business.

05

Owners of small businesses who want to have a revolving line of credit for ongoing expenses and working capital.

06

Companies facing unexpected expenses or emergencies requiring immediate financial support.

07

Entrepreneurs aiming to take advantage of business opportunities that require quick access to funds.

08

Business owners looking to improve their cash flow management by utilizing revolving credit options.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out small business revolving loan on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your small business revolving loan. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit small business revolving loan on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as small business revolving loan. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete small business revolving loan on an Android device?

Complete your small business revolving loan and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your small business revolving loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.